HTC 2008 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2008 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Information

| 39

38 |

2008 Annual Report

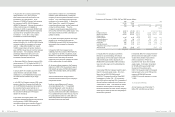

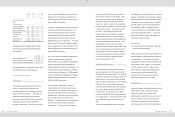

the Company’s paid-in capital. Also, the capital

surplus from long-term investments may not be used

for any purpose.

The additional paid-in capital was NT$4,410,871

thousand as of January 1, 2006. In April 2007, the

retirement of treasury stock caused a decrease of

additional paid-in capital amounted to 36,627

thousand. As a result, the additional paid-in capital

as of December 31, 2008 was NT$4,374,244

thousand (US$133,361 thousand). Under the

Company Law, the Company may transfer the

capital surplus to common stock if there is no

accumulated deficit.

When the Company did not subscribe for the new

shares issued by BandRich Inc. in May 2006 and

Vitamin D Inc. in September 2008, adjustments of

NT$15,845 thousand and NT$1,689 thousand

(US$52 thousand) were made to the investment’s

carrying value and capital surplus, respectively. As a

result, the capital surplus from long-term equity

investments as of December 31, 2008 was

NT$17,534 thousand (US$535 thousand).

The additional paid-in capital from a merger (Note 1),

which took effect on March 1, 2004, was NT$25,972

thousand. Then, because of treasury stock

retirement in April 2007, the additional paid-in capital

from a merger decreased to NT$25,756 thousand

(US$785 thousand).

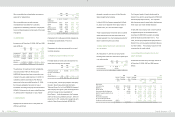

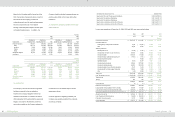

Appropriation of Retained Earnings and

Dividend Policy

Based on the Company Law of the ROC and the

Company’s Articles of Incorporation, 10% of the

Company’s annual net income less any deficit

should first be appropriated as legal reserve until

this reserve equals its capital. From the remainder,

there should be appropriations of not more than 3‰

as remuneration to directors and supervisors and at

least 5% as bonuses to employees.

The appropriation of retained earnings should be

proposed by the board of directors and approved by

the stockholders in their annual meeting.

As part of a high-technology industry and a growing

enterprise, the Company considers its operating

environment, industry developments, and long-term

interests of stockholders as well as its programs to

maintain operating efficiency and meet its capital

expenditure budget and financial goals in

determining the stock or cash dividends to be paid.

The Company’s dividend policy stipulates that at

least 50% of total dividends may be distributed as

cash dividends.

Had the Company recognized the employees’

bonuses of NT$531,000 thousand as expenses in

2005, the pro forma earnings per share in 2005

would have decreased from NT$33.26 to NT$31.76,

which were not adjusted retroactively for the effect of

stock dividend distribution in later years.

Had the Company recognized the employees’

bonuses of NT$2,105,000 thousand as expenses in

2006, the pro forma earnings per share in 2006

would have decreased from NT$57.85 to NT$53.03,

which were not adjusted retroactively for the effect of

stock dividend distribution in the following year.

Had the Company recognized the employees’

bonuses of NT$1,313,200 thousand as expenses in

2007, the pro forma earnings per share in 2007

would have decreased from NT$50.48 to NT$48.19,

which were not adjusted retroactively for the effect of

stock dividend distribution in the following year.

Based on a resolution passed by the Company’s

board of directors in February 2008, the employee

bonus payable should be appropriated at 18% of net

income less employee bonus expenses. If the

actual amounts subsequently resolved by the

stockholders differ from the proposed amounts, the

differences are recorded in the year of stockholders’

resolution as a change in accounting estimate. If

bonus shares are resolved to be distributed to

employees, the number of shares is determined by

dividing the amount of bonus by the closing price

(after considering the effect of cash and stock

dividends) of the shares of the day preceding the

stockholders’ meeting.

As of January 17, 2009, the date of the

accompanying independent auditors’ report, the

appropriation of the 2008 earnings had not been

proposed by the Board of Directors. Information on

earnings appropriation can be accessed online

through the Market Observation Post System on the

Web site.

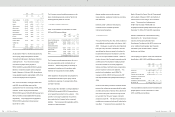

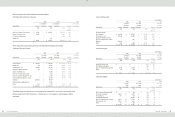

20.TREASURY STOCK

On October 7, 2008, the Company’s board of

directors passed a resolution to buy back 10,000

thousand Company shares from the open market.

The repurchase period was between October 8,

2008 and December 7, 2008, and the repurchase

price ranged from NT$400 (US$12) to NT$500

(US$15) per share. If the Company’s share price

was lower than this price range, the Company might

continue to buy back its shares.

The Company bought back 10,000 thousand shares

for NT$3,410,277 thousand (US$103,972 thousand)

during the repurchase period.

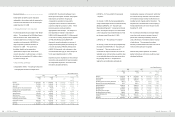

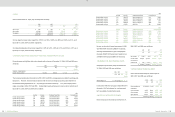

(In thousands of shares)

Purpose

As of

January 1, 2008

Increase

Decrease

As of

December 31, 2008

For maintaining the

Company’s credit and

stockholders’ equity

-

10,000

-

10,000

On December 12, 2006, the Company’s board of

directors passed a resolution to buy back 5,000

thousand Company shares from the open market.

The repurchase period was between December 13,

2006 and January 19, 2007, and the repurchase

price ranged from NT$601 to NT$800 per share. If

the Company’s share price was lower than this price

range, the Company might continue to buy back its

shares.

During the repurchase period, the Company bought

back 3,624 thousand shares, which were approved

to be retired by the Company’s board of directors in

April 2007, for NT$1,991,755 thousand.