HTC 2008 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2008 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

(6) Company's Dividend Policy and

Implementation Thereof:

>Dividend Policy :

Because the Company is a technology and capital-

intensive enterprise in its growing phase, the

Company sets a policy to allocate dividends with

consideration to factors such as the Company's

current and future investment climate, demand for

working capital, competitive environment at home

and globally, capital budget, as well as the interests

of the shareholders, balanced dividends, and long-

term financial planning of the Company. Every year,

the board of directors shall propose the allocation

ratio and propose it at the shareholders' meeting.

The earnings may be allocated in cash dividends or

stock dividends, provided that the ratio of cash

dividends may not be less than 50% of the total

dividends.

According to the company's Articles of Incorporation,

if the Company has earnings after the annual final

accounting, it shall be allocated in the following

order:

1. To pay taxes.

2. To cover accumulated losses, if any.

3. To appropriate 10% legal reserve unless the total

legal reserve accumulated has already reached the

amount of the Company's authorized capital.

4. To pay remuneration to directors and supervisors at

0.3% maximum of the balance after withholding the

amounts under subparagraphs 1 to 3.

5. To pay bonus to employees at 5% minimum of the

balance after withholding the amounts under

subparagraphs 1 to 3, or such balance plus the

unappropriated retained earnings of previous years.

However, the bonus may not exceed the limits on

employee bonus distributions as set out in the

Regulations Governing the Offering and Issuance of

Securities by Issuers. Where bonus to employees is

allocated by means of new share issuance, the

employees to receive bonus may include employees

serving with affiliates who meet specific

requirements. Such specific requirements shall be

prescribed by the board of directors.

6. For any remainder, the board of directors shall

propose allocation ratios based on the dividend

policy set forth in paragraph 2 of this Article and

propose them at the shareholders' meeting.

>The dividend distributions proposed at the most

recent shareholders' meeting: (Board of Directors

has adopted, 2009 pending on the approval of the

Shareholders General Meeting.)

On April 30, 2009 Company adopted a resolution

passed by Board of Directors for the distribution of

2008 earnings for the proposed allocation of NTD

372,696,920 in stock dividend and NTD

20,125,634,120 in cash dividend, propose to

distribute NT$0.5 stock dividends and NT$27 cash

dividends per share.(based on book closure date of

outstanding shares for 2009 Annual Shareholders.

Meeting), the Board of Directors may make the

required adjustments to the actual earnings

distribution ratio on the basis of the number of issued

and outstanding stocks registered in the Common

Stockholders' Roster as at the record date.

>If a material change in dividend policy is

expected, provide an explanation :

There is no material change in dividend policy.

(7) Impact of The Stock Dividend Proposal of

This Shareholders Meeting on Operational

Performance and Earnings Per Share:

Company is not required to make public Company's

2009 financial forecast information ; therefore it is

inapplicable.

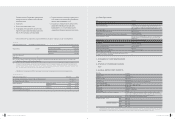

(8) Information on Employee Profit Sharing &

Regular Compensation for Directors and

Supervisors:

>Company's Articles of Incorporation stipulate the

distribution of employee profit sharing as well as

Directors and Supervisors' remuneration in terms

of percentage or scope.

V. CAPTIAL AN D SHARES

94

2OO 8 HTC AN N UAL REPO RT

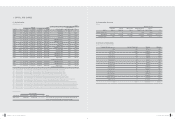

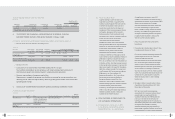

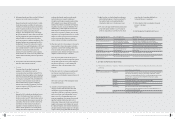

(4) List of Principal Shareholders:

04/21/2009

Shares

Name of principal shareholders Current Shareholding Percentage

Euro Pacific Growth Fund Special Account under custodial administration of Chase Manhattan Bank 38,751,100 5.20%

Way-Chih Investment Co., LTD. 37,852,752 5.08%

Way-Lien Technology Inc. 36,396,764 4.88%

Cher Wang 23,558,949 3.16%

Hon-Mou Investment Co., Ltd. 22,014,333 2.95%

Wen-Chi Chen 19,342,525 2.59%

Capital Revenue Founder Company Investment Special Account under custodial administration of Chase Manhattan Bank 15,308,500 2.05%

The Central Bank of Saudi Arabia Investment Special Account under custodial administration of Chase Manhattan Bank

14,565,698 1.95%

World Capital Growth and Revenue Fund Company Investment Special Account under custodial administration of Chase Manhattan Bank

11,872,500 1.59%

HTC Depositary Receipts Special Account under custodial administration of Citibank N.A. 11,677,074 1.57%

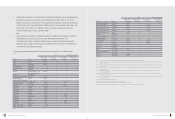

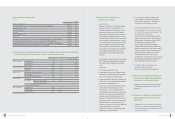

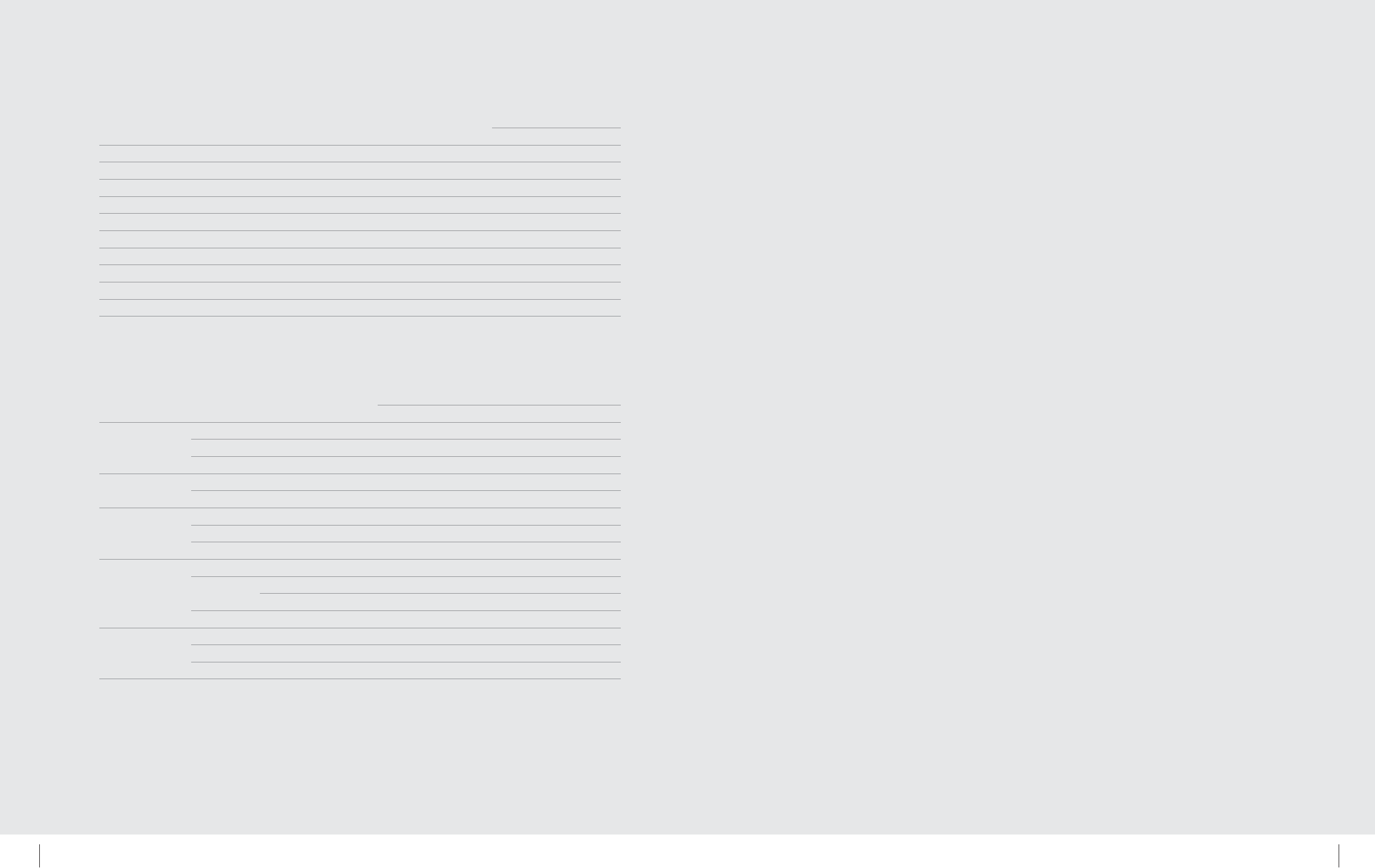

(5) Provide Share Prices for The Past Two Fiscal Years, Together with The Company's Net Worth Per

Share, Earnings Per Share, Dividends Per Share, and Related Information:

Year

Item 2007 2008 01/01/2009 ~ 03/31/2009

Market price per share Highest market price 703 888 446

Lowest market price 390 256 308.50

Average market price 548.64 576.90 371.09

Net worth per share(note) Before distribution 97.84 80.30 88.06

After distribution 61.73 (note) (note)

Earnings per share Weighted average shares(thousand shares) 573,229 754,148 745,394

Earnings per share 50.48 37.97 6.54

Retroactively adjusted earnings per share 38.30 (note) (note)

Dividends per share Cash dividends 34 27 (note) -

Stock dividends Dividends from retained earnings 0.3 0.05 (note) -

Dividends from capital surplus - --

Accumulated undistributed dividend - --

Reutrn on investment Price/Earnings ration 10.87 15.19 -

Price/Dividend ratio 16.14 21.37 (note) -

Cash dividend yield 6.20% 4.68 (note) -

Note : Pending 2009 shareholders' approval

'0 8A R_ HT C/ 英文版* NEW 05/ 21/ 20 09 11: 02 頁面 9 4