HTC 2008 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2008 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Information

| 95

94 |

2008 Annual Report

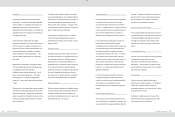

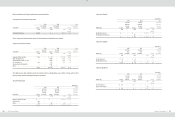

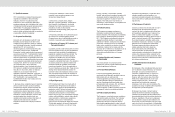

The tax effects of deductible temporary differences and loss and tax credit carryforwards that gave rise to

deferred tax assets as of December 31, 2006, 2007 and 2008 were as follows:

2006

2007

2008

NT$

NT$

NT$

US$

(Note 3)

Temporary differences

Provision for loss on decline in value of inventory

$

222,916

$

229,072

$

418,861

$

12,770

Unrealized marketing expenses

245,772

757,691

1,456,074

44,393

Unrealized reserve for warranty expense

348,499

867,489

1,307,151

39,852

Capitalized expense

31,936

39,628

59,474

1,813

Unrealized royalties

942,097

1,009,848

1,535,925

46,827

Unrealized bad-debt expenses

-

16,072

26,503

808

Unrealized valuation loss on financial instruments

19,117

24,064

128,521

3,918

Other

27,770

45,345

11,711

357

Loss carryforwards

7,868

25,293

50,545

1,541

Tax credit carryforwards

9,574

47,484

2,281,856

69,569

Total deferred tax assets

1,855,549

3,061,986

7,276,621

221,848

Less: Valuation allowance

(

1,147,549

)

(

2,026,939

)

(

5,826,064

)

(

177,624

)

Total deferred tax assets, net

708,000

1,035,047

1,450,557

44,224

Deferred tax liabilities

Unrealized pension cost

(

18,505

)

(

23,797

)

(

29,353

)

(895

)

Unrealized foreign exchange gain, net

(

38,254

)

(

43,035

)

(

41,249

)

(

1,258

)

Unrealized depreciation

-

(

5,049

)

(

6,532

)

(

199

)

651,241

963,166

1,373,423

41,872

Less: Current portion

(

428,077

)

(

570,992

)

(

550,530

)

(

16,784

)

Deferred tax assets - noncurrent

$

223,164

$

392,174

$

822,893

$25,088

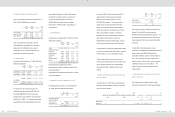

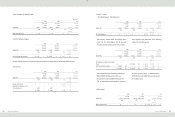

Details of the tax credit carryforwards were as follows:

Credit

2006

2007

2008

Grant Year

Validity Period

NT$

NT$

NT$

US$

(Note 3)

2004

2004-2008

$

-

$

6,965

$

-

$

-

2005

2005-2009

-

6,479

6,479

198

2006

2006-2010

9,574

15,475

15,475

472

2007

2007-2011

-

18,565

220,270

6,715

2008

2008-2012

-

-

2,039,632

62,184

$

9,574

$

47,484

$

2,281,856

$

69,569

Details of the loss carryforwards were as follows:

Loss

2006

2007

2008

Year

Validity Period

NT$

NT$

NT$

US$

(Note 3)

2005

2006-2010

$

-

$

95

$

95

$

3

2006

2007-2011

31,474

50,703

50,703

1,546

2007

2008-2012

-

50,372

48,885

1,490

2008

2009-2013

-

-

102,497

3,125

$

31,474

$

101,170

$

202,180

$

6,164

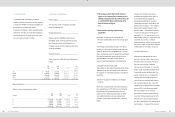

Based on the Income Tax Act of the ROC, the

investment research and development tax credits

can be carried forward for four years. The total

credits used in each year cannot exceed half of the

estimated income tax provision, except in the last

year.

Valuation allowance is based on management’s

evaluation of the amount of tax credits that can be

carried forward for four years, based on the

Company’s financial forecasts.

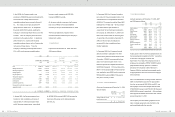

The income taxes in 2006, 2007 and 2008 were as

follows:

2006

2007

2008

NT$

NT$

NT$

US$

(Note 3)

Current income tax

$

1,849,052

$

3,497,798

$

3,602,387

$

109,799

Increase in deferred income tax assets

(

172,381

)

(

309,485

)

(

410,257

)

(

12,508

)

Underestimation (overestimation) of prior year’s income tax

31,704

125,911

(

8,940

)

(

243

)

Income tax

$

1,708,375

$

3,314,224

$

3,183,190

$

97,048

The integrated income tax information of HTC is as follows:

2006

2007

2008

NT$

NT$

NT$

US$

(Note 3)

Balance of imputation credit account (ICA)

$

1,772,897

$

3,005,386

$

5,568,676

$

169,777

Unappropriated earnings generated from 1998

31,991,090

41,403,867

44,626,182

1,360,555

Actual/ estimated creditable ratio (including income tax payable)

5.54 %

(actual ratio)

7.26%

(actual ratio)

12.48%

(estimated ratio)

12.48%

(estimated ratio)