Hertz 2008 Annual Report Download - page 148

Download and view the complete annual report

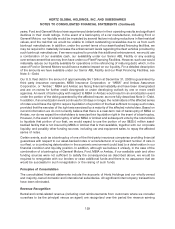

Please find page 148 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Basis of Presentation

The car and equipment rental industries are significantly influenced by general economic conditions. In

the final three months of 2008, both the car and equipment rental markets experienced unprecedented

declines due to the precipitous slowdown in consumer spending as well as significantly reduced

demand for industrial and construction equipment. The car rental industry is also significantly influenced

by developments in the travel industry, and, particularly, in airline passenger traffic while the equipment

rental segment, is being impacted by the difficult economic and business environment as investment in

commercial construction and the industrial markets slow. The United States and international markets

are currently experiencing a significant decline in economic activities, including a tightening of the credit

markets, reduced airline passenger traffic, reduced consumer spending and volatile fuel prices. These

conditions are expected to continue in 2009. During 2008, this resulted in a rapid decline in the volume of

car rental and equipment rental transactions, an increase in depreciation and fleet related costs as a

percentage of revenue, lower industry pricing and lower residual values for the non-program cars and

equipment that we sold.

We are highly leveraged and a substantial portion of our liquidity needs arises from debt service on

indebtedness incurred in connection with the Transactions and from the funding of our costs of

operations, working capital and capital expenditures. Based on December 31, 2008 availability and our

2009 business plan, we have sufficient liquidity in our existing fleet facilities to meet our 2009 debt

maturities. We are beginning discussions with banks and lenders to review refinancing options for the

indebtedness maturing in 2010. The agreements governing our indebtedness require us to comply with

two key covenants based on a consolidated leverage ratio and a consolidated interest expense

coverage ratio. These covenants are described further in Note 3—Debt. Our failure to comply with the

obligations contained in any agreements governing our indebtedness could result in an event of default

under the applicable instrument, which could result in the related debt becoming immediately due and

payable and could further result in a cross default or cross acceleration of our debt issued under other

instruments.

In response to the economic downturn, in 2008 we implemented aggressive strategic actions to reduce

costs and improve liquidity. These actions included reducing wage and benefit costs through significant

headcount reductions, accelerating fleet deletions and delaying additions to right-size the fleet to current

demand levels and rationalizing our location footprint by closing a number of locations. We have

developed additional plans for 2009 in an effort to mitigate the impact of continued revenue declines on

our results of operations, including further reducing costs through the recently announced additional

headcount reductions, continuing to right-size our car and equipment rental fleet in response to the

economic conditions, continued reengineering of our processes to reduce costs, increasing pricing and

continuing to reduce the cost of acquiring our car and equipment rental fleet, among other actions.

As a result of these past and planned actions, we believe that we will remain in compliance with our debt

covenants and that cash generated from operations, together with amounts available under various

liquidity facilities will be adequate to permit us to meet our debt service obligations, ongoing costs of

operations, working capital needs and capital expenditure requirements for the next year and beyond.

Our future financial and operating performance, ability to service or refinance our debt and ability to

comply with covenants and restrictions contained in our debt agreements will be subject to future

economic conditions and to financial, business and other factors, many of which are beyond our control.

As of December 31, 2008, approximately 24% of our fleet consisted of cars purchased from Ford, of

which approximately 32% were program cars and approximately 28% of our fleet consisted of cars

purchased from General Motors, of which approximately 32% were program cars. In the past several

128