HTC 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Information

| 71

70 |

2008 Annual Report

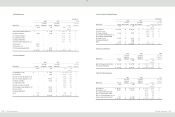

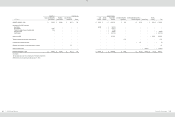

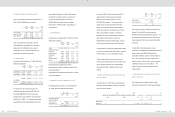

In January 2007 and October 2008, the Company wholly acquired the shares issued by Communication Global

Certification Inc. and One & Company Design, Inc. The net assets acquired were as follows:

Communication Global Certification Inc.

One & Company Design, Inc.

NT$

NT$

US$

(Note 3)

Cash on hand and in banks

$

39,961

$

7,336

$

224

Other current assets

40,201

12,378

377

Property

175,940

16,620

507

Intangible assets

174,253

115,055

3,508

Other assets

3,913

164

5

Current liabilities

(

63,315

)

(

15,220

)

(

464

)

Long-term bank loans

(

90,050

)

-

-

Other liabilities

(

903

)

-

-

Total consideration

$

280,000

$

136,333

$

4,157

Cash consideration

$

280,000

$

136,333

$

4,157

Cash on hand and in banks

(

39,961

)

(

7,336

)

(

224

)

Expected net cash outflow on the acquisition of a subsidiary

$

240,039

$

128,997

$

3,933

As mentioned in Note 1, HTC and the foregoing

subsidiaries are hereinafter referred to collectively

as the “Company.”

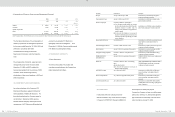

Current/Noncurrent Assets and Liabilities

Current assets include cash, cash equivalents, and

those assets held primarily for trading purposes or

to be realized, sold or consumed within one year

from the balance sheet date. All other assets

such as properties and intangible assets are

classified as noncurrent. Current liabilities are

obligations incurred for trading purposes or to be

settled within one year from the balance sheet

date. All other liabilities are classified as

noncurrent.

Financial Assets/Liabilities at Fair Value through

Profit or Loss

Financial instruments classified as financial assets

or financial liabilities at fair value through profit or

loss (“FVTPL”) include financial assets or financial

liabilities held for trading and those designated as

at FVTPL on initial recognition. The Company

recognizes a financial asset or a financial liability

on its balance sheet when the Company becomes

a party to the contractual provisions of the financial

instrument. A financial asset is derecognized

when the Company has lost control of its

contractual rights over the financial asset. A

financial liability is derecognized when the

obligation specified in the relevant contract is

discharged, cancelled or expired.

Financial instruments at FVTPL are initially

measured at fair value. Transaction costs directly

attributable to the acquisition of financial assets or

financial liabilities at FVTPL are recognized

immediately in profit or loss. At each balance

sheet date subsequent to initial recognition,

financial assets or financial liabilities at FVTPL are

remeasured at fair value, with changes in fair value

recognized directly in profit or loss in the year in

which they arise. Cash dividends received

subsequently (including those received in the year

of investment) are recognized as income for the

year. On derecognition of a financial asset or a

financial liability, the difference between its

carrying amount and the sum of the consideration

received and receivable or consideration paid and

payable is recognized in profit or loss.

A derivative that does not meet the criteria for

hedge accounting is classified as a financial asset

or a financial liability held for trading. If the fair

value of the derivative is positive, the derivative is

recognized as a financial asset; otherwise, the

derivative is recognized as a financial liability.

Fair values of financial assets and financial

liabilities at the balance sheet date are determined

as follows: publicly traded stocks - at closing

prices; open-end mutual funds - at net asset

values; bonds - at prices quoted by the Taiwan

GreTai Securities Market; and financial assets and

financial liabilities without quoted prices in an

active market - at values determined using

valuation techniques.

Available-for-Sale Financial Assets

Available-for-sale financial assets are initially

measured at fair value plus transaction costs that

are directly attributable to the acquisition. At each

balance sheet date subsequent to initial

recognition, available-for-sale financial assets are

remeasured at fair value, with changes in fair value

recognized in equity until the financial assets are

disposed of, at which time, the cumulative gain or

loss previously recognized in equity is included in

profit or loss for the year.

The recognition, derecognition and the fair value

bases of available-for-sale financial assets are

similar to those of financial assets at FVTPL.

Cash dividends are recognized on the

stockholders’ resolutions, except for dividends

distributed from the pre-acquisition profit, which

are treated as a reduction of investment cost.

Stock dividends are not recognized as investment

income but are recorded as an increase in the

number of shares. The total number of shares

subsequent to the increase is used for

recalculation of cost per share.

An impairment loss is recognized when there is

objective evidence that the financial asset is

impaired. Any subsequent decrease in

impairment loss for an equity instrument classified

as available-for-sale is recognized directly in

equity.