Hertz 2008 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

than those that we believe we would have obtained in the absence of such affiliation. It is our

management’s practice to bring to the attention of our Board of Directors any transaction, even if it arises

in the ordinary course of business, in which our management believes that the terms being sought by

transaction participants affiliated with the Sponsors or our Board of Directors would be less favorable to

us than those to which we would agree absent such affiliation.

In the second quarter of 2007, we were advised by ML, an affiliate of one of our Sponsors, that between

November 17, 2006, and April 19, 2007, ML engaged in principal trading activity in our common stock.

Some of those purchases and sales of our common stock should have been reported to the SEC on

Form 4, but were not so reported. ML and certain of its affiliates have engaged in additional principal

trading activity since that time. ML and certain of its affiliates have since filed amended or additional

reports on Form 4 disclosing the current number of shares of our common stock held by ML and its

affiliates. To date, ML has paid to us approximately $4.9 million for its ‘‘short-swing’’ profit liability

resulting from its principal trading activity that is subject to recovery by us under Section 16 of the

Securities Exchange Act of 1934, as amended. In the event that ML or its affiliates (including private

investment funds managed by certain private equity-arm affiliates of ML) sell additional shares of our

common stock in the future, this amount may change. In 2008 and 2007, we recorded $0.1 million, net of

tax and $2.9 million (net of tax of $1.9 million), respectively, in our consolidated balance sheet in

‘‘Additional paid-in capital.’’ In addition, because ML may be deemed to be an affiliate of Hertz Holdings

and there was no registration statement in effect with respect to its sale of shares during this period,

certain of these sales may have been made in violation of Section 5 of the Securities Act of 1933, as

amended.

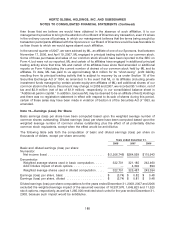

Note 15—Earnings (Loss) Per Share

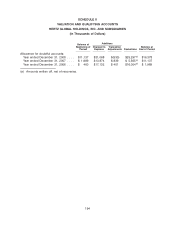

Basic earnings (loss) per share have been computed based upon the weighted average number of

common shares outstanding. Diluted earnings (loss) per share have been computed based upon the

weighted average number of common shares outstanding plus the effect of all potentially dilutive

common stock equivalents, except when the effect would be anti-dilutive.

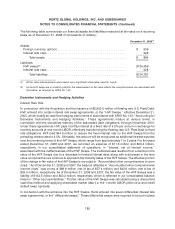

The following table sets forth the computation of basic and diluted earnings (loss) per share (in

thousands of dollars, except per share amounts):

Years ended December 31,

2008 2007 2006

Basic and diluted earnings (loss) per share:

Numerator:

Net income (loss) ............................... $(1,206,746) $264,559 $115,943

Denominator:

Weighted average shares used in basic computation ...... 322,701 321,185 242,460

Add: Dilutive impact of stock options ................. — 4,302 894

Weighted average shares used in diluted computation ..... 322,701 325,487 243,354

Earnings (loss) per share, basic ...................... $ (3.74) $ 0.82 $ 0.48

Earnings (loss) per share, diluted ..................... $ (3.74) $ 0.81 $ 0.48

Diluted earnings (loss) per share computations for the years ended December 31, 2008, 2007 and 2006

excluded the weighted-average impact of the assumed exercise of 16,337,976, 1,645,623 and 11,520

stock options, respectively, as well as 1,285,000 restricted stock units for the year ended December 31,

2008, because such impact would be antidilutive.

188