HTC 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

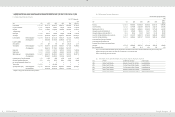

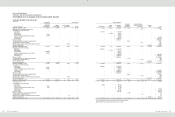

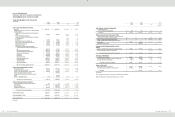

Financial Information

| 25

24 |

2008 Annual Report

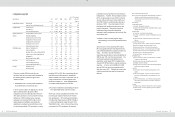

Pension Plan

Pension cost under a defined benefit plan is

determined by actuarial valuations. Contributions

made under a defined contribution plan are

recognized as pension cost during the year in which

employees render services.

Curtailment or settlement gains or losses of the

defined benefit plan are recognized as part of the

net yearic pension cost for the year.

Income Tax

The Company applies intra-year and inter-year

allocations for its income tax, whereby (1) a portion

of income tax expense is allocated to the cumulative

effect of changes in accounting principles; and (2)

deferred income tax assets and liabilities are

recognized for the tax effects of temporary

differences, unused loss carryforward and unused

tax credits. Valuation allowances are provided to

the extent, if any, that it is more likely than not that

deferred income tax assets will not be realized. A

deferred tax asset or liability is classified as current

or noncurrent in accordance with the classification of

its related asset or liability. However, if a deferred

income tax asset or liability does not relate to an

asset or liability in the financial statements, then it is

classified as either current or noncurrent based on

the expected length of time before it is realized or

settled.

Tax credits for purchases of machinery, equipment

and technology, research and development

expenditures, and personnel training expenditures

are recognized using the flow-through method.

Adjustments of prior years’ tax liabilities are added to

or deducted from the current year’s tax provision.

According to the Income Tax Law, an additional tax

at 10% of unappropriated earnings is provided for as

income tax in the year the stockholders approve to

retain the earnings.

Stock-Based Employee Compensation Plans

Employee stock options granted between January 1,

2004 and December 31, 2007 were accounted for

under the interpretations issued by the Accounting

Research and Development Foundation (“ARDF”).

The Company adopted the intrinsic value method,

under which compensation cost was recognized on

a straight-line basis over the vesting period.

Treasury Stock

The Company adopted the Statement of Financial

Accounting Standards No. 30 - “Accounting for

Treasury Stocks,” which requires the treasury stock

held by the Company to be accounted for by the cost

method. The cost of treasury stock is shown as a

deduction to arrive at stockholders’ equity, while gain

or loss from selling treasury stock is treated as an

adjustment to capital surplus.

When treasury stocks are sold and the selling price

is above the book value, the difference should be

credited to the capital surplus - treasury stock

transactions. If the selling price is below the book

value, the difference should first be offset against

capital surplus from the same class of treasury stock

transactions, and any remainder should be debited

to retained earnings. The carrying value of

treasury stocks should be calculated using the

weighted-average method.

When the Company's treasury stock is retired, the

treasury stock account should be credited, and the

capital surplus - premium on stock account and

capital stock account should be debited

proportionately according to the share ratio. The

difference should be credited to capital surplus or

debited to capital surplus and/or retained earnings.

Foreign Currencies

The financial statements of foreign operations are

translated into New Taiwan dollars at the following

exchange rates:

a. Assets and liabilities - at exchange rates

prevailing on the balance sheet date;

b. Stockholders’ equity - at historical exchange

rates;

c. Dividends - at the exchange rate prevailing on the

dividend declaration date; and

d. Income and expenses - at average exchange

rates for the year.

Exchange differences arising from the translation of

the financial statements of foreign operations are

recognized as a separate component of

stockholders’ equity. Such exchange differences

are recognized as gain or loss in the year in which

the foreign operations are disposed of.

Nonderivative foreign-currency transactions are

recorded in New Taiwan dollars at the rates of

exchange in effect when the transactions occur.

Exchange differences arising from the settlement of

foreign-currency assets and liabilities are

recognized as gain or loss.

At the balance sheet date, foreign-currency

monetary assets and liabilities are revalued using

prevailing exchange rates and the exchange

differences are recognized in profit or loss.

At the balance sheet date, foreign-currency

nonmonetary assets (such as equity instruments)

and liabilities that are measured at fair value are

revalued using prevailing exchange rates, with the

exchange differences treated as follows:

a. Recognized in stockholders’ equity if the changes

in fair value are recognized in stockholders’

equity;

b. Recognized in profit and loss if the changes in fair

value is recognized in profit or loss.

Foreign-currency nonmonetary assets and liabilities

that are carried at cost continue to be stated at

exchange rates at the trade dates.

If the functional currency of an equity-method

investee is a foreign currency, translation

adjustments will result from the translation of the

investee’s financial statements into the reporting

currency of the Company. These adjustments are

accumulated and reported as a separate component

of stockholders’ equity.