HTC 2008 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2008 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Information

| 89

88 |

2008 Annual Report

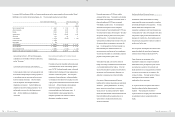

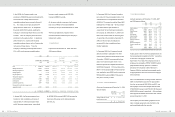

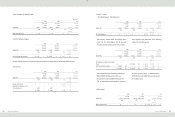

Assumptions used in actuarially determining the

present value of the projected benefit obligation

were as follows:

2006

2007

2008

Weighted-average discount rate

2.75%

2.75%

2.75%

Assumed rate of increase in future compensation

4.25%

2%-4%

2%-4%

Expected long-term rate of return on plan assets

2.75%

2.75%

2.75%

The vested benefits as of December 31, 2006, 2007

and 2008 all amounted to NT$0 thousand.

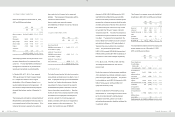

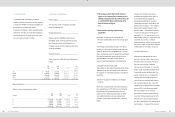

21.STOCKHOLDERS’ EQUITY

Capital Stock

The Company’s outstanding common stock as of

January 1, 2006 amounted to NT$3,570,160

thousand, divided into 357,016 thousand common

shares at NT$10.00 par value. In May 2006, the

stockholders approved the transfer of retained

earnings amounting to NT$714,032 thousand and

employee bonuses amounting to NT$80,000

thousand to capital stock. As a result, the amount

of the Company’s outstanding common stock as of

December 31, 2006 increased to NT$4,364,192

thousand, divided into 436,419 thousand common

shares at NT$10.00 par value.

In April 2007, the Company retired 3,624 thousand

treasury shares (NT$36,240 thousand). In June

2007, the stockholders approved the transfer of

retained earnings amounting to NT$1,298,385

thousand and employee bonuses amounting to

NT$105,000 thousand to capital stock. As a result,

the amount of the Company’s outstanding common

stock as of December 31, 2007 was NT$5,731,337

thousand, divided into 573,134 thousand common

shares at NT$10.00 par value.

Also, in June 2008, the stockholders approved the

transfer of retained earnings amounting to

NT$1,719,401 thousand (US$52,421 thousand) and

employee bonuses amounting to NT$103,200

thousand (US$3,146 thousand) to capital stock. As

a result, the amount of the Company’s outstanding

common stock as of December 31, 2008 increased

to NT$7,553,938 thousand (US$230,303 thousand),

divided into 755,394 thousand common shares at

NT$10.00 (US$0.30) par value.

In their meeting on December 11, 2002, the

Company’s Board of Directors resolved to issue

7,000 thousand units of employee stock options in

accordance with Article 28.3 of the Securities and

Exchange Law. Each option represents the right to

buy one newly issued common share of the

Company. The exercise price is the closing price of

the Company’s common shares on the option

issuance date. The option holders can exercise

the right up to 35% of the granted option units no

earlier than two years from the grant date. After

three years from the grant date, the holders can

exercise their right at up to 70% of the granted

option units. After four years from the grant date,

the option holders are eligible to exercise their rights

on all the options owned. The exercise period is

five years. The Company had issued 3,000

thousand units of the stock options to employees

which were increased to 7,011 thousand units by

taking into account the effect of stock dividends and

the issuance of additional common stocks. After

the employees’ choosing to give up the stock

options in the first and second quarter of 2007, there

were no employee stock options outstanding as of

June 20, 2007, the date of stockholders' meeting.

The remaining employee stock options which were

not issued, amounting to 4,000 thousand units,

expired on December 25, 2003.

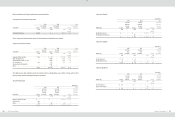

Global Depositary Receipts

The Company issued 14,400 thousand common

shares corresponding to 3,600 thousand units of

Global Depositary Receipts (GDRs). For this GDR

issuance, the Company’s stockholders, including Via

Technologies, Inc., also issued 12,878.4 thousand

common shares, corresponding to 3,219.6 thousand

GDR units. Thus, the entire offering consisted of

6,819.6 thousand GDR units. Each GDR represents

four common shares, with par value of NT$131.1.

For this common share issuance, net of related

expenses, NT$1,696,855 thousand was accounted

for as capital surplus. This share issuance for cash

was completed and registered on November 19,

2003.

The holders of these GDRs have the same rights

and obligations as the stockholders of the Company.

However, the distribution of the offering and sales of

GDRs and the shares represented thereby in certain

jurisdictions may be restricted by law. In addition,

the GDRs offered and the shares represented are

not transferable, except in accordance with the

restrictions described in the GDR offering circular

and related laws applied in Taiwan. Through the

depositary custodian in Taiwan, GDR holders are

entitled to exercise these rights:

a.To vote; and

b.To receive dividends and participate in new share

issuance for cash subscription.

Taking into account the effect of stock dividends, the

GDRs increased to 8,322 thousand units (33,287.9

thousand shares). The holders of these GDRs

requested the Company to redeem the GDRs to get

the Company’s common shares. As of December

31, 2008, there were 6,623.1 thousand units of

GDRs redeemed, representing 26,492 thousand

common shares, and the outstanding GDRs

represented 6,796 thousand common shares or

0.90% of the Company’s common shares.

Capital Surplus

Under the Company Law, capital surplus can only be

used to offset a deficit. However, the capital

surplus from share issued in excess of par

(additional paid-in capital from issuance of common

shares, conversion of bonds and treasury stock

transactions) and donations may be capitalized,

which however is limited to a certain percentage of

the Company’s paid-in capital. Also, the capital

surplus from long-term investments may not be used

for any purpose.

The additional paid-in capital was NT$4,410,871

thousand as of January 1, 2006. In April 2007, the

retirement of treasury stock caused a decrease of

additional paid-in capital amounted to 36,627

thousand. As a result, the additional paid-in capital

as of December 31, 2008 was NT$4,374,244

thousand (US$133,361 thousand). Under the

Company Law, the Company may transfer the

capital surplus to common stock if there is no

accumulated deficit.