Hertz 2008 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

Risks Related to Our Business—We could be harmed by a further decline in the results of operations or

financial condition of the manufacturers of our cars.’’ and ‘‘Risks Related to Our Substantial

Indebtedness—Our reliance on asset-backed financing to purchase cars subjects us to a number of

risks, many of which are beyond our control.’’

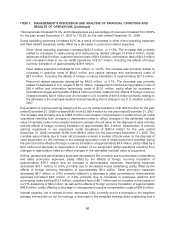

We rely significantly on asset-backed financing to purchase cars for our domestic and international car

rental fleets. For further information concerning our asset-backed financing programs, see ‘‘Financing’’

below. The amount of financing available to us pursuant to these programs depends on a number of

factors, many of which are outside our control. In the past several years, Ford and General Motors, which

are the principal suppliers of cars to us on both a program and non-program basis, have experienced

deterioration in their operating results and significant declines in their credit ratings. In the fall of 2008,

Ford and General Motors approached the U.S. Congress to request assistance from the federal

government in order to fund their continuing operations. Subsequent to that request, the federal

government has provided some assistance to General Motors. In addition, General Motors has

presented its reorganization plan to the U.S. government, requesting additional funds. While Ford has

publicly stated that it does not intend to seek such assistance, there can be no assurance that it will not

do so in the future. If the federal government does not provide such assistance, one or both of these

manufacturers could commence bankruptcy reorganization proceedings.

In the event of a bankruptcy of a car manufacturer, including Ford or General Motors, our liquidity would

be impacted by several factors including reductions in fleet residual values, as discussed above, and the

risk that we would be unable to collect outstanding receivables due to us from such bankrupt

manufacturer. In addition, under the current terms of our asset-backed financing facilities, we may be

required to materially increase the enhancement levels regarding the fleet vehicles provided by such

bankrupt manufacturer. If we were required to provide this additional enhancement, we would use a

combination of our available cash, our availability under our Senior ABL Facility or any existing

over-enhancement that we may then have under our Fleet Financing Facilities, which, in the case of Ford

or General Motors would have a material impact on our liquidity. For a detailed description of the

amounts we have available under our Senior ABL Facility and our Fleet Financing Facilities, see Note 3 to

the Notes to our consolidated financial statements included in this Annual Report under caption

‘‘Item 8—Financial Statements and Supplemental Data.’’ For a discussion of the risks associated with a

manufacturer’s bankruptcy or our reliance on asset-backed financing, see ‘‘Item 1A—Risk Factors—

Risks Related to Our Business—We could be harmed by a further decline in the results of operations or

financial condition of the manufacturers of our cars.’’ and ‘‘Risks Related to Our Substantial

Indebtedness—Our reliance on asset-backed financing to purchase cars subjects us to a number of

risks, many of which are beyond our control.’’

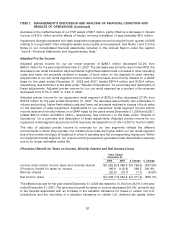

Also, substantially all of our revenue earning equipment and certain related assets are owned by special

purpose entities, or are subject to liens in favor of our lenders under the Senior ABL Facility, the U.S. ABS

Program, the International Fleet Debt facilities, the International ABS Fleet Financing Facility, the fleet

financing facilities relating to our car rental fleets in Hawaii, Kansas, Puerto Rico and St. Thomas, the U.S.

Virgin Islands; Brazil; Canada; Belgium; and our U.K. leveraged financing facility. Substantially all our

other assets in the United States are also subject to liens in favor of our lenders under the Senior Credit

Facilities, and substantially all of our other assets outside the United States are (with certain limited

exceptions) subject to liens in favor of our lenders under the International Fleet Debt facilities, the

International ABS Fleet Financing Facility or (in the case of our Canadian equipment rental business) the

Senior ABL Facility. None of such assets will be available to satisfy the claims of our general creditors.

94