Hertz 2008 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

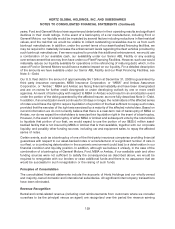

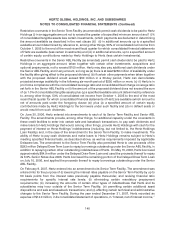

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Reclassifications

Certain prior year amounts have been reclassified to conform with current reporting.

Recent Accounting Pronouncements

In September 2006, the Financial Accounting Standards Board, or ‘‘FASB,’’ issued SFAS No. 157, ‘‘Fair

Value Measurements,’’ or ‘‘SFAS No. 157.’’ SFAS No. 157 defines fair value, establishes a framework for

measuring fair value in accordance with GAAP and expands disclosures about fair value measurements.

We adopted the provisions of SFAS No. 157 on January 1, 2008, except as they relate to non-financial

assets and liabilities that are not recognized or disclosed at fair value in the financial statements on a

recurring basis (at least annually), which provisions become effective for us beginning in January 2009.

We are currently reviewing SFAS No. 157, as it relates to our non-financial assets and liabilities that are

not recognized or disclosed at fair value in the financial statements on a recurring basis (at least

annually), to determine its impact, if any, on our financial position or results of operations. See Note 13—

Financial Instruments.

In February 2007, the FASB issued SFAS No. 159, ‘‘The Fair Value Option for Financial Assets and

Financial Liabilities,’’ or ‘‘SFAS No. 159.’’ SFAS No. 159 permits entities to choose to measure many

financial assets and liabilities and certain other items at fair value. The provisions of SFAS No. 159 were

effective for us beginning in January 2008. We chose not to change the measurement of the pertinent

assets and liabilities as a result of SFAS No. 159; therefore, SFAS No. 159 did not have any impact on our

financial position or results of operations.

In December 2007, the FASB issued SFAS No. 141 (revised 2007), ‘‘Business Combinations,’’ or ‘‘SFAS

No. 141(R).’’ The new standard requires the acquiring entity that gains control in a business combination

to recognize 100% of the fair value of the assets acquired and liabilities assumed in the transaction;

establishes the acquisition-date fair value as the measurement objective for all assets acquired and

liabilities assumed; requires that acquisition related costs be expensed; and requires the acquirer to

disclose to investors and other users all of the information they need to evaluate and understand the

nature and financial effect of the business combination. The provisions of SFAS No. 141(R) became

effective for us in January 2009.

In December 2007, the FASB issued SFAS No. 160, ‘‘Noncontrolling Interests in Consolidated Financial

Statements-an amendment of ARB No. 51,’’ or ‘‘SFAS No. 160.’’ SFAS No. 160 will change the

accounting and reporting for minority interests, which will be recharacterized as noncontrolling interests

and classified as a component of stockholders’ equity. Additionally, the amount of consolidated net

income attributable to the parent and to the noncontrolling interests must be clearly identified and

presented on the face of the consolidated statement of operations. Finally, changes in a parent’s

ownership interest while the parent retains its controlling financial interest in its subsidiary will be

accounted for consistently as equity transactions. The provisions of SFAS No. 160 became effective for

us in January 2009.

In March 2008, the FASB issued SFAS No. 161, ‘‘Disclosures about Derivative Instruments and Hedging

Activities—an amendment of FASB Statement No. 133,’’ or ‘‘SFAS No. 161.’’ SFAS No. 161 changes the

disclosure requirements for derivative instruments and hedging activities. Entities are required to

provide enhanced disclosures about how and why an entity uses derivative instruments, how derivative

instruments and related hedged items are accounted for under FASB Statement 133 and its related

interpretations, and how derivative instruments and related hedged items affect an entity’s financial

position, financial performance, and cash flows. The provisions of SFAS No. 161 will be effective for us

beginning with our quarterly report for the period ended March 31, 2009.

134