HTC 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2OO 8 HTC AN N UAL REPO RT

107

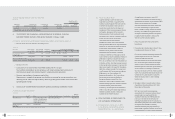

(2) Future Investment Plans

Long-term strategic investments made by the

corporation focus primarily on supporting HTC's

business success and growth in its main business.

Investment and acquisition decisions are taken

based on the benefit of such to the design and

development of future products, expansion of sales

and long-term development of the corporation.

Practical objectives of such investments include

reducing the cost of products, raising the quality and

inherent value of products, enhancing the

convenience of product user interfaces,

strengthening customer service and increasing

overall operational effectiveness. Major investments

planned for our main business address the areas of

mobile content, communications, mobile and

information security, location based services,

entertainment and user interface / experience

innovation. Investments currently approved by the

board of directors include a capitalization increase of

US$8 million in High Tech Computer Asia Pacific

PTE, Ltd. to, indirectly, invest in the establishment of

a subsidiary in China, the primary business interests

of which will be market development, repair and after

sales service as well as the support of China-based

distributors working to develop China market sales

for HTC products. HTC has allocated an additional

US$8 million for its China subsidiary, HTC

Electronics (Shanghai) Co., Ltd. Funds will help

finance expansion of production facilities in

Shanghai's Kangqiao Industrial Zone. Said

allocations for the two China investments will be

executed following approval by Taiwan's Investment

Commission (Ministry of Economic Affairs).

Furthermore, HTC has approved an investment of

US$12.5 million through the British Virgin Islands to

establish a subsidiary focused on trading raw

materials and semi-finished products.

6. RISK FACTORS OF RELEVANCE TO

HTC BUSINESS OPERATIONS

(1) Potential Factors of Influence on HTC

Competitiveness & Growth Goals and

Related M easures / Countermeasures

Competitiveness in the sector in which HTC

competes comes primarily from factors including: 1)

successful product research and development (R&D)

efforts and innovativeness and 2) strategic

partnership relationships with industry leaders and

an incisive understanding and grasp of market

trends. In addition to strong competencies in these

two areas, HTC maintains strong global business

development, streamlined production management

and global logistics capabilities - adding further

depth to its overall competitive position.

• Factors Favorable to the Achievement of HTC

Growth Goals

1. Partnerships with Industry Leaders Allow HTC Role

in Leading Industry Change and Trends

From the very beginning, strategic partnerships with

industry leaders such as Microsoft, Qualcomm,

Google and Texas Instruments and

telecommunications service providers have helped

HTC develop and expand markets for converged

devices such as the world's first Windows Mobile

based smart phone, the first smart phone featuring a

3D user interface, and, in 2008, the world's first

smart phone designed on the new Android operating

system. Such partnerships help inject innovation and

variation into HTC products while ensuring HTC

stands with industry leaders to drive and shape

industry trends.

2. Strategies to Reform Corporate Culture, Enhance

Organizational Strengths and Raise HTC Global

Brand Value and Recognition

HTC has in recent years made increasingly

successful efforts to remold and enhance internal

corporate culture in a way that reflects the

corporation's shift away from ODM business to a

new focus on the business of developing and

marketing its proprietary brand. The corporation is

also bolstering strengths in non-technical, executive

management talent essential to extending

international sales and marketing networks and

product design capabilities. Expected results include

a strengthening of the overall corporate organization

VI. FIN AN CIAL STATUS, O PERATIN G RESULTS AN D RISK MAN AGEM EN T

106

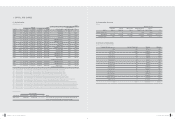

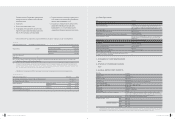

(2) Cash Liquidity Analysis for the Coming Year

Unit: NT$1,000

Remedial measures for

projected cash deficit

Beginning cash Projected whole-year Projected whole-year Projected cash surplus

Financial

balance

cash flow from operating activities

cash outflow (deficit) amount

Investment plan management plan

61,826,873 37,756,872 26,497,924 73,085,821

--

Remedial measures for projected cash deficit: Not Applicable

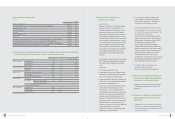

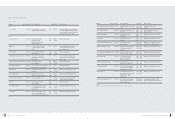

4. THE EFFECT ON FINANCIAL OPERATIONS OF MATERIAL CAPITAL

EXPENDITURES DURING THE MOST RECENT FISCAL YEAR

(1) Review and Analysis of M aterial Capital Expenditures and Funding Sources

> Material capital expenditure utilization and funding sources

Unit: NT$1,000

Planned items Actual or projected Actual or projected Total amount of Actual or projected capital utilization

sources of capital date of completion required capital 2006 2007 2008 2009 2010

Plant Construction & Equipment / Working capital 2008

2,546,277 372,131 587,349 1,586,797

Facilities Purchase

Purchase, Installation and Working capital 2009

746,669 172,384 574,285

Maintenance of Equipment / Facilities

Purchase & Construction of New Plant Working capital 2010

7,579,848 2,765,318 3,064,530 1,750,000

>

Anticipated benefits

•

Construction of new plant facilities, Taipei R&D building and HTC Campus

New buildings and facilities to provide employees with suitably designed and furnished work

environments to support and enhance long-term, sustained business operations.

•

Purchase and installation of equipment and facilities

Replacement / upgrade of equipment and facilities is essential to raising productivity and

reducing overall costs of doing business, and to supporting HTC's share of the market and

operating profit margin.

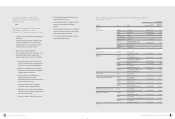

5. STATUS OF INVESTMENT DIVERSIFICATION DURING CURRENT YEAR

(1) Analysis of Equity Investments

Unit: NT$1,000

Other future

Item Amount(Note) Policy Primary reason for profits or losses Corrective plans investment plans

H.T.C. (B.V.I.) Corp.

457,727 Financial holding company: indirect Gains by the invested enterprise _ Please refer to (2)

investment in overseas maintenance,

installation, after-sales service, and .

market development companies

High Tech Computer Aisa 1,463,114 Investment holding Losses by the invested enterprise _ Please refer to (2)

Pacific PTE. Ltd.

Note: The investment amount for the current fiscal year exceeds five percent of paid-in capital.

'0 8A R_ HT C/ 英文版* NEW 05/ 21/ 20 09 11: 02 頁面 10 6