HTC 2008 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2008 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Information

| 99

98 |

2008 Annual Report

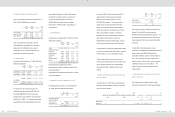

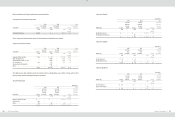

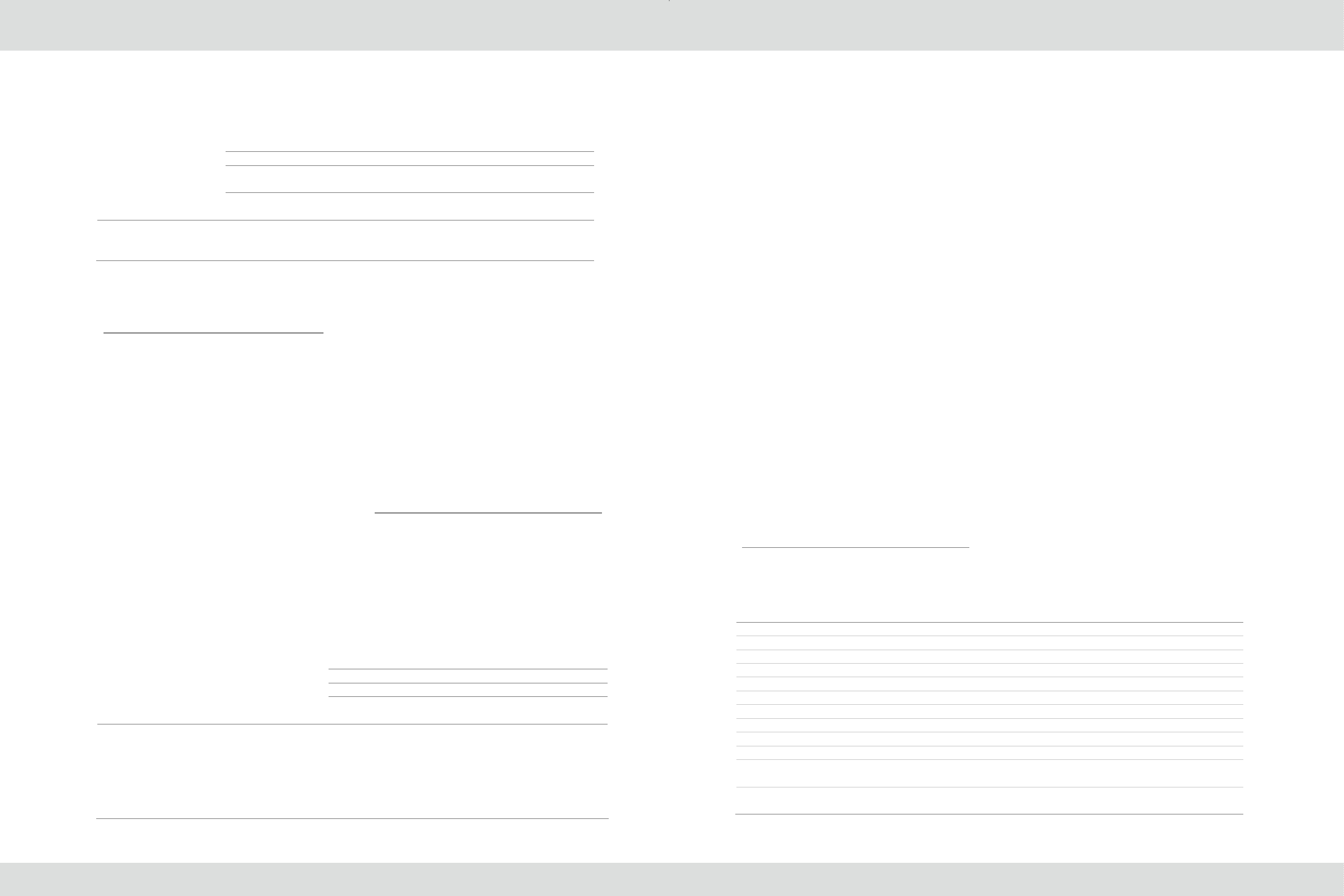

>Derivative Financial Instruments

December 31

2006

2007

2008

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

NT$

NT$

NT$

NT$

NT$

US$

NT$

US$

(Note 3)

(Note 3)

Liabilities

Financial liabilities at fair value

through profit or loss

76,470

76,470

96,256

96,256

514,083

15,673

514,083

15,673

Methods and Assumptions Used in

Determining Fair Values of Financial

Instruments

Not subject to Statement of Financial Accounting

Standards No. 34 - “Financial Instruments:

Recognition and Measurement” are cash,

receivables, other current financial assets,

payables, accrued expenses and other current

financial liabilities, which have carrying amounts

that approximate their fair values.

The financial instruments neither include

refundable deposits, guarantee deposits nor

long-term bank loans. The fair values of

aforementioned financial instruments were based

on the present value of future cash flows

discounted at the average interest rates for time

deposits with maturities similar to those of the

financial instruments.

The fair values of financial instruments at fair value

through profit or loss and available-for-sale

financial assets are based on quoted market prices

in an active market, and their fair values can be

reliably measured. If the securities do not have

market prices, fair value is measured on the basis

of financial or other information. The Company

uses estimates and assumptions that are

consistent with information that market participants

would use in setting a price for these securities.

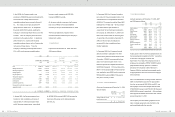

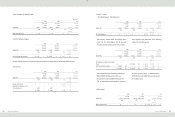

Methodology Used to Determine the Fair

Values of Financial Instruments

Quoted Market Prices

Measurement Method

December 31

December 31

2006

2007

2008

2006

2007

2008

NT$

NT$

NT$

US$

NT$

NT$

NT$

US$

(Note 3)

(Note 3)

Assets

Available-for-sale financial assets - noncurrent

$

1,733

$

784

$

339

$

10

$

-

$

-

$

-

$

-

Financial assets carried at cost

-

-

-

-

1,192

501,192

501,192

15,280

Bond investments not quoted in an active market

-

-

-

-

-

33,030

-

-

Investments accounted for using equity method

-

-

-

-

-

-

39,906

1,217

Liabilities

Financial liabilities at fair value through profit or loss

76,470

96,256

514,083

15,673

-

-

-

-

There was no loss or gain recognized for the years

ended December 31, 2006, 2007 and 2008 on the

fair value changes of derivatives with fair values

estimated using valuation techniques. However,

on the changes in fair value of available-for-sale

financial assets, the Company recognized an

unrealized gain of NT$849 thousand, an

unrealized loss of NT$949 thousand and another

unrealized loss of NT$445 thousand (US$14

thousand) under stockholders’ equity in the years

ended December 31, 2006, 2007 and 2008,

respectively.

As of December 31, 2006, 2007 and 2008,

financial assets exposed to cash flow interest rate

risk amounted to NT$30,468,400 thousand,

NT$46,613,935 thousand and NT$60,900,272

thousand (US$1,856,715 thousand), respectively.

As of December 31, 2007, financial assets

exposed to fair value interest rate risk was

NT$33,030 thousand.

Financial Risks

>Market Risk

The Company uses derivative contracts for

hedging purposes, i.e., to reduce any adverse

effect of exchange rate fluctuations of accounts

receivable/payable. The gains or losses on these

contracts almost offset the gains or losses on the

hedged items. Thus, market risk is not material.

>Credit Risk

The Company deals only with banks with good

credit standing based on the banks’ reputation and

takes into account past experience with them.

Moreover, the Company has a series of control

procedures for derivative transactions.

Management believes its exposure to

counter-parties’ default on contracts is low.

>Cash Flow Risk

The Company has sufficient working capital to

settle derivative contracts. However, there are no

future cash requirements for contract settlement.

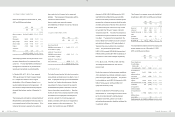

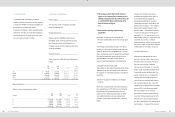

27.RELATED-PARTY TRANSACTIONS

The related parties were as follows:

Related Party

Relationship with the Company

First International Computer, Inc. (FIC)

Chairperson is an immediate relative of the chairperson of HTC

FIC (Suzhou) Inc.

Chairperson is an immediate relative of the chairperson of HTC

Xander International Corp.

Chairperson is an immediate relative of the chairperson of HTC

VIA Technologies, Inc.

Same c hairperson with HTC

Chander Electronics Corp.

Same chairperson with HTC

Way-Lien Technology Inc.

Same chairperson with HTC

Captec Partners Management Corp.

Main director is the chairperson of HTC

Comserve Network Netherlands B.V.

Main director is an immediate relative of the chairperson of HTC

Employees’ Welfare Committee

Employees’ Welfare Committee of HTC

Landtek Corporation (BVI)

Main director is the chairperson of HTC

HTC Education Foundation for Social Welfare Charity

a non-profit organization of which the funds donated from the Company exceeds one

third of the non-profit organization’s total funds

High Tech Computer Foundation

a non-profit organization of which the funds donated from the Company exceeds one

third of the non-profit organization’s total funds