Hertz 2008 Annual Report Download - page 150

Download and view the complete annual report

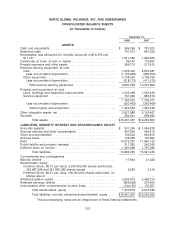

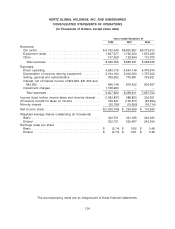

Please find page 150 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

equipment is rented based on the terms of the rental or leasing contract. Revenue related to new

equipment sales and consumables is recognized at the time of delivery to, or pick-up by, the customer

and when collectability is reasonably assured. Fees from our licensees are recognized over the period

the underlying licensees’ revenue is earned (over the period the licensees’ revenue earning equipment

is rented).

Cash and Equivalents

We consider all highly liquid debt instruments purchased with an original maturity of three months or less

to be cash equivalents.

Restricted Cash

Restricted cash includes cash and equivalents that are not readily available for our normal

disbursements. Restricted cash and equivalents are restricted for the purchase of revenue earning

vehicles and other specified uses under our Fleet Debt facilities, for our like-kind exchange programs

and to satisfy certain of our self-insurance regulatory reserve requirements. As of December 31, 2008

and 2007, the portion of total restricted cash that was associated with our Fleet Debt facilities was

$557.2 million and $573.1 million, respectively.

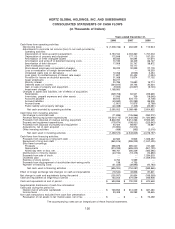

Depreciable Assets

The provisions for depreciation and amortization are computed on a straight-line basis over the

estimated useful lives of the respective assets, as follows:

Revenue Earning Equipment:

Cars .............................. 5 to 16 months

Other equipment ...................... 24 to 108 months

Buildings ............................. 15 to 50 years

Capitalized internal use software ............ 1 to 15 years

Service cars and service equipment ......... 1 to 25 years

Other intangible assets ................... 3 to 10 years

Leasehold improvements ................. The shorter of their economic lives or the lease

term.

We follow the practice of charging maintenance and repairs, including the cost of minor replacements, to

maintenance expense accounts. Costs of major replacements of units of property are capitalized to

property and equipment accounts and depreciated on the basis indicated above. Gains and losses on

dispositions of property and equipment are included in income as realized. When revenue earning

equipment is acquired, we estimate the period that we will hold the asset, primarily based on historical

measures of the amount of rental activity (e.g., automobile mileage and equipment usage) and the

targeted age of equipment at the time of disposal. We also estimate the residual value of the applicable

revenue earning equipment at the expected time of disposal. The residual values for rental vehicles are

affected by many factors, including make, model and options, age, physical condition, mileage, sale

location, time of the year and channel of disposition (e.g., auction, retail, dealer direct). The residual

value for rental equipment is affected by factors which include equipment age and amount of usage.

Depreciation is recorded on a straight-line basis over the estimated holding period. Depreciation rates

are reviewed on a quarterly basis based on management’s ongoing assessment of present and

estimated future market conditions, their effect on residual values at the time of disposal and the

estimated holding periods. Market conditions for used vehicle and equipment sales can also be affected

130