HTC 2008 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2008 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Information

| 85

84 |

2008 Annual Report

In April 2008, the Company made a new

investment of US$350 thousand and transferred its

bond investment of US$1,000 thousand to

convertible preferred stocks issued by Vitamin D

Inc. As a result, the Company acquired 27%

equity interest in Vitamin D Inc. for NT$40,986

thousand, (US$1,250 thousand), enabling the

Company to exercise significant influence over this

investee. Thus, the Company accounts for this

investment by the equity method. In September

2008, Vitamin D Inc. issued 2,375 thousand

convertible preferred shares, but the Company did

not buy any of these shares. Thus, the

Company’s ownership percentage declined from

27% to 26%, and there was a capital surplus -

long-term equity investments of NT$1,689

thousand (US$52 thousand).

On its equity-method investments, the Company

had a loss of NT$6,151 thousand (US$188

thousand) for the year ended December 31, 2008.

The financial statements of equity-method

investees had been examined by the Company’s

independent auditors.

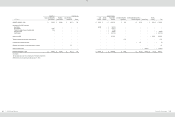

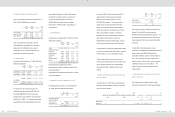

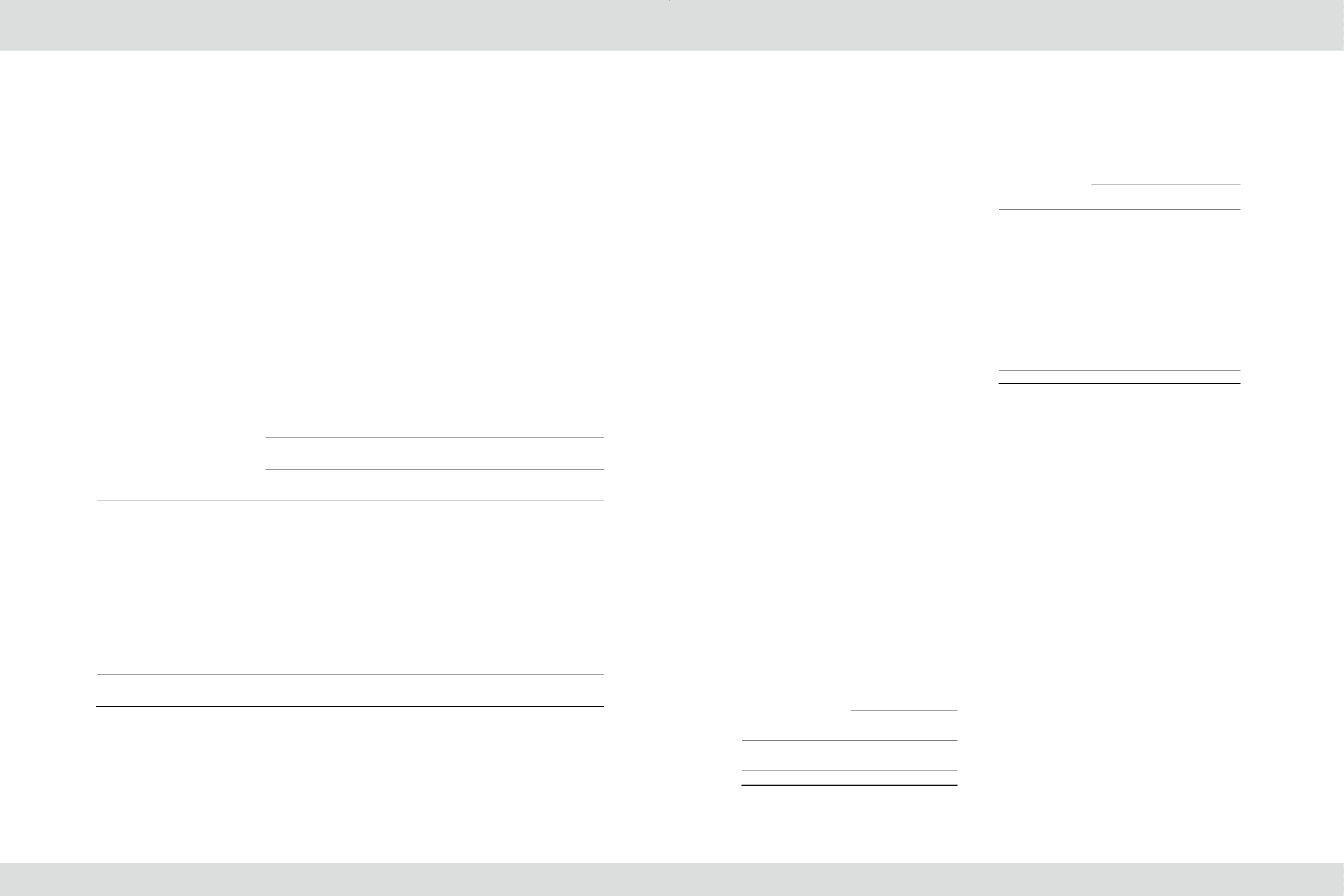

15.PROPERTIES

Properties as of December 31, 2006, 2007 and

2008 were as follows:

2006

2007

2008

Carrying Value

Carrying Value

Cost

Accumulated

Depreciation

Carrying Value

NT$

NT$

NT$

NT$

NT$

US$

(Note 3)

Land

$

610,293

$

610,293

$

3,568,124

$

-

$

3,568,124

$

108,784

Buildings and structures

735,785

1,831,765

2,856,815

525,185

2,331,630

71,086

Machinery and equipment

1,170,572

1,339,950

4,579,241

3,086,203

1,493,038

45,519

Molding equipment

-

11,113

194,320

179,994

14,326

437

Computer equipment

73,830

97,374

350,118

229,329

120,789

3,683

Transportation equipment

1,167

703

4,605

3,012

1,593

49

Furniture and fixtures

51,056

98,092

462,157

154,811

307,346

9,370

Leased assets

3,927

3,141

5,336

2,356

2,980

91

Leasehold improvements

49,797

79,306

188,182

62,947

125,235

3,818

Prepayments for construction-in-progress and

equipment-in-transit

473,971

149,225

951,289

-

951,289

29,003

$

3,170,398

$

4,220,962

$

13,160,187

$

4,243,837

$

8,916,350

$

271,840

In August 2008, the Company acquired from

Runtop Inc. land and building, with areas of

approximately 10.6 thousand square meters

and 40 thousand square meters, respectively,

for NT$900,000 thousand (US$27,439 thousand) to

have more office space and to build parking lots,

dormitory, etc.

In December 2008, the Company bought the

land - about 8.3 thousand square meters - from

Yulon Motors Ltd. for NT$3,335,000 thousand

(US$101,677 thousand) to build the Taipei R&D

headquarters in Xindian City. Of the purchase

price, 80% had been paid and 80% of

ownership of the land had been transferred to

the Company as of December 31, 2008. Yulon

Motors Ltd. should transfer the remaining 20%

of ownership of the land before December 20,

2009, and the Company should pay the

remaining 20% after completing the land

transfer registration.

In December 2008, the Company’s board of

directors resolved to participate in the third

auction held by Taiwan Financial Asset Service

Corporation (“TFASC”) and acquired the land -

about 16.5 thousand square meters - from

Hualon Corporation for NT$355,620 thousand

(US$10,842 thousand). Of the purchase price,

NT$71,130 thousand (US$2,169 thousand) had

been paid by the end of 2008, and the remaining

NT$284,490 thousand (US$8,673 thousand)

was paid on January 7, 2009.

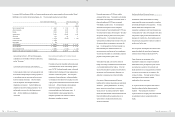

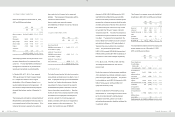

16.SHORT-TERM BORROWINGS

Short-term borrowings as of December 31, 2008

were as follows:

2006

2007

2008

NT$

NT$

NT$

US$

(Note 3)

Working capital loans, annual

interest at 2.80%~4.40%

$

-

$

-

$

75,000

$

2,286

$

-

$

-

$

75,000

$

2,286

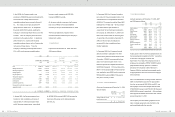

17.ACCRUED EXPENSES

Accrued expenses as of December 31, 2006, 2007

and 2008 were as follows:

2006

2007

2008

NT$

NT$

NT$

US$

(Note 3)

Bonus to employees

$

451,000

$

-

$

6,164,889

$

187,954

Marketing

983,088

3,190,918

5,790,466

176,539

Salaries & bonuses

828,071

989,143

1,220,533

37,211

Services

53,074

148,815

520,383

15,865

Export expenses

200,083

139,512

460,724

14,047

Research materials

128,505

193,859

539,071

16,435

Meals and welfare

57,598

58,287

101,563

3,096

Repairs and maintenance

23,759

33,686

82,096

2,503

Insurance

42,403

47,460

74,061

2,258

Research and development

-

-

65,600

2,000

Pension for contribution plan

26,781

33,870

49,630

1,513

Travel

58,027

40,777

32,507

991

Others

82,689

250,082

247,247

7,538

$

2,935,078

$

5,126,409

$

15,348,770

$

467,950

As discussed in Note 4 to the financial statements, the

Company adopted Interpretation 96-052 - “Accounting

for Bonuses to Employees, Directors and

Supervisors.” As a result, the Company accrued an

employee bonus payable of NT$6,164,889 thousand

(US$187,954 thousand). Based on a resolution

passed by the Company’s board of directors in

February 2008, the employee bonus payable should

be appropriated at 18% of net income less employee

bonus expenses.

Also, in the stockholders’ meetings of 2006, 2007 and

2008, the stockholders approved the appropriation

from the net earnings of 2005, 2006 and 2007, and

the employee bonuses were NT$451,000 thousand,

NT$2,000,000 thousand and NT$1,210,000 thousand

(US$36,890 thousand), respectively. Only employee

bonus payable of NT$451,000 thousand had not been

paid on December 31, 2006.

The Company accrued marketing expenses on the

basis of related agreements and other factors that

would significantly affect the accruals.