Hertz 2008 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

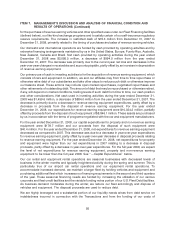

We have a significant amount of debt that will mature over the next several years. The aggregate

amounts of maturities of debt (in millions of dollars) are as follows: 2009, $3,637.7 (including $2,612.2 of

other short-term borrowings); 2010, $2,961.4; 2011, $123.7; 2012, $176.2; 2013, $1,372.3; after 2013,

$2,762.6. For a discussion of these maturities, see ‘‘Contractual Obligations.’’ The approximately

$2.6 billion of short-term borrowings included in the 2009 maturity are revolving in nature and do not

permanently expire in 2009. As a result of strategic cost reduction actions taken in 2008 and planned for

2009, we believe that we will remain in compliance with our debt covenants and that cash generated

from operations, together with amounts available under various liquidity facilities will be adequate to

permit us to meet our debt service obligations, ongoing costs of operations, working capital needs and

capital expenditure requirements for the next year and beyond. Our future financial and operating

performance, ability to service or refinance our debt and ability to comply with covenants and restrictions

contained in our debt agreements will be subject to future economic conditions and to financial,

business and other factors, many of which are beyond our control. Recent turmoil in the credit markets

and the financial instability of insurance companies providing financial guarantees for asset-backed

securities has reduced the availability of debt financing, which may result in increases in the interest

rates at which lenders are willing to make debt financing available to us. The impact of such an increase

would be more significant than it would be for some other companies because of our substantial debt.

For a discussion of risks related to our substantial indebtedness, see ‘‘Item 1A—Risk Factors—Risks

Relating to Our Substantial Indebtedness.’’

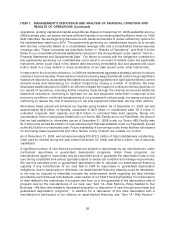

Our U.S. fleet debt in the amount of approximately $4.1 billion at December 31, 2008 is guaranteed by

third party insurance companies, MBIA Insurance Corporation, or ‘‘MBIA’’ and Ambac Assurance

Corporation, or ‘‘Ambac’’. MBIA and Ambac are facing financial instability and have been downgraded

and are on review for further credit downgrade or under developing outlook by one or more credit

agencies. An event of bankruptcy with respect to MBIA or Ambac would result in an amortization event

under the portion of the debt guaranteed by the affected insurer. In addition, if an amortization event

continues for 30 days or longer, the noteholders of the affected series of notes would have the right to

require liquidation of a portion of the fleet sufficient to repay such notes, provided that the exercise of the

right was exercised by a majority of the affected noteholders. Based on current information we do not

currently believe that there is a near-term risk of bankruptcy of MBIA or Ambac, nor do we expect the

noteholders to exercise their liquidation right in the event of a bankruptcy. However, in the event of a

bankruptcy of either MBIA or Ambac and subsequent vote by the noteholders to liquidate that portion of

our fleet, we would expect to use the portion of our $825 million asset-backed facility that is not insured

by MBIA or Ambac that is then available, together with our corporate liquidity and possibly other funding

sources, including car and equipment sales, to repay the affected series of notes. For a discussion of

risks related to the financial instability of MBIA or Ambac, see ‘‘Item 1A—Risk Factors—Risks Relating to

Our Substantial Indebtedness—The third-party insurance companies that provide credit enhancements

in the form of financial guarantees of U.S. Fleet Debt could face financial instability due to factors beyond

our control.’’

Certain events, such as a bankruptcy of one of the third-party insurance companies providing financial

guarantees with respect to our asset-backed notes or a manufacturer of a significant number of cars in

our fleet, or a continuing deterioration in the economic environment could lead to a deterioration in our

financial condition and liquidity position. In addition, although we believe it unlikely, in the case of the

bankruptcy of a combination of General Motors, Ford, MBIA or Ambac, if our available cash and other

funding sources were not sufficient to satisfy the consequences as described in Note 1 to the Notes to

our consolidated financial statements included in this Annual Report under caption ‘‘Item 8—Financial

Statements and Supplemental Data’’, we would be required to renegotiate with our lenders or raise

additional funds and there is no assurance that we would be successful in such renegotiation or the

raising of such funds.

95