HTC 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Information

| 15

14 |

2008 Annual Report

HTC CORPORATION

(Formerly High Tech Computer Corporation)

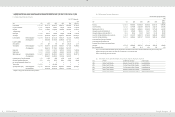

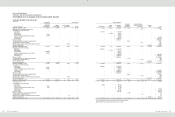

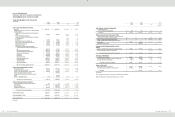

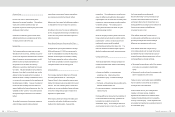

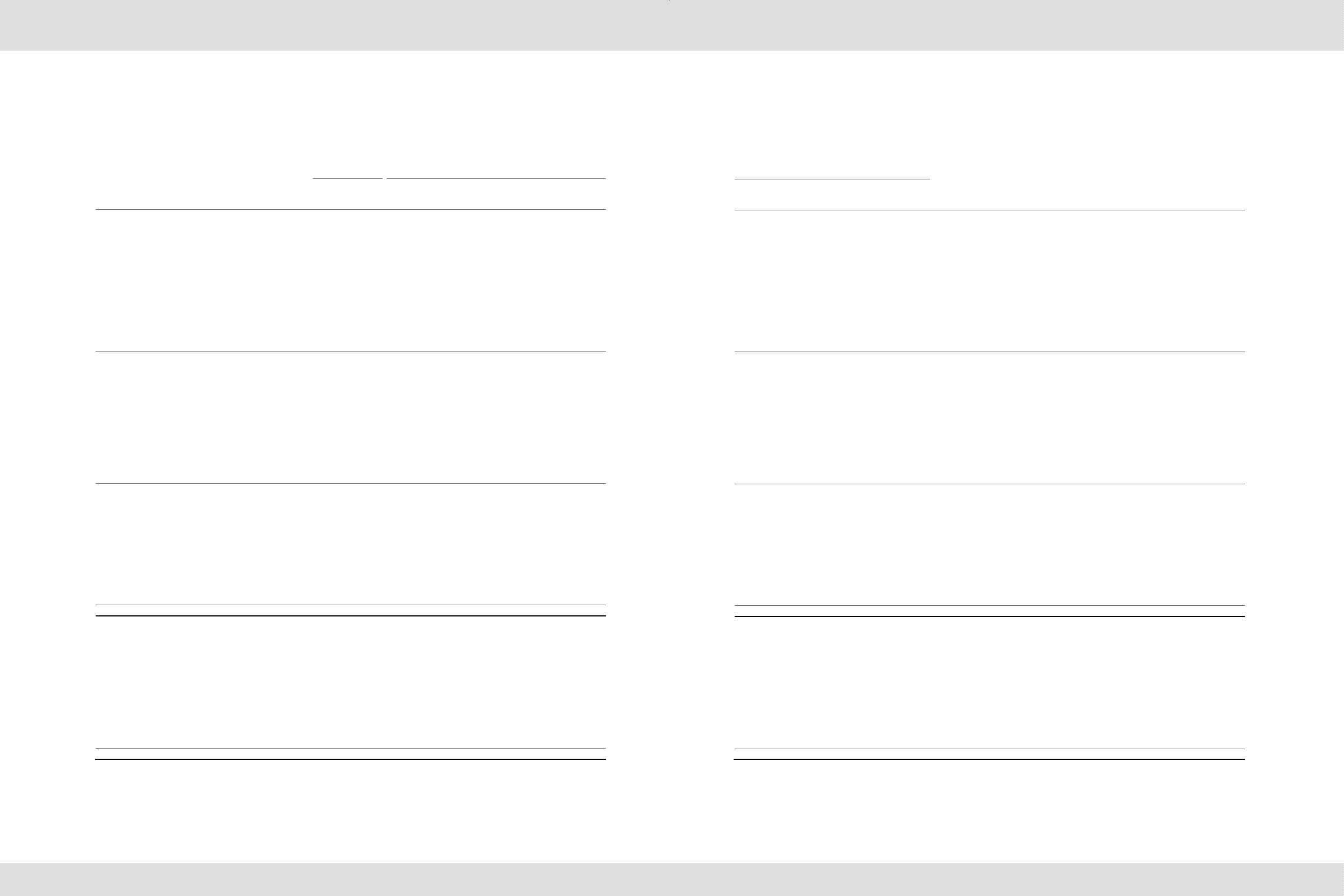

STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

YEARS ENDED DECEMBER 31, 2006, 2007 AND 2008

(In Thousands)

Capital Stock

Capital Surplus

New Taiwan Dollars

Issued and

Outstanding

Common Stock

Additional

Paid-in Capital

Long-Term Equity

Investments

Merger

BALANCE, JANUARY 1, 2006

$

3,570,160

$

4,410,871

$

-

$

25,972

Adjustments due to accounting changes (Note 4)

-

-

-

-

Appropriation of the 2005 net earnings

Legal reserve

-

-

-

-

Special reserve

-

-

-

-

Stock dividends

714,032

-

-

-

Transfer of employee bonuses to common stock

80,000

-

-

-

Employee bonuses

-

-

-

-

Cash dividends

-

-

-

-

Net income in 2006

-

-

-

-

Translation adjustments on long-term equity investments

-

-

-

-

Unrealized gain on financial instruments

-

-

-

-

Adjustment due to changes in ownership percentage in investees

-

-

15,845

-

Purchase of treasury stock

-

-

-

-

BALANCE, DECEMBER 31, 2006

4,364,192

4,410,871

15,845

25,972

Appropriation of the 2006 net earnings

Legal reserve

-

-

-

-

Special reserve

-

-

-

-

Stock dividends

1,298,385

-

-

-

Transfer of employee bonuses to common stock

105,000

-

-

-

Employee bonuses

-

-

-

-

Cash dividends

-

-

-

-

Net income in 2007

-

-

-

-

Translation adjustments on long-term equity investments

-

-

-

-

Unrealized loss on financial instruments

-

-

-

-

Purchase of treasury stock

-

-

-

-

Retirement of treasury stock

(

36,240

)

(

36,627

)

-

(

216

)

BALANCE, DECEMBER 31, 2007

5,731,337

4,374,244

15,845

25,756

Appropriation of the 2007 net earnings

Legal reserve

-

-

-

-

Stock dividends

1,719,401

-

-

-

Transfer of employee bonuses to common stock

103,200

-

-

-

Employee bonuses

-

-

-

-

Cash dividends

-

-

-

-

Net income in 2008

-

-

-

-

Translation adjustments on long-term equity investments

-

-

-

-

Unrealized loss on financial instruments

-

-

-

-

Adjustment due to changes in ownership percentage in investees

-

-

1,689

-

Purchase of treasury stock

-

-

-

-

BALANCE, DECEMBER 31, 2008

$

7,553,938

$

4,374,244

$

17,534

$

25,756

BALANCE, JANUARY 1, 2008

$

174,736

$133,361

$

483

$

785

U.S. Dollars

Appropriation of the 2007 net earnings

Legal reserve

-

-

-

-

Stock dividends

52,421

-

-

-

Transfer of employee bonuses to common stock

3,146

-

-

-

Employee bonuses

-

-

-

-

Cash dividends

-

-

-

-

Net income in 2008

-

-

-

-

Translation adjustments on long-term equity investments

-

-

-

-

Unrealized loss on financial instruments

-

-

-

-

Adjustment due to changes in ownership percentage in investees

-

-

52

-

Purchase of treasury stock

-

-

-

-

BALANCE, DECEMBER 31, 2008

$

230,303

$

133,361

$

535

$

785

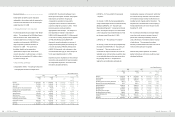

Retained Earnings

Legal Reserve

Special

Reserve

Accumulated

Earnings

Cumulative

Translation

Adjustments

Unrealized Valuation

Losses on Financial

Instruments

Treasury

Stock

Total

$

813,326

$

19,133

14,152,255

$

(

5,041

)

$

(

1,135

)

$

-

$

22,985,541

-

-

-

-

48

-

48

1,178,194

-

(

1,178,194

)

-

-

-

-

-

(

12,958

)

12,958

-

-

-

-

-

-

(

714,032

)

-

-

-

-

-

-

(

80,000

)

-

-

-

-

-

-

(

451,000

)

-

-

-

(

451,000

)

-

-

(

4,998,224

)

-

-

-

(

4,998,224

)

-

-

25,247,327

-

-

-

25,247,327

-

-

-

15,827

-

-

15,827

-

-

-

-

849

-

849

-

-

-

-

-

-

15,845

-

-

-

-

-

(

243,995

)

(

243,995

)

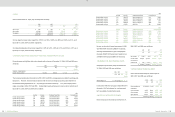

1,991,520

6,175

31,991,090

10,786

(

238

)

(

243,995

)

42,572,218

2,524,733

-

(

2,524,733

)

-

-

-

-

-

(

6,175

)

6,175

-

-

-

-

-

-

(

1,298,385

)

-

-

-

-

-

-

(

105,000

)

-

-

-

-

-

-

(

2,000,000

)

-

-

-

(

2,000,000

)

-

-

(

11,685,470

)

-

-

-

(

11,685,470

)

-

-

28,938,862

-

-

-

28,938,862

-

-

-

(

1,122

)

-

-

(

1,122

)

-

-

-

-

(

949

)

-

(

949

)

-

-

-

-

-

(

1,747,760

)

(

1,747,760

)

-

-

(

1,918,672

)

-

-

1,991,755

-

4,516,253

-

41,403,867

9,664

(

1,187

)

-

56,075,779

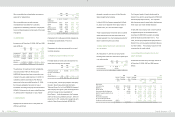

2,893,886

-

(

2,893,886

)

-

-

-

-

-

-

(

1,719,401

)

-

-

-

-

-

-

(

103,200

)

-

-

-

-

-

-

(

1,210,000

)

-

-

-

(

1,210,000

)

-

-

(

19,486,547

)

-

-

-

(

19,486,547

)

-

-

28,635,349

-

-

-

28,635,349

-

-

-

55,938

-

-

55,938

-

-

-

-

(

445

)

-

(

445

)

-

-

-

-

-

-

1,689

-

-

-

-

-

(

3,410,277

)

(

3,410,277

)

$

7,410,139

$

-

$

44,626,182

$

65,602

$

(

1,632

)

$

(

3,410,277

$

60,661,486

$

137,691

$

-

$

1,262,313

$

295

$

(

36

)

$

-

$

1,709,628

88,228

-

(

88,228

)

-

-

-

-

-

-

(

52,421

)

-

-

-

-

-

-

(

3,146

)

-

-

-

-

-

-

(

36,890

)

-

-

-

(

36,890

)

-

-

(

594,102

)

-

-

-

(

594,102

)

-

-

873,029

-

-

-

873,029

-

-

-

1,705

-

-

1,705

-

-

-

-

(

14

)

-

(

14

)

-

-

-

-

-

-

52

-

-

-

-

-

(

103,972

)

(

103,972

)

$

225,919

$

-

$

1,360,555

$

2,000

$

(

50

)

$

(

103,972

)

$

1,849,436

The accompanying notes are an integral part of the financial statements.

(With Deloitte & Touche audit report dated January 17, 2009)