HTC 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Information

| 29

28 |

2008 Annual Report

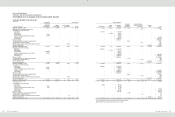

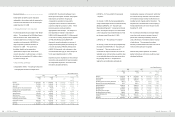

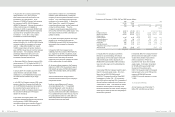

5.CASH

Cash as of December 31, 2006, 2007 and 2008 was as follows:

2006

2007

2008

NT$

NT$

NT$

US$

(Note 3)

Cash on hand

$

1,000

$

1,000

$

930

$

29

Cash in banks

4,137,988

8,776,552

1,774,195

54,091

Time deposits

30,258,400

46,258,680

60,051,748

1,830,846

$

34,397,388

$

55,036,232

$

61,826,873

$

1,884,966

On time deposits, interest rates ranged from 1.610% to 2.145%, 1.809% to 4.400% and 0.30% to 2.41%, as of

December 31, 2006, 2007 and 2008, respectively.

On preferential deposits, interest rates ranged from 2.30% to 5.25%, 3.05% to 4.15% and 0.02% to 2.71% as of

December 31, 2006, 2007 and 2008, respectively.

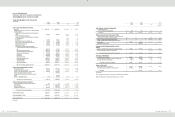

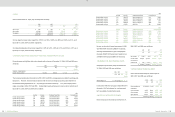

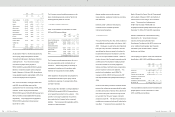

6.FINANCIAL ASSETS AND LIABILITIES AT FAIR VALUE THROUGH PROFIT OR LOSS

Financial assets and liabilities at fair value through profit or loss as of December 31, 2006, 2007 and 2008 were

as follows:

2006

2007

2008

NT$

NT$

NT$

US$

(Note 3)

Derivatives - financial liabilities

Forward exchange contracts

$

76,470

$

96,256

$

514,083

$

15,673

The Company had derivative transactions in 2006, 2007 and 2008 to manage exposures related to exchange rate

fluctuations. However, these transactions did not meet the criteria for hedge accounting under Statement of

Financial Accounting Standards No. 34 - “Accounting for Financial Instruments.” Thus, the Company had no

hedge accounting in 2006, 2007 and 2008. Outstanding forward exchange and currency option contracts as of

December 31, 2006, 2007 and 2008 were as follows:

2006

Buy/Sell

Currency

Settlement Period/ Date

Contract Amount

Forward exchange contracts

Sell

USD/NTD

2007.01.05-2007.03.28

US$

78,000

Forward exchange contracts

Sell

EUR/USD

2007.01.05-2007.03.09

EUR€

108,000

Forward exchange contracts

Buy

USD/JPY

2007.01.12-2007.03.09

US$

11,000

Forward exchange contracts

Sell

GBP/USD

2007.01.05-2007.02.16

GBP£

6,150

Forward exchange contracts

Sell

JPY/NTD

2007.01.12-2007.03.28

JP¥

427,750

Forward exchange contracts

Sell

JPY/USD

2007.01.17-2007.03.28

JP¥

810,626

2007

Buy/Sell

Currency

Settlement Period/ Date

Contract Amount

Forward exchange contracts

Sell

USD/NTD

2008.01.04-2008.01.30

US$

63,000

Forward exchange contracts

Sell

EUR/USD

2008.01.09-2008.03.05

EUR

€

201,500

Forward exchange contracts

Buy

USD/CAD

2008.01.11-2008.02.22

US$

5,146

Forward exchange contracts

Sell

GBP/USD

2008.01.11-2008.01.30

GBP£

3,725

Forward exchange contracts

Sell

JPY/NTD

2008.01.09

JP¥

425,000

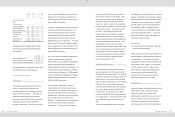

2008

Buy/Sell

Currency

Settlement Period/ Date

Contract Amount

Forward exchange contracts

Sell

AUD/USD

2009.01.07-2009.01.16

AUD$

17,000

Forward exchange contracts

Sell

EUR/USD

2009.01.07-2009.02.27

EUR€

141,000

Forward exchange contracts

Sell

GBP/USD

2009.01.07-2009.02.18

GBP£

3,870

Forward exchange contracts

Sell

JPY/NTD

2009.01.16

JP¥

95,000

Forward exchange contracts

Buy

USD/JPY

2009.01.07-2009.02.13

US$

16,726

Forward exchange contracts

Sell

USD/NTD

2009.01.07-2009.01.23

US$

37,000

Forward exchange contracts

Buy

USD/CAD

2009.01.16

US$

618

Net gain on derivative financial instruments in 2008

was NT$311,946 thousand (US$9,511 thousand),

including realized settlement gain of NT$826,029

thousand (US$25,184 thousand) and valuation loss

of NT$514,083 thousand (US$15,673 thousand).

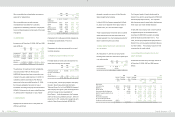

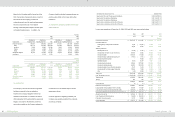

7.AVAILABLE-FOR-SALE FINANCIAL ASSETS

Available-for-sale financial assets as of December

31, 2006, 2007 and 2008 were as follows:

2006

2007

2008

NT$

NT$

NT$

US$

(Note 3)

VIA Technologies, Inc.

$

1,733

$

784

$

339

$

10

In December 1999, the Company invested NT$1,971

thousand in VIA Technologies, Inc. and accounted

for it as available-for-sale financial asset.

8.NOTES AND ACCOUNTS RECEIVABLE

Notes and accounts receivable as of December 31,

2006, 2007 and 2008 were as follows:

2006

2007

2008

NT$

NT$

NT$

US$

(Note 3)

Notes receivable

$

58,930

$

3,058

$

3,456

$

105

Accounts receivable

18,320,329

19,215,152

29,407,383

896,567

Less: Allowance for

doubtful accounts

(

2,350

)

(

271,285

)

(

550,597

)

(

16,787

)

$

18,376,909

$

18,946,925

$

28,860,242

$

879,885

9.OTHER CURRENT FINANCIAL ASSETS

Other current financial assets as of December 31,

2006, 2007 and 2008 were as follows:

2006

2007

2008

NT$

NT$

NT$

US$

(Note 3)

Other receivables from

related parties

$

130,990

$

171,901

$

13,869

$

423

Interest receivables

24,854

50,444

40,026

1,220

Other receivables

22,676

47,625

193,092

5,887

Agency payments

189,977

14,081

28,519

870

$

368,497

$

284,051

$

275,506

$

8,400