HTC 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Information

| 31

30 |

2008 Annual Report

Other receivables from related parties were agency

payments for related parties.

Other receivables were primarily overseas

value-added tax receivables from customers,

prepayment for withholding income tax of employees’

bonus and travel expenses and proceeds of the sales

of properties.

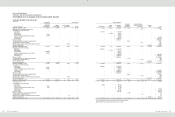

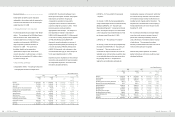

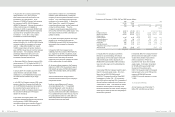

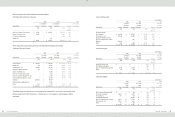

10.INVENTORIES

Inventories as of December 31, 2006, 2007 and 2008

were as follows:

2006

2007

2008

NT$

NT$

NT$

US$

(Note 3)

Finished goods

$

753,426

$

405,952

$

1,302,917

$

39,723

Work-in-process

1,207,886

1,641,460

2,435,581

74,255

Raw materials

3,914,242

4,988,289

5,303,195

161,683

5,875,554

7,035,701

9,041,693

275,661

Less: Valuation

allowance

(

891,663

)

(

916,288

)

(

1,623,226

)

(

49,488

)

$

4,983,891

$

6,119,413

$

7,418,467

$

226,173

The write-down of inventories to their net realizable

value amounted to NT$1,111,843 thousand

(US$33,898 thousand) and was recognized as cost

of sales for the year ended December 31, 2008. For

consistency with the presentation of the financial

statements for the year ended December 31, 2008,

the Company reclassified “provision for loss on

inventories” amounting to NT$729,310 thousand and

NT$487,479 thousand for the years ended December

31, 2006 and 2007, respectively, to “cost of sales.”

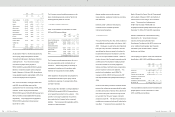

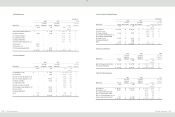

11.PREPAYMENTS

Prepayments as of December 31, 2006, 2007 and

2008 were as follows:

2006

2007

2008

NT$

NT$

NT$

US$

(Note 3)

Royalty

$

1,631,513

$

1,232,901

$

976,824

$

29,781

Software and

hardware maintenance

80,517

76,732

73,218

2,232

Service

50,606

32,241

89,181

2,719

Travel

47,298

6,542

3,601

110

Molding equipment

40,088

158,280

80,420

2,452

Materials purchases

1,479

1,838

2,875

88

Others

29,618

28,793

11,512

351

$

1,881,119

$

1,537,327

$

1,237,631

$

37,733

Prepayments for royalty were primarily prepayments

for discount purposes (Note 27 has more

information).

Prepayments for others were primarily for rent and

insurance expenses.

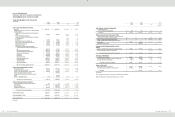

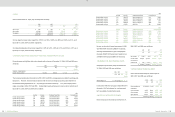

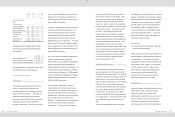

12.FINANCIAL ASSETS CARRIED AT COST

Financial assets carried at cost as of December 31,

2006, 2007 and 2008 were as follows:

2006

2007

2008

NT$

NT$

NT$

US$

(Note 3)

Hua-Chuang Automobile

Information Technical Center

Co., Ltd.

$

-

$

500,000

$

500,000

$

15,244

Answer Online, Inc.

1,192

1,192

1,192

36

$

1,192

$

501,192

$

501,192

$

15,280

In January 2007, the Company acquired 10% equity

interest in Hua-Chuang Automobile Information

Technical Center Co., Ltd. for NT$500,000 thousand.

The Company also signed a joint venture agreement

with Yulon Group, the main stockholder of

Hua-Chuang. Under the agreement, the Company

and Yulon Group may, between January 1, 2010 and

December 31, 2011, submit written requests to each

other for Yulon Group to buy back NT$300,000

thousand at original price, some of Hua-Chuang’s

shares bought by the Company.

In March 2004, the Company merged with IA Style,

Inc. (Note 1) and acquired 1.82% equity interest in

Answer Online, Inc. as a result of the merger.

These unquoted equity instruments were not carried

at fair value because their fair value could not be

reliably measured; thus, the Company accounted for

these investments by the cost method.

13.BOND INVESTMENTS NOT QUOTED IN AN

ACTIVE MARKET

As of December 31, 2007 the Company had the

following bond investment, which had no quoted price

in an active market:

2007

2007

2008

NT$

NT$

NT$

US$

(Note 3)

Bond investment

$

-

$

33,030

$

-

$

-

Less: Current portion

-

(

33,030

)

-

-

$

-

$

-

$

-

$

-

The Company bought 12-month bond issued by

Vitamin D Inc. with 6% annual interest for NT$33,030

thousand (US$1,000 thousand). The unquoted

debt instrument was not carried at fair value because

its fair value could not be reliably measured.

In April 2008, the Company made a new investment

of US$350 thousand and transferred its bond

investment of US$1,000 thousand to convertible

preferred stocks issued by Vitamin D Inc. As a

result, the Company acquired 27% equity interest in

Vitamin D Inc. and can exercise significant influence

over this investee. The Company accounts for this

investment by the equity method.

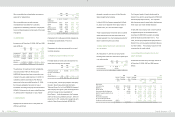

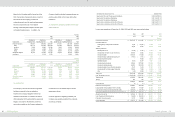

14.INVESTMENTS ACCOUNTED FOR BY THE

EQUITY METHOD

Investments accounted for by the equity method as

of December 31, 2006, 2007 and 2008 were as

follows:

2006

2007

2008

Carrying

Value

Ownership

Percentage

Carrying

Value

Ownership

Percentage

Original Cost

Carrying Value

Ownership

Percentage

NT$

NT$

NT$

US$

NT$

US$

(Note 3)

(Note 3)

Equity method

H.T.C. (B.V.I.) Corp.

$

422,788

100

$

1,427,492

100

$

1,543,906

$

47,070

$

1,557,022

$

47,470

100

BandRich Inc.

136,200

51

114,487

51

135,000

4,116

29,460

898

51

HTC HK, Limited

889

100

8,034

100

1,277

39

46,743

1,425

100

Communication Global Certification Inc.

-

-

281,621

100

280,000

8,537

273,583

8,341

100

High Tech Computer Asia Pacific Pte. Ltd.

-

-

565,499

100

2,023,774

61,700

2,094,922

63,870

100

Vitamin D Inc.

-

-

-

-

40,986

1,250

39,906

1,217

26

HTC Investment Corporation

-

-

-

-

300,000

9,146

301,006

9,177

100

PT. High Tech Computer Indonesia

-

-

-

-

62

2

62

2

1

Prepayments for long-term investments

261,679

-

-

-

316,656

9,654

316,656

9,654

-

$

821,556

$

2,397,133

$

4,641,661

$

141,514

$

4,659,360

$

142,054