Hertz 2008 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

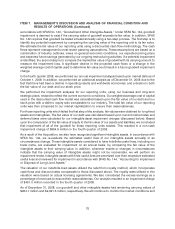

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

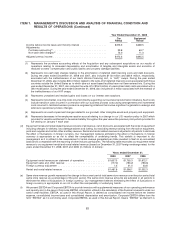

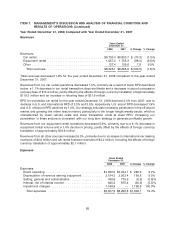

Year Ended December 31, 2006

Car Equipment

Rental Rental

Income before income taxes and minority interest ................ $373.5 $269.5

Adjustments:

Purchase accounting(1) ................................ 23.8 64.7

Non-cash debt charges(2) .............................. 75.0 11.3

Adjusted pre-tax income ................................ $472.3 $345.5

(1) Represents the purchase accounting effects of the Acquisition and any subsequent acquisitions on our results of

operations relating to increased depreciation and amortization of tangible and intangible assets and accretion of

revalued workers’ compensation and public liability and property damage liabilities.

(2) Represents non-cash debt charges relating to the amortization of deferred debt financing costs and debt discounts.

During the years ended December 31, 2008 and 2007, also includes $11.8 million and $20.4 million, respectively,

associated with the ineffectiveness of our Hertz Vehicle Financing LLC, or ‘‘HVF,’’ swaps. During the year ended

December 31, 2008, also includes $30.0 million related to the write-off of deferred financing costs associated with those

countries outside the United States as to which take-out asset-based facilities have not been entered into. During the

year ended December 31, 2007, also includes the write-off of $16.2 million of unamortized debt costs associated with a

debt modification. During the year ended December 31, 2006, also includes $1.0 million associated with the reversal of

the ineffectiveness of our HVF swaps.

(3) Represents unrealized and realized gains and losses on our interest rate swaptions.

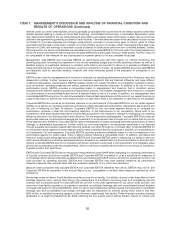

(4) Represents incremental, one-time costs incurred directly supporting our business transformation initiatives. Such costs

include transition costs incurred in connection with our business process outsourcing arrangements and incremental

costs incurred to facilitate business process re-engineering initiatives that involve significant organization redesign and

extensive operational process changes.

(5) Represents non-cash impairment charges related to our goodwill, other intangible assets and property and equipment.

(6) Represents decreases in the employee vacation accrual relating to a change in our U.S. vacation policy in 2007 which

provides for vacation entitlement to be earned ratably throughout the year versus the previous policy which provided for

full vesting on January 1 each year.

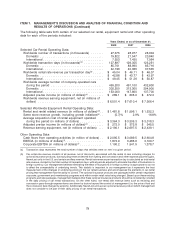

(d) Equipment rental and rental related revenue consists of all revenue, net of discounts, associated with the rental of equipment

including charges for delivery, loss damage waivers and fueling, but excluding revenue arising from the sale of equipment,

parts and supplies and certain other ancillary revenue. Rental and rental related revenue is adjusted in all periods to eliminate

the effect of fluctuations in foreign currency. Our management believes eliminating the effect of fluctuations in foreign

currency is appropriate so as not to affect the comparability of underlying trends. This statistic is important to our

management as it is utilized in the measurement of rental revenue generated per dollar invested in fleet on an annualized

basis and is comparable with the reporting of other industry participants. The following table reconciles our equipment rental

revenue to our equipment rental and rental related revenue (based on December 31, 2007 foreign exchange rates) for the

years ended December 31, 2008, 2007 and 2006 (in millions of dollars):

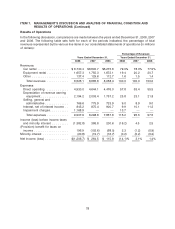

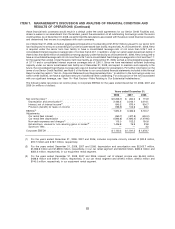

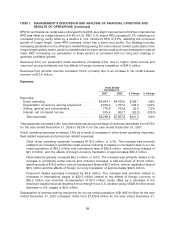

Years ended December 31,

2008 2007 2006

Equipment rental revenue per statement of operations ........... $1,657.3 $1,755.3 $1,672.1

Equipment sales and other revenue ....................... (177.0) (190.2) (193.6)

Foreign currency adjustment ............................ 1.5 31.0 53.8

Rental and rental related revenue ......................... $1,481.8 $1,596.1 $1,532.3

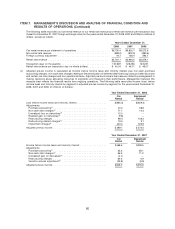

(e) Same store revenue growth represents the change in the current period total same store revenue over the prior period total

same store revenue as a percentage of the prior period. The same store revenue amounts are adjusted in all periods to

eliminate the effect of fluctuations in foreign currency. Our management believes eliminating the effect of fluctuations in

foreign currency is appropriate so as not to affect the comparability of underlying trends.

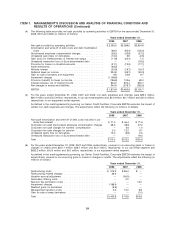

(f) We present EBITDA and Corporate EBITDA to provide investors with supplemental measures of our operating performance

and liquidity and, in the case of Corporate EBITDA, information utilized in the calculation of the financial covenants under our

senior credit facilities. EBITDA, as used in this Annual Report, is defined as consolidated net income before net interest

expense, consolidated income taxes and consolidated depreciation and amortization. Corporate EBITDA differs from the

term ‘‘EBITDA’’ as it is commonly used. Corporate EBITDA, as used in this Annual Report, means ‘‘EBITDA’’ as that term is

81