Hertz 2008 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

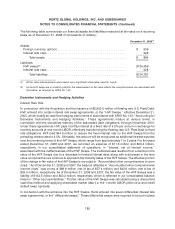

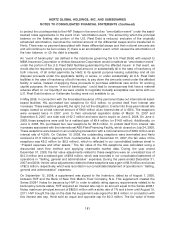

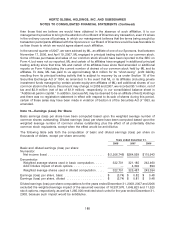

The following table summarizes our financial assets and liabilities measured at fair value on a recurring

basis as of December 31, 2008 (in thousands of dollars):

December 31, 2008(1)

Assets:

Foreign currency options ...................................... $ 536

Interest rate caps ........................................... 328

Total assets ............................................ $ 864

Liabilities:

HVF swaps(2) .............................................. $134,459

Interest rate caps ........................................... 328

Total liabilities ........................................... $134,787

(1) All fair value measurements were based upon significant observable (Level 2) inputs.

(2) As the HVF swaps are in a liability position, the measurement of fair value reflects the nonperformance risk associated with

the liability, as required by SFAS No. 157.

Derivative Instruments and Hedging Activities

Interest Rate Risk

In connection with the Acquisition and the issuance of $3,550.0 million of floating rate U.S. Fleet Debt,

HVF entered into certain interest rate swap agreements, or the ‘‘HVF Swaps,’’ effective December 21,

2005, which qualify as cash flow hedging instruments in accordance with SFAS No. 133, ‘‘Accounting for

Derivative Instruments and Hedging Activities.’’ These agreements mature at various terms, in

connection with the scheduled maturity of the associated debt obligations, through November 2010.

Under these agreements, HVF pays monthly interest at a fixed rate of 4.5% per annum in exchange for

monthly amounts at one-month LIBOR, effectively transforming the floating rate U.S. Fleet Debt to fixed

rate obligations. HVF paid $44.8 million to reduce the fixed interest rate on the HVF Swaps from the

prevailing market rates to 4.5%. Ultimately, this amount will be recognized as additional interest expense

over the remaining terms of the HVF Swaps, which range from approximately 1 to 3 years. For the years

ended December 31, 2008 and 2007, we recorded an expense of $11.8 million and $20.4 million,

respectively, in our consolidated statement of operations, in ‘‘Interest, net of interest income,’’

associated with the ineffectiveness of the HVF Swaps. The ineffectiveness resulted from a decline in the

value of the HVF Swaps due to a decrease in forward interest rates along with a decrease in the time

value component as we continue to approach the maturity dates of the HVF Swaps. The effective portion

of the change in fair value of the HVF Swaps is recorded in ‘‘Accumulated other comprehensive income

(loss).’’ As of December 31, 2008 and 2007, the balance reflected in ‘‘Accumulated other comprehensive

income (loss)’’ was a loss of $89.6 million (net of tax of $57.4 million) and $45.6 million (net of tax of

$29.0 million), respectively. As of December 31, 2008 and 2007, the fair value of the HVF Swaps was a

liability of $134.5 million and $50.2 million, respectively, which is reflected in our consolidated balance

sheet in ‘‘Other accrued liabilities.’’ The fair value of the HVF Swaps was calculated using a discounted

cash flow method and applying observable market data (i.e. the 1-month LIBOR yield curve and credit

default swap spreads).

In connection with the entrance into the HVF Swaps, Hertz entered into seven differential interest rate

swap agreements, or the ‘‘differential swaps.’’ These differential swaps were required to be put in place

180