HTC 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Information

| 7

6 |

2008 Annual Report

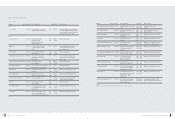

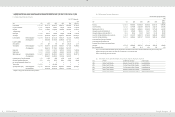

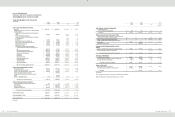

2. FINANCIAL ANALYSIS

Unit

:

NT$ thousands

Item (Note 2~3

2008

(Note 1)

2007

2006

2005

2004

2009.3.31

(Note 1)

Capital Structure Analysis

Debt Ratio (%)

47

38

35

42

50

42

Long-term Fund to Fixed Assets Ratio (%)

822

1,509

1,463

921

510

785

Liquidity Analysis

Current Ratio (%)

186

242

264

216

206

206

Quick Ratio (%)

169

218

233

183

157

189

Times Interest Earned (Times)

136,167

133,409

90,464

614

136

117,219

Operating Performance

Analysis

Average Collection Turnover (Times)

6.09

6.01

6.09

6.25

5.21

5.19

Days Sales Outstanding

60

61

60

58

70

70

Average Inventory Turnover (Times)

12.68

12.14

13.01

11.38

8.69

11.02

Average Payment Turnover (Times)

4.08

4.03

4.80

5.22

4.60

3.62

Average Inventory Turnover Days

29

30

28

32

42

33

Fixed Assets Turnover (Times)

20.68

31.91

36.02

29.16

14.45

15.12

Total Assets Turnover (Times)

1.32

1.31

1.59

1.82

1.61

1.12

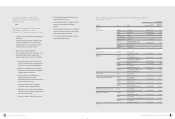

Profitability Analysis

Return on Total Assets (%)

28

37

48

38

20

17

Return on Equity (%)

49

59

77

69

41

31

Operating Income to Paid-in Capital Ratio (%)

401

533

592

343

137

65

Pre-tax Income to Paid-in Capital Ratio (%)

418

561

618

340

143

72

Net Margin (%)

19

24

24

16

11

15

Basic Earnings Per Share (NT$)

37.97

38.30

33.15

15.59

5.38

6.54

Cash Flow

Cash Flow Ratio (%)

69

116

106

75

31

24

Cash Flow Adequacy Ratio (%)

221

291

296

196

72

249

Cash Flow Reinvestment Ratio (%)

28

47

44

44

15

16

Leverage

Operating Leverage

1.44

1.20

1.16

1.26

1.70

1.66

Financial Leverage

1.00

1.00

1.00

1.00

1.01

1.00

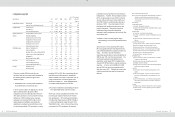

Changes in certain 2008 financial ratios as

compared with previous years may be attributed to

the following factors present during the most

recent fiscal year:

1. Classification from 1 January 2008 of employee

bonus distributions as expensed costs

In terms of ratios noted in the table above, only the

ratio for 2008 has been adjusted to reflect

employee bonuses as expensed costs. Ratios for

other years continue to count such under earnings

distributions. 2008 employee bonus expenses

decreased net income by NT$5.6 billion, which

reduced apparent profitability accordingly. By

adjusting out employee bonus distributions, return

on total assets would be 33% and return on equity

would be 59% for 2008. Also, operating profit and

profit before tax would represent, respectively,

482% and 499% of the paid in capital ratio, the net

margin would be 22%, and earnings per share

would rise to NT$45.41. Such highlights further

the exceptional profit performance of HTC.

2. Purchase of multiple lots and buildings for future

HTC Taipei R&D Center and HTC Compus.

Working to enhance competitiveness further, HTC

is continuing to expand investments in research

and development. HTC purchased land located

in Xindian City, Taipei County for NT$3.335 billion

on which buildings will be raised to house HTC’s

Taipei R&D Center. Also, to improve the working

environment for HTC employees, the company

purchased various properties near to its Taoyuan

headquarters. Together, these purchases caused

HTC’s net fixed assets to rise to NT$7.4 billion at

the end of the current period; a rise of 98% over

the NT$3.7 billion in net fixed assets reported at

the close of 2007. Thus, the long-term fund to

fixed assets ratio and fixed assets turnover are

lower for the period. Payments for land and

building purchases have also reduced the

company’s cash flow adequacy ratio and cash flow

reinvestment ratio.

3. Growth in HTC non-ODM (original design

manufacturing) revenues during 2008 exceeded

40%

Since the launch of the proprietary HTC brand,

HTC has aggressively promoted brand business

and invested significantly to build brand value and

image. Such led to accrued marketing /

advertising expenditures and warranty liabilities for

2008 to grow 70% over the previous period. The

counting of employee bonus distributions as

expenditure costs caused HTC to register at the

close of 2008 NT$6.2 billion in new accrued bonus

expenses. As such, current liabilities for 2008

were up 59% over the previous period and the

debt ratio rose to 47%. Similarly, the current ratio,

quick ratio and cash flow ratio for the period all

declined.

Note 1: Included employee bonus expenses

Note 2: In accordance with 2008 financial reporting requirements, write-downs of

inventories or reversal of write-downs and product warranty costs

registered during the period 2004 to 2007 have been reclassified as cost

of revenues items.

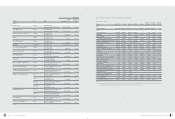

Note 3: Glossary

a. Capital Structure Analysis

(1) Debt Ratio

=

Total Liabilities / Total Assets.

(2) Long-term Fund to Fixed Assets Ratio

=

(Shareholders' Equity + Long-term

Liabilities) / Net Fixed Assets.

b. Liquidity Analysis

(1) Current Ratio

=

Current Assets / Current Liabilities.

(2) Quick Ratio

=

(Current Assets - Inventories - Prepaid Expenses) / Current

Liabilities.

(3) Times Interest Earned

=

Earnings before Interest and Taxes / Interest

Expenses.

c. Operating Performance Analysis

(1) Average Collection Turnover

=

Net Sales / Average Trade Receivables.

(2) Days Sales Outstanding

=

365 / Average Collection Turnover.

(3) Average Inventory Turnover

=

Cost of Sales / Average Inventory.

(4) Average Payment Turnover

=

Cost of Sales / Average Trade Payables.

(5) Average Inventory Turnover Days

=

365 / Average Inventory Turnover.

(6) Fixed Assets Turnover

=

Net Sales / Net Fixed Assets.

(7) Total Assets Turnover

=

Net Sales / Total Assets.

d. Profitability Analysis

(1) Return on Total Assets

=

(Net Income + Interest Expenses * (1 - Effective

Tax Rate) ) / Average Total Assets.

(2) Return on Equity

=

Net Income / Average Shareholders' Equity.

(3) Net Margin

=

Net Income / Net Sales.

(4) Earnings Per Share

=

(Net Income - Preferred Stock Dividend) / Weighted

Average Number of Shares Outstanding.

e. Cash Flow

(1) Cash Flow Ratio

=

Net Cash Provided by Operating Activities / Current

Liabilities.

(2) Cash Flow Adequacy Ratio

=

Five-year Sum of Cash from Operations /

Five-year Sum of Capital Expenditures, Inventory Additions, and Cash

Dividend.

(3) Cash Flow Reinvestment Ratio

=

(Cash Provided by Operating Activities -

Cash Dividends) / (Gross Fixed Assets + Investments + Other Assets +

Working Capital).

f. Leverage

(1) Operating Leverage

=

(Net Sales - Variable Cost) / Income from Operations.

(2) Financial Leverage

=

Income from Operations / (Income from Operations –

Interest Expenses)