HTC 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Information

| 33

32 |

2008 Annual Report

In August 2000, the Company acquired 100%

equity interest in H.T.C. (B.V.I.) Corp. for

NT$12,834 thousand and accounted for this

investment by the equity method. As of

December 31, 2008 the Company had increased

this investment to NT$1,860,562 thousand

(US$56,724 thousand). Because the registration

of this investment was not completed on

December 31, 2008, the amounts of NT$316,656

thousand (US$9,654 thousand) were temporarily

accounted for as “prepayments for long-term

investments.” H.T.C. (B.V.I.) Corp. makes

investments on behalf of the Company.

In April 2006, the Company acquired 92% equity

interest in BandRich Inc. for NT$135,000 thousand

and accounted for this investment by the equity

method. In May 2006, BandRich Inc. issued

12,000 thousand shares of common stock at a

price of NT$12.50 per share of which the Company

didn’t purchase. The Company’s ownership

percentage declined from 92% to 51% and

resulted in capital surplus - long term equity

investments of NT$15,845 thousand.

In September 2006, the Company acquired 100%

equity interest in HTC HK, Limited for NT$1,277

thousand and accounted for this investment by the

equity method.

In January 2007, the Company acquired 100%

equity interest in Communication Global

Certification Inc. for NT$280,000 thousand and

accounted for this investment by the equity

method.

In July 2007, the Company acquired 100% equity

interest in High Tech Computer Asia Pacific Pte.

Ltd. for NT$560,660 thousand and accounted for

this investment by the equity method. As of

December 31, 2008, the Company had increased

this investment to NT$2,023,774 thousand

(US$61,700 thousand).

In April 2008, the Company made a new

investment of US$350 thousand and transferred its

bond investment of US$1,000 thousand to

convertible preferred stocks issued by Vitamin D

Inc. As a result, the Company acquired 27%

equity interest in Vitamin D Inc. for NT$40,986

thousand, (US$1,250 thousand), enabling the

Company to exercise significant influence over this

investee. Thus, the Company accounts for this

investment by the equity method. In September

2008, Vitamin D Inc. issued 2,375 thousand

convertible preferred shares, but the Company did

not buy any of these shares. Thus, the

Company’s ownership percentage declined from

27% to 26%, and there was a capital surplus - long

term equity investments of NT$ 1,689 thousand

(US$52 thousand).

In July 2008, the Company acquired 100% equity

interest in HTC Investment Corporation for

NT$300,000 thousand (US$9,146 thousand) and

accounted for this investment by the equity

method.

In December 2007, the Company and its

subsidiary, High Tech Computer Asia Pacific Pte.

Ltd., acquired 1% and 99%, respectively, equity

interest in PT. High Tech Computer Indonesia for

NT$62 thousand and NT$6,122 thousand,

respectively. As a result, the Company accounted

for this investment by the equity method.

On its equity-method investments, the Company

had a loss of NT$12,554 thousand and a gain of

NT$103,997 and a loss of NT$57,289 thousand

(US$1,747 thousand) in 2006, 2007 and 2008,

respectively.

The financial statements of equity-method

investees had been examined by the Company’s

independent auditors.

Under the revised Statement of Financial

Accounting Standards No. 7, “Consolidated

Financial Statements,” which took effect on

January 1, 2005, the Company included the

accounts of all its direct and indirect subsidiaries in

the consolidated financial statements as of and for

the years ended December 31, 2006, 2007 and

2008. All significant intercompany balances and

transactions have been eliminated.

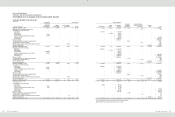

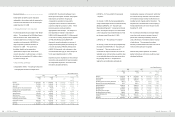

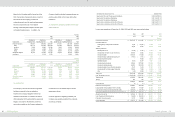

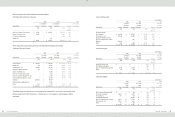

15.PROPERTIES

Properties as of December 31, 2006, 2007 and 2008 were as follows:

2006

2007

2008

Carrying

Value

Carrying

Value

Cost

Accumulated Depreciation

Carrying Value

NT$

NT$

NT$

NT$

NT$

US$

(Note 3)

Land

$

610,293

$

610,293

$

3,568,124

$

-

$

3,568,124

$

108,784

Buildings and structures

735,785

1,816,889

2,853,645

524,564

2,329,081

71,009

Machinery and equipment

1,020,799

1,037,491

3,927,100

2,700,928

1,226,172

37,383

Molding equipment

-

-

172,632

172,632

-

-

Computer equipment

41,304

51,268

264,248

192,061

72,187

2,201

Transportation equipment

706

484

2,732

1,057

1,675

51

Furniture and fixtures

23,824

29,055

127,202

98,793

28,409

866

Leased assets

3,927

3,141

4,712

2,356

2,356

72

Leasehold improvements

2,656

21,336

95,208

36,436

58,772

1,792

Prepayments for land, construction-in-progress and

equipment-in-transit

470,330

145,944

88,875

-

88,875

2,709

$

2,909,624

$

3,715,901

$

11,104,478

$3,728,827

$

7,375,651

$

224,867

In August 2008, the Company acquired from

Runtop Inc. land and building, with areas of

approximately 10.6 thousand square meters and

40 thousand square meters, respectively, for

NT$900,000 thousand (US$27,439 thousand) to

have more office space and to build parking lots,

dormitory, etc.

In December 2008, the Company bought the land -

about 8.3 thousand square meters - from Yulon

Motors Ltd. for NT$3,335,000 thousand

(US$101,677 thousand) to build the Taipei R&D

headquarters in Xindian City. Of the purchase

price, 80% had been paid and 80% of ownership of

the land had been transferred to the Company as

of December 31, 2008. Yulon Motors Ltd. should

transfer the remaining 20% of ownership of the

land before December 20, 2009, and the Company

should pay the remaining 20% after completing the

land transfer registration.

In December 2008, the Company’s board of

directors resolved to participate in the third

auction held by Taiwan Financial Asset

Service Corporation (“TFASC”) and

acquired the land - about 16.5 thousand

square meters - from Hualon Corporation

for NT$355,620 thousand (US$10,842

thousand). Of the purchase price,

NT$71,130 thousand (US$2,169 thousand)

had been paid by the end of 2008, and the

remaining NT$284,490 thousand

(US$8,673 thousand) was paid on January

7, 2009.

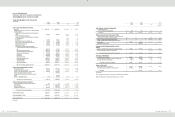

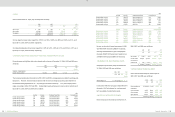

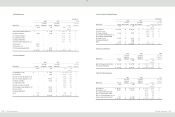

16.ACCRUED EXPENSES

Accrued expenses as of December 31,

2006, 2007 and 2008 were as follows: