Hertz 2008 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

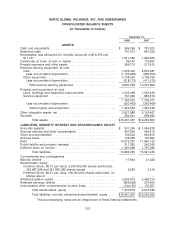

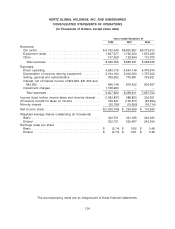

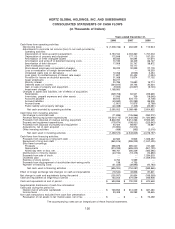

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Thousands of Dollars)

Years ended December 31,

2008 2007 2006

Cash flows from operating activities:

Net income (loss) .................................... $ (1,206,746) $ 264,559 $ 115,943

Adjustments to reconcile net income (loss) to net cash provided by

operating activities:

Depreciation of revenue earning equipment ................... 2,194,164 2,003,360 1,757,202

Depreciation of property and equipment ..................... 172,848 177,113 197,230

Amortization of other intangible assets ...................... 66,282 62,594 61,614

Amortization and write-off of deferred financing costs ............. 70,193 48,409 66,127

Amortization of debt discount ........................... 17,908 20,747 38,872

Debt modification costs ............................... — 16,177 —

Stock-based employee compensation charges ................. 28,023 32,939 27,179

Loss on revaluation of foreign denominated debt ............... — — 19,233

Unrealized (gain) loss on derivatives ....................... 12,058 (3,925) 2,454

Loss (gain) on ineffectiveness of interest rate swaps ............. 11,807 20,424 (1,034)

Provision for losses on doubtful accounts .................... 31,068 13,874 17,132

Asset writedowns ................................... 93,211 — —

Minority interest .................................... 20,786 19,690 16,714

Deferred taxes on income .............................. (234,810) 59,743 30,354

Gain on sale of property and equipment ..................... (9,602) (24,807) (9,743)

Impairment charges .................................. 1,168,900 — —

Changes in assets and liabilities, net of effects of acquisition:

Receivables ....................................... (329,708) 84,541 229,663

Inventories, prepaid expenses and other assets ................ 17,956 709 (18,548)

Accounts payable ................................... 36,615 304,170 (4,708)

Accrued liabilities ................................... (43,582) (20,299) 86,308

Accrued taxes ..................................... (1,801) 10,875 (3,789)

Public liability and property damage ....................... (20,068) (1,405) (23,381)

Net cash provided by operating activities ................... 2,095,502 3,089,488 2,604,822

Cash flows from investing activities:

Net change in restricted cash ............................. (71,836) (105,856) (260,212)

Revenue earning equipment expenditures ..................... (10,024,175) (11,342,095) (11,420,898)

Proceeds from disposal of revenue earning equipment ............. 8,846,094 9,214,266 9,555,025

Property and equipment expenditures ........................ (178,674) (196,001) (223,943)

Proceeds from disposal of property and equipment ............... 40,424 98,957 73,887

Acquisitions, net of cash acquired .......................... (70,920) (12,514) —

Other investing activities ................................ (488) (362) (2,016)

Net cash used in investing activities ...................... (1,459,575) (2,343,605) (2,278,157)

Cash flows from financing activities:

Proceeds from issuance of long-term debt ..................... 22,565 9,903 1,309,437

Repayment of long-term debt ............................. (860,515) (996,203) (1,247,425)

Short-term borrowings:

Proceeds ........................................ 396,679 695,000 747,469

Repayments ...................................... (374,333) (695,000) (901,123)

Ninety-day term or less, net ............................. 198,761 295,229 (465,595)

Distributions to minority interest ........................... (24,150) (13,475) (10,830)

Proceeds from sale of stock .............................. — — 1,284,503

Dividends paid ...................................... — — (1,259,518)

Exercise of stock options ................................ 6,754 5,599 —

Proceeds from disgorgement of stockholder short-swing profits ....... 138 4,755 —

Payment of financing costs .............................. (61,223) (39,895) (40,783)

Net cash used in financing activities ...................... (695,324) (734,087) (583,865)

Effect of foreign exchange rate changes on cash and equivalents ....... (76,540) 43,858 87,841

Net change in cash and equivalents during the period ............... (135,937) 55,654 (169,359)

Cash and equivalents at beginning of period ..................... 730,203 674,549 843,908

Cash and equivalents at end of period ......................... $ 594,266 $ 730,203 $ 674,549

Supplemental disclosures of cash flow information:

Cash paid during the period for:

Interest (net of amounts capitalized) ......................... $ 763,953 $ 814,059 $ 681,480

Income taxes ....................................... 33,408 28,293 33,645

Non-cash transactions excluded from cash flow presentation:

Revaluation of net assets to fair market value, net of tax ............ $ — $ — $ 75,459

The accompanying notes are an integral part of these financial statements.

126