HTC 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

V. CAPTIAL AN D SHARES

96

Company's Articles of Incorporation stipulate that for

earnings, the order of distribution shall be followed

according to below:

1. To pay taxes.

2. To cover accumulated losses, if any.

3. To appropriate 10% legal reserve unless the total

legal reserve accumulated has already reached the

amount of the Company's authorized capital.

4. To pay remuneration to directors and supervisors at

0.3% maximum of the balance after withholding the

amounts under subparagraphs 1 to 3.

5. To pay bonus to employees at 5% minimum of the

balance after withholding the amounts under

subparagraphs 1 to 3, or such balance plus the

unappropriated retained earnings of previous years.

2OO 8 HTC AN N UAL REPO RT

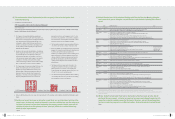

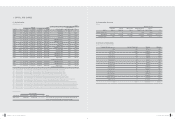

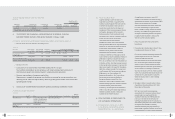

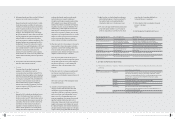

>Board of Directors has adopted the proposed distribution of bonus for employees in the following manner :

Unit: NT$ 1,000

Distributions of Earnings in 2008 Accrued Expenses for Employee Bonus Resolution Approved by the Board of Directors

April 30, 2009

Employee Bonus 6,164,889 Employee Stock Bonus (Note) 4,954,889

Employee Cash Bonus 1,210,000

Total Amount 6,164,889

Directors' and Supervisors'

Remunerations 0 0

Note: The value of employee cash/stock bonuses and director/supervisor remunerations proposals approved by the board of directors is the same as the

Company's accrued expenses in the financial reporting period.

Note: For employee stock bonuses NT$4,954,889,133 ,the number of shares shall be calculated based on the closing price one day prior to the 2009 regular shareholders' meeting on an ex-

dividend basis. For employees receiving less than one share, bonuses will be distributed in the form of cash. However, the maximum number of new shares issued for employee profit

sharing shall not exceed an employee stock bonus dilution rate of 1.75%. which is the ratio of employee stock bonuses to outstanding shares ex-dividends. Shares that exceed the dilution

rate of 1.75% will be converted into cash and be distributed to employees in the form of cash converted.

>Distributions of earnings in 2007 as employees' bonus and remunerations for directors and supervisors :

Unit: NT$ 1,000; 1,000 shares

Distributions of earnings in 2007 Resolution Actual

Date of passage of annual dividends of the Board of Directors' Meeting resolution April 25, 2008

Date of Regular Shareholders' Meeting June 13, 2008

Employee Stock Bonus Total Number of Shares 10,320 10,320

Total Amount 103,200 103,200

Employee Cash Bonus Total Amount 1,210,000 1,210,000

Director' and Supervisors' Remunerations 00

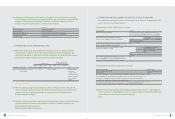

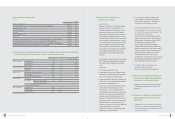

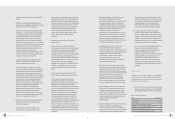

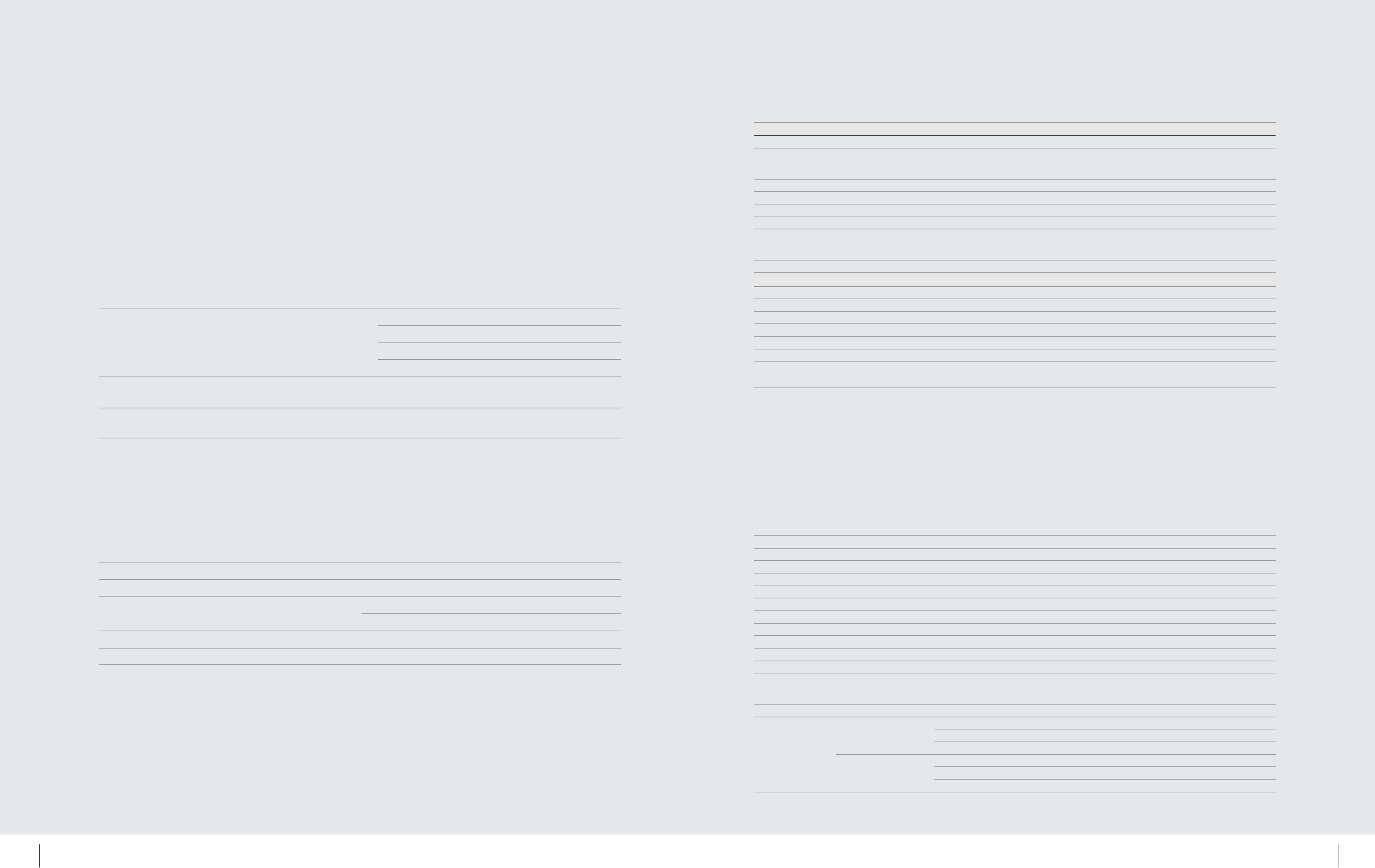

(9) Share Repurchases:

Topic Explanation

Initial Estimation of Share Buy-back Status

Board of Director resolution 10/7/2008

Purpose of the share buy-back To stabilize stock price by maintaining company credibility and shareholders

rights. According to the Regulations Governing Share Repurchase by Listed and

OTC Companies, Article 2 requires off-setting of buy-back Treasury stocks.

Type of share buy-back Common stock

Total amount allocated for share buy-back NTD 5,000,000,000

Buy-back period 10/08/2008~12/07/2008

Estimated number of buy-back shares (as percentage of total outstanding shares) 10,000,000 shares (1.32%)

Estimated buy-back price interval Buy-back stock price is between NTD 400 to NTD 500. It is further resolved by

the Board of Directors to continue buy-back of shares if the stock price falls

under NTD 400.

Method of Buy-back Buy-back shares from stock exchange

Actual Stock Buy-back Status

Buy-back period 10/13/2008~12/05/2008

Number of buy-back shares (as a percentage of total shares outstanding) 10,000,000 shares (1.32%)

Total amount for buy-back shares NTD 3,408,149,000

Average price per buy-back share NTD 340.81

Number of Shares Cancelled or Transferred Cancelled 10,000,000 shares

Cumulative number of own shares held 0 shares

Ratio of cumulative number of own shares held during the repurchase period to the

total number of the Company's issued shares 0%

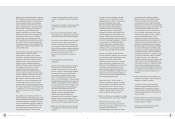

2. ISSUANCE OF CORPORATE BONDS

None

3. STATUS OF PREFERRED SHARES

None

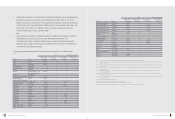

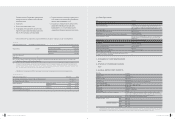

4. GLOBAL DEPOSITORY RECEIPTS

04/30/2009

Issuing Date 11/19/2003

Issuance & Listing Luxembourg

Total amount USD 105,182,100.60

Offering price per GDR USD 15.4235

Units issued 8,321,966(note)

Underlying securities Cash offering and HTC common shares from selling shareholders

Common shares represented 33,287,870(note)

Rights & obligations of GDR holders Same as those of common share holders

Trustee Not applicable

Depositary bank Citibank, N.A. - New York

Custodian bank Citibank, N.A. - Taipei Branch

GDRS outstanding 2,996,078

Apportionment of expenses for the issuance & maintenance All fees and expenses such as underwriting fees, legal fees, listing fees and other expenses

related to issuance of GDRS were borne by HTC and the selling shareholders, while maintenance

expenses such as annual listing fees and accountant fees were borne by HTC.

Terms & conditions in the deposit agreement & custody agreement See deposit agreement and custody agreement for details

Closing price per GDR 2008 High USD 116.29

Low USD 32.87

Average USD 74.16

01/01/2009 ~04/30/2009 High USD 54.18

Low USD 37.32

Average USD 44.91

Note: The total number of units issued includes additional issuance on 18 August 2004, 12 August 2005, 1 August 2006, 20 August 2007 and 21 July 2008 of dividends on the common shares

represented by overseas depositary receipts, in respective amounts of 216,088 units (representing 864,352 common shares), 70,290 units (representing 281,161 common shares), 218,776

units (representing 875,107 common shares), 508,556 units (representing 2,034,224 common shares) and 488,656 units (representing 1,954,626 common shares).

'0 8A R_ HT C/ 英文版* NEW 05/ 21/ 20 09 11: 02 頁面 9 6