HTC 2008 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2008 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Information

| 87

86 |

2008 Annual Report

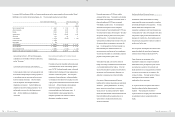

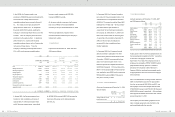

18.OTHER CURRENT LIABILITIES

Other current liabilities as of December 31, 2006,

2007 and 2008 were as follows:

2006

2007

2008

NT$

NT$

NT$

US$

(Note 3)

Reserve for warranty

expenses

$1,393,995

$3,469,957

$5,228,603

$159,408

Other payable

38,699

66,755

389,103

11,863

Agency receipts

145,373

226,124

285,914

8,717

Advance receipts

57,426

177,150

180,504

5,503

Directors’

remuneration

21,842

21,842

21,842

666

Others

4,668

8,204

2,730

83

$1,662,003

$3,970,032

$6,108,696

$186,240

The Company provides warranty service for one to

two years, depending on the contracts with our

customers. The warranty liability is estimated on

management’s evaluation of the products under

warranty and recognized as warranty liability.

In October 2008, H.T.C. (B.V.I.) Corp. acquired

100% equity interest of One & Company Design,

Inc., and paid the investment to the original

stockholders of One & Company Design, Inc. in

several installments based on the agreement. Of

the investment, NT$122,700 thousand (US$3,741

thousand) had not been paid as of December 31,

2008.

The Company also estimated a contingent liability of

NT$259,450 thousand (US$7,910 thousand) due to

an increased financial risk from the customer. If the

customer cannot pay its payments, the upstream

firms might dun the Company for the customer’s

liabilities. The Company is still negotiating with the

customer to resolve this issue.

Agency receipts were primarily overseas

value-added tax, employees’ income tax, insurance,

and other items.

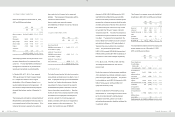

19.LONG-TERM BANK LOANS

2006

2007

2008

NT$

NT$

NT$

US$

(Note 3)

Secured loans (Note 28)

NT$50,000 thousand, repayable

from July 2006 in 16 quarterly

installments; 1% annual interest

$ -

$31,250

$18,750

$ 572

NT$65,000 thousand, repayable

from July 2008 in 16 quarterly

installments; 1% annual interest

-

65,000

56,875

1,734

Less: Current portion

-

(20,625

)

(28,750

)

(877

)

$ -

$75,625

$46,875

$1,429

20.PENSION PLAN

The Labor Pension Act (the “Act), which provides for

a new defined contribution plan, took effect on July 1,

2005. Employees covered by the Labor Standards

Law (the “Law”) before the enforcement of the Act

were allowed to choose to remain to be subject to

the defined benefit pension mechanism under the

Law or to be subject instead to the Act. Based on

the Act, the rate of the Company’s required monthly

contributions to the employees’ individual pension

accounts is at least 6% of monthly wages and

salaries, and these contributions are recognized as

pension expense in the income statement. The

pension fund contributions were NT$90,488

thousand in 2006, NT$113,985 thousand in 2007

and NT$162,692 (US$4,960 thousand) in 2008.

Under the Law, which provides for a defined benefit

pension plan, retirement payments should be made

according to the years of service, with a payment of

two units for each year of service but only one unit

per year after the 15th year; however, total units

should not exceed 45. The rate of the Company’s

contributions to a pension fund was 2% after the Act

took effect. The pension fund is deposited in the

Bank of Taiwan (the Central Trust of China merged

with the Bank of Taiwan in 2007, with the Bank of

Taiwan as the survivor entity) in the committee’s

name. The pension fund balances were

NT$311,532 thousand, NT$348,853 thousand and

NT$389,216 thousand (US$11,866 thousand) as of

December 31, 2006, 2007 and 2008, respectively.

H.T.C. (B.V.I.) Corp., HTC HK, Limited, and High

Tech Computer Asia Pacific Pte. Ltd. have no

pension plans.

Under their respective local government regulations,

other subsidiaries have defined contribution pension

plans covering all eligible employees. The pension

fund contributions were NT$3,006 thousand in 2006

NT$15,728 thousand in 2007 and NT$41,827

(US$1,275 thousand) in 2008.

Based on the Statement of Financial Accounting

Standards No. 18 - “Accounting for Pensions” issued

by the Accounting Research and Development

Foundation of the ROC, pension cost under a

defined benefit pension plan should be calculated by

the actuarial method.

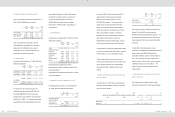

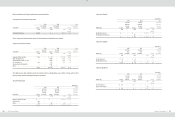

The Company’s net pension costs under the defined

benefit plan in 2006, 2007 and 2008 were as follows:

2006

2007

2008

NT$

NT$

NT$

US$

(Note 3)

Service cost

$

5,259

$

4,930

$

5,194

$

158

Interest cost

9,400

8,629

8,743

267

Projected return on plan

assets

(

10,320

)

(

8,988

)

9,980

)

(304

)

Amortization

1,708

2,256

1,561

47

Curtailment gain

-

-

(

211

)

(

6

)

Net pension cost

$

6,047

$

6,827

$

5,307

$

162

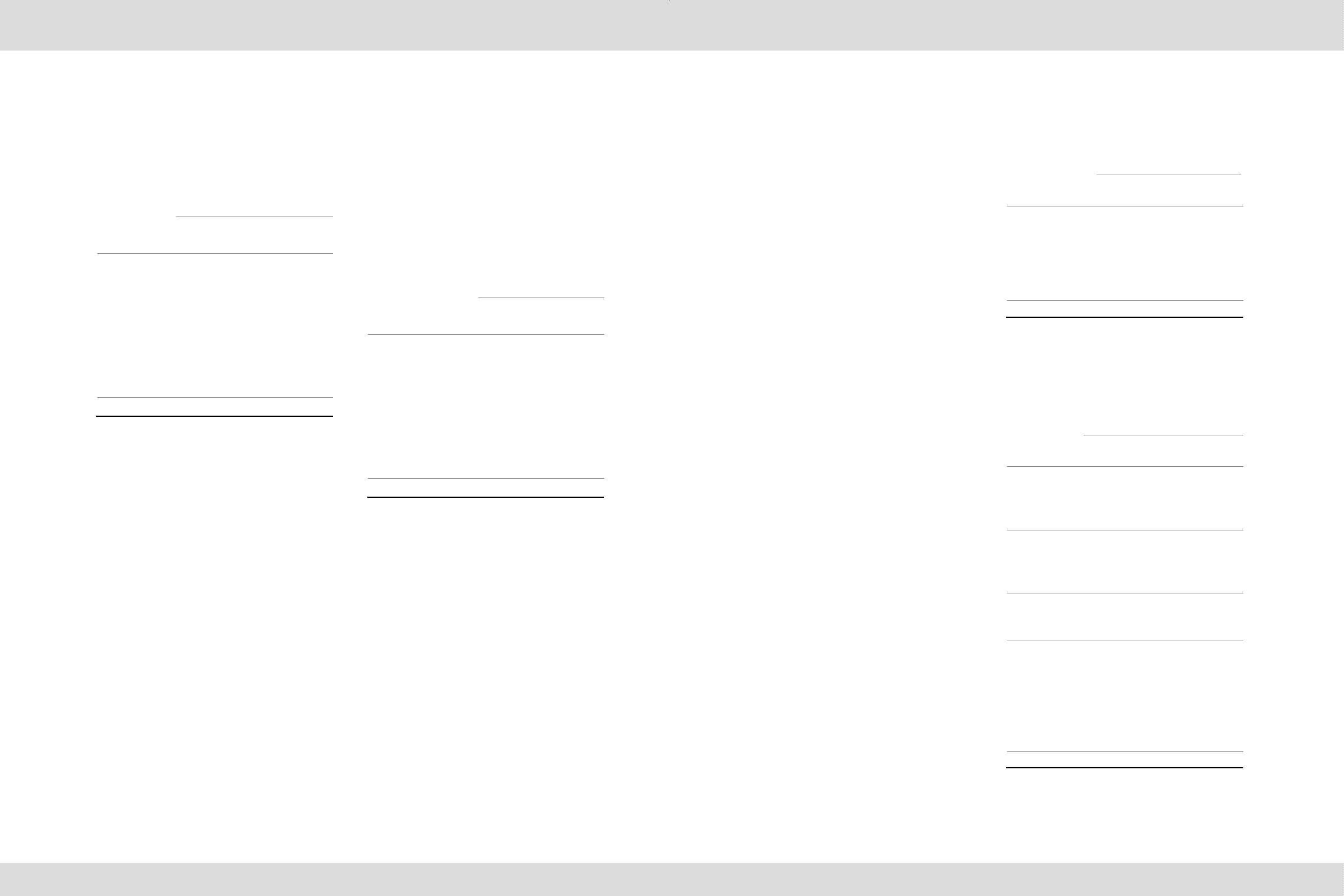

The reconciliations between pension fund status and

prepaid pension cost as of December 31, 2006,

2007 and 2008 were as follows:

2006

2007

2008

NT$

NT$

NT$

US$

(Note 3)

Present actuarial value

of benefit obligation

Vested benefits

$

-

$

-

$

-

$

-

Non-vested benefits

153,371

172,092

164,214

5,006

Accumulated benefit

obligation

153,371

172,092

164,214

5,006

Additional benefits on

future salaries

159,023

145,809

176,784

5,390

Projected benefit

obligation

312,394

317,901

340,998

10,396

Plan assets at fair value

(

311,532

)

(

348,853

)

(

389,216

)

(

11,866

)

Funded status

862

(30,952

)

(

48,218

)

(

1,470

)

Unrecognized net

transitional obligation

-

(1,032

)

(

564

)

(

17

)

Unrecognized pension

loss

(

74,882

)

(63,229

)

(

68,630

)

(

2,092

)

Additional minimum

pension liability

-

953

475

14

Prepaid pension cost

$(

74,020

)

$(

94,260

)

$(

116,937

)

$(

3,565

)