HTC 2008 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2008 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Information

| 107

106 |

2008 Annual Report

31.OTHER EVENTS

In December 2008, the Company’s board of

directors resolved to buy a land near the Company

in Taoyuan for NT$791,910 thousand (US$24,144

thousand) from a related party, Syuda

Construction Company, to have more office space,

parking lots, dormitory, etc. Both parties agreed to

pay and transfer the ownership of the land at the

same time before January 31, 2009.

32.SEGMENT INFORMATION

Industry Type

The Company mainly manufactures and sells

smart handheld devices.

Foreign Operations

Because sales to unaffiliated customers and

identifiable assets of foreign segments were less

than 10 percent of that of the Company, the

Company was exempt from disclosing information

on foreign operations.

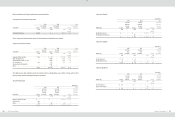

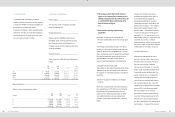

Export Revenues

Export revenues in 2006, 2007 and 2008 were as

follows:

2006

2007

2008

NT$

NT$

NT$

US$

(Note 3)

Asia

$

7,683,450

$

11,697,068

$

22,772,833

$

694,294

America

48,865,122

49,395,639

53,916,578

1,643,798

Europe

38,873,000

47,018,610

60,176,261

1,834,642

Others

6,771,781

7,770,119

11,532,155

351,590

$

102,193,353

$

115,881,436

$

148,397,827

$

4,524,324

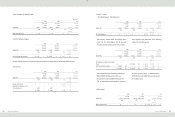

Major Customers

Sales to major customers were as follows:

2006

2007

2008

Customer

NT$

NT$

NT$

US$

(Note 3)

A

$

13,372,184

$

19,710,823

$

26,859,037

$

818,873

B

12,326,693

15,942,551

21,639,592

659,744

C

10,335,852

12,592,997

21,375,563

651,694

D

17,839,399

16,931,462

4,414,395

134,585

$

53,874,128

$

65,177,833

$

74,288,587

$

2,264,896

6. The Company should disclose the financial

impact to the Company if the Company and its

affiliated companies have incurred any financial

or cash flow difficulties in 2008 and as of the

Date of This Annual Report

None.

7. Other matters requiring supplementary

explanation

Explanation of significant accounting policies:

1.Financial assets/liabilities at fair value through profit

or loss

The financial products whose change in fair value is

recognized in earnings are forward foreign exchange

contracts. Because of the small differences in buying

prices, selling prices, and mid-market prices, estimated

fair value for outstanding contracts at period end is

generally based on the public market quotes of

financial institutions (usually the mid-market price).

2.Available-for-sale financial assets

The available-for-sale financial assets are listed stocks.

Estimates of fair value are based on the closing price

for exchange- or OTC-listed securities on the balance

sheet date.

3.Revenue recognition and allowance for doubtful

accounts

Revenue is measured at fair value as the transaction

price agreed between HTC and buyers (considering

trade discounts and volume discounts). As HTC

operations have shifted toward primarily non-ODM

work, added trade discounts have included price

protection, marketing development fund, and mail-in

rebate.

Allowances for doubtful accounts are

estimated using aging analysis, which is

reviewed and updated regularly by

assessing the probability of recovering

outstanding receivables, credit ratings and

general economic factors. HTC assigns a

rating to each customer based on their

financial health. The allowance accounts

of customers with good credit ratings are

accrued by 1% ~ 5% when such are 31~90

days overdue and by 5% ~ 100% when such

exceed 91 days overdue. Individual

determinations are made for customers with

poor credit, as well as reasonable estimates

of allowances for receivables not yet due.

4.Inventory write-downs

Assessments of allowances for loss on

decline in inventory value or loss on items

retired are based on analysis of inventory

age and of slow moving or obsolete

inventory items. HTC began on 1 January

2008 to adopt newly released Statement of

Financial Accounting Standards No. 10 to

assess inventory value on a category by

category basis and allows companies to

write off as losses currently-held inventory

with no practical market value. Also, HTC

applies inventory aging analysis to products

stored in HTC’s main warehouse facility,

with items stored from 60~180 days

depreciated by 25~75% and those stored

more than 180 days depreciated by 100%.

Items stored in other warehouse facilities

are held to depreciation ratios appropriate to

their situations. Changes in the business