HTC 2008 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2008 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Information

| 67

66 |

2008 Annual Report

HTC CORPORATION

(Formerly High Tech Computer Corporation)

AND SUBSIDIARIES

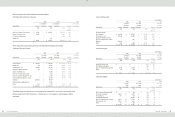

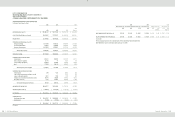

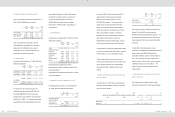

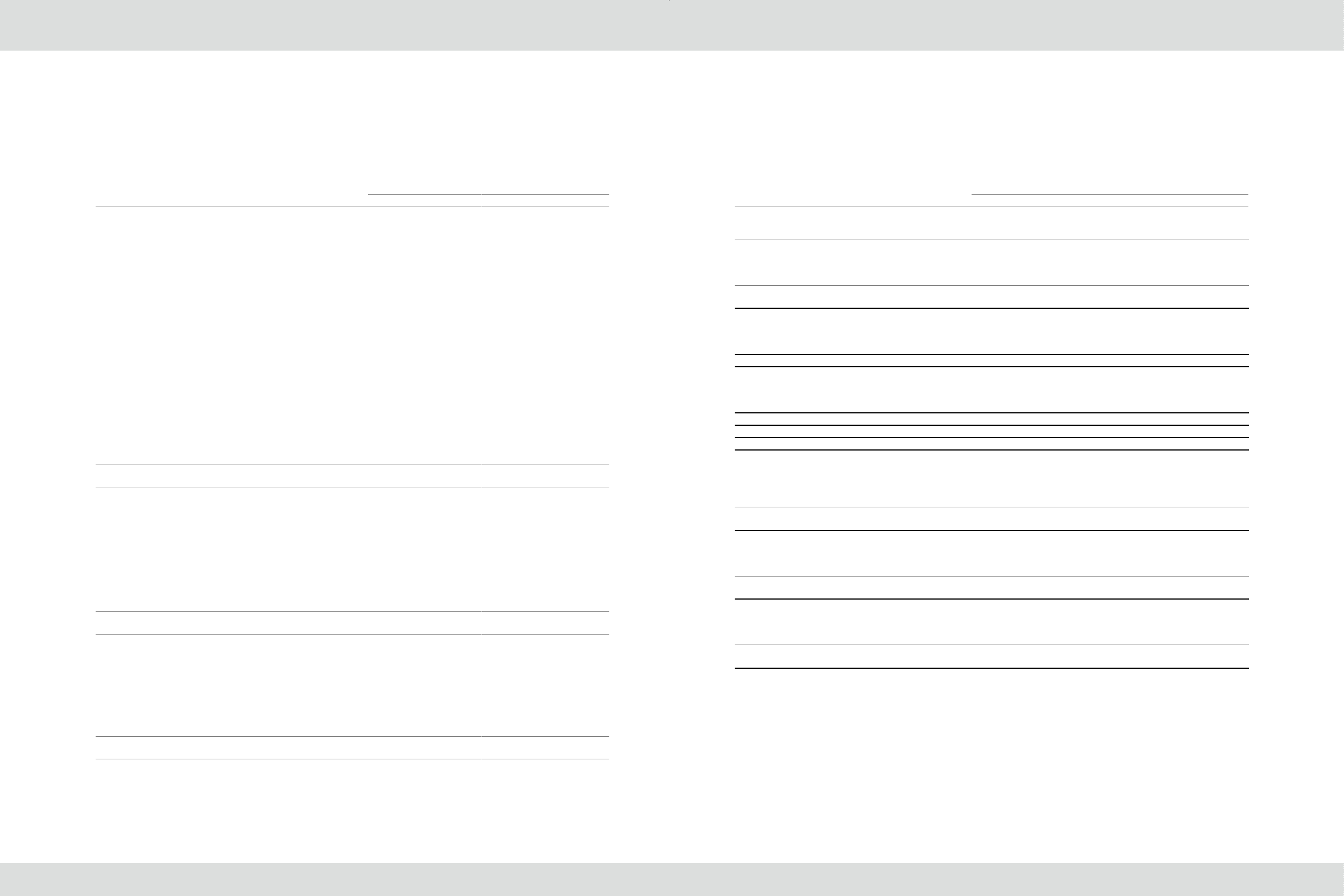

CONSOLIDATED STATEMENTS OF CASH FLOWS

YEARS ENDED DECEMBER 31, 2006, 2007 AND 2008

(In Thousands)

2006

2007

2008

NT$

NT$

NT$

US$ (Note 3)

CASH FLOWS FROM OPERATING ACTIVITIES

Net income

$

25,234,342

$

28,917,712

$

28,552,526

$

870,504

Adjustments to reconcile net income to net cash provided by operating activities

Depreciation (including depreciation of assets leased to others)

638,353

681,257

746,472

22,758

Transfer of properties to expenses

-

-

18,103

552

Foreign exchange loss on bond investments not quoted in an active market

-

-

2,670

81

Amortization

40,516

51,862

61,777

1,883

(Gain) loss on disposal of properties and deferred charges, net

(

35,699

)

1,319

2,857

87

Loss on equity-method investments

-

-

6,151

188

Deferred income tax assets

(

172,381

)

(

309,485

)

(

409,268

)

(

12,478

)

Prepaid pension cost

(

24,260

)

(

20,252

)

(

22,677)

)

(

691

)

Net changes in operating assets and liabilities

Financial instruments at fair value through profit or loss

136,555

19,786

418,356

12,755

Notes and accounts receivable

(

4,719,321

)

(

230,524

)

(

9,970,016

)

(

303,964

)

Other current financial assets

(

85,611

)

83,900

(

140,196

)

(

4,274

)

Inventories

(

645,482

)

(

1,273,718

)

(

1,013,635

)

(

30,904

)

Prepayments

(

1,449,856

)

304,116

282,622

8,617

Other current assets

(

192,527

)

(

63,149

)

17,947

547

Notes and accounts payable

3,199,690

5,918,175

5,366,753

163,621

Income tax payable

1,141,854

799,986

1,469,214

44,793

Accrued expenses

1,241,816

2,636,439

10,221,198

311,622

Other current liabilities

459,756

2,280,787

2,016,103

61,466

Net cash provided by operating activities

24,767,745

39,798,211

37,626,957

1,147,163

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of properties

(

1,166,408

)

(

1,424,307

)

(

5,639,163

)

(

171,926

)

Proceeds of the sales of properties and deferred charges

44,701

6,552

76,857

2,343

Increase in long-term investments - equity method

-

-

(

10,626

)

(

324

)

Increase in restricted assets

-

(

34,500

)

(

6,965

)

(

212

)

Increase in financial assets carried at cost

-

(

500,000

)

-

-

Purchase of bond investments not quoted in an active market

-

(

33,030

)

-

-

Acquisition of a subsidiary

-

(

240,039

)

(

6,297

)

(

192

)

Increase in refundable deposits

(

8,642

)

(

86,803

)

(

59,949

)

(

1,828

)

Increase in deferred charges

(

19,401

)

(

52,019

)

(

167,866

)

(

5,118

)

Net cash used in investing activities

(

1,149,750

)

(

2,364,146

)

(

5,814,009

)

(

177,257

)

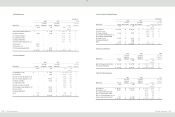

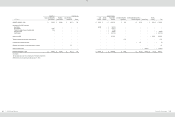

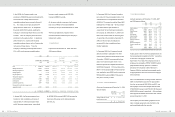

CASH FLOWS FROM FINANCING ACTIVITIES

Increase in short-term borrowings

-

-

75,000

2,287

Decrease in long-term bank loans

-

(

16,231

)

(

20,625

)

(

629

)

Increase (decrease) in guarantee deposits received

79

(

7

)

5,787

176

Cash dividends

(

4,998,224

)

(

11,685,470

)

(

19,486,547

)

(

594,102

)

Bonus to employees

-

(

2,451,000

)

(

1,210,000

)

(

36,890

)

Purchase of treasury stock

(

243,995

)

(

1,747,760

)

(

3,410,277

)

(

103,972

)

Increase in minority interest

161,499

-

-

-

Net cash used in financing activities

(

5,080,641

)

(

15,900,468

)

(

24,046,662

)

(

733,130

)

2006

2007

2008

NT$

NT$

NT$

US$ (Note 3)

EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH

EQUIVALENTS

$

7,238

$

(

13,230

)

$

(

18,743

)

$

(

571

)

NET INCREASE IN CASH AND CASH EQUIVALENTS

18,544,592

21,520,367

7,747,543

236,205

CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR

16,425,226

34,969,818

56,490,185

1,722,262

CASH AND CASH EQUIVALENTS, END OF YEAR

$

34,969,818

$

56,490,185

$

64,237,728

$

1,958,467

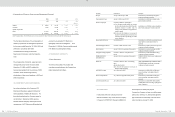

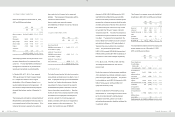

SUPPLEMENTAL CASH FLOW INFORMATION

Cash paid during the year

Interest

$

298

$

1,212

$10,354

$

316

Income tax

$

738,902

$

2,823,723

$

2,111,548

$

64,376

NONCASH INVESTING AND FINANCING ACTIVITIES

Transfer of bond investment not quoted in an active market to

investments accounted for by the equity method

$

-

$

-

$

33,030

$

1,007

Transfer of properties to assets leased to others

$

-

$

-

$

309,959

9,450

Transfer of retained earnings and employee bonuses to common stock

$

794,032

$

1,403,385

$

1,822,601

$

55,567

Retirement of treasury stock

$

-

$

1,991,755

$

-

$

-

PURCHASE OF PROPERTIES

Cost of properties purchased

$

1,199,315

$

1,553,653

$

5,773,031

$

176,007

Increase in payable for purchase of equipment

(

29,013

)

(

130,222

)

(

134,806

)

(

4,110

)

(Increase) decrease in lease payable

(

3,894

)

876

938

29

Cash paid for purchase of properties

$

1,166,408

$

1,424,307

$

5,639,163

$

171,926

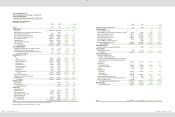

BONUS TO EMPLOYEES

Appropriation of bonus to employees

$

451,000

$

2,000,000

$

1,210,000

$

36,890

(Increase) decrease in payable for employee bonus

(

451,000

)

451,000

-

-

Cash paid

$

-

$

2,451,000

$

1,210,000

$

36,890

ACQUISITION OF A SUBSIDIARY

Expected net cash outflow on the acquisition of a subsidiary

$

-

$

240,039

$

128,997

$

3,933

Increase in other payable

-

-

(

122,700

)

(

3,741

)

Cash paid for acquisition of a subsidiary

$

-

$

240,039

$

6,297

$

192

(Concluded)

The accompanying notes are an integral part of the consolidated financial statements.

(With Deloitte & Touche audit report dated January 17, 2009)