HTC 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Information

| 35

34 |

2008 Annual Report

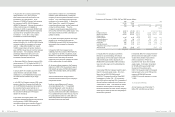

2006

2007

2008

NT$

NT$

NT$

US$

(Note 3)

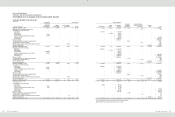

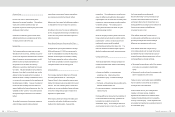

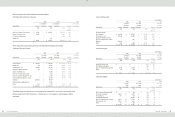

Bonus to employees

$

451,000

$

-

$

6,164,889

$

187,954

Marketing

983,088

3,007,021

5,810,533

177,150

Services

49,221

615,365

1,180,716

35,998

Salaries & bonuses

762,942

914,062

1,012,048

30,855

Export expenses

162,221

127,867

447,814

13,653

Research materials

119,075

189,469

397,075

12,106

Meals and welfare

57,436

58,287

99,952

3,047

Repairs and maintenance

23,759

32,564

76,171

2,322

Insurance

40,398

46,967

69,978

2,134

Research and development

-

-

65,600

2,000

Pension for defined

contribution plan

26,327

32,918

48,405

1,476

Travel

58,027

40,777

30,714

936

Others

57,635

204,532

229,041

6,983

$

2,791,129

$

5,269,829

$

15,632,936

$

476,614

As discussed in Note 4 to the financial statements,

the Company adopted Interpretation 96-052 -

“Accounting for Bonuses to Employees, Directors

and Supervisors.” As a result, the Company

accrued an employee bonus payable of

NT$6,164,889 thousand (US$187,954 thousand).

Based on a resolution passed by the Company’s

board of directors in February 2008, the employee

bonus payable should be appropriated at 18% of net

income less employee bonus expenses.

Also, in the stockholders’ meetings of 2006, 2007

and 2008, the stockholders approved the

appropriation from the net earnings of 2005, 2006

and 2007, and the employee bonuses were

NT$451,000 thousand, NT$2,000,000 thousand and

NT$1,210,000 thousand (US$36,890 thousand),

respectively. Only employee bonus payable of

NT$451,000 thousand had not been paid on

December 31, 2006.

The Company accrued marketing expenses on the

basis of related agreements and other factors that

would significantly affect the accruals.

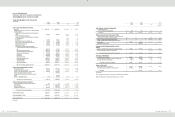

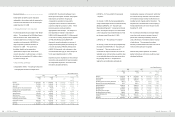

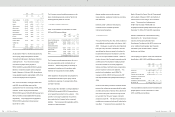

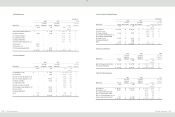

17.OTHER CURRENT LIABILITIES

Other current liabilities as of December 31, 2006,

2007 and 2008 were as follows:

2006

2007

2008

NT$

NT$

NT$

US$

(Note 3)

Reserve for warranty expenses

$1,393,995

$3,469,957

$5,225,862

$159,325

Other payables (Note 25)

149,292

310,582

634,417

19,342

Agency receipts

122,897

107,618

255,853

7,801

Deferred credits - profit from

intercompany transactions

164,011

175,075

134,091

4,088

Advance receipts

37,340

105,424

120,504

3,674

Directors’ remuneration

21,842

21,842

21,842

666

Others

23,245

106,860

16,207

494

$1,912,622

$4,297,358

$6,408,776

$195,390

The Company provides warranty service for one to

two years, depending on the contracts with our

customers. The warranty liability is estimated on

management’s evaluation of the products under

warranty and recognized as warranty liability.

Other payables to related parties were payables for

investments accounted for by the equity method,

miscellaneous expenses of overseas sales offices

and repair materials.

The Company also estimated a contingent liability of

NT$259,450 thousand (US$7,910 thousand) due to

an increased financial risk from the customer. If the

customer cannot pay its payments, the upstream

firms might dun the Company for the customer’s

liabilities. The Company is still negotiating with the

customer to resolve this issue.

Agency receipts were primarily overseas

value-added tax, employees’ income tax, insurance,

and other items.

Deferred credits - profit from intercompany

transactions were unrealized profit from

intercompany transactions.

18.PENSION PLAN

The Labor Pension Act (the “Act), which provides for

a new defined contribution plan, took effect on July 1,

2005. Employees covered by the Labor Standards

Law (the “Law”) before the enforcement of the Act

were allowed to choose to remain to be subject to

the defined benefit pension mechanism under the

Law or to be subject instead to the Act. Based on

the Act, the rate of the Company’s required monthly

contributions to the employees’ individual pension

accounts is at least 6% of monthly wages and

salaries, and these contributions are recognized as

pension expense in the income statement. The

pension fund contributions were NT$89,723

thousand in 2006, NT$110,723 thousand in 2007

and NT$158,050thousand (US$4,818 thousand) in

2008.

Under the Law, which provides for a defined benefit

pension plan, retirement payments should be made

according to the years of service, with a payment of

two units for each year of service but only one unit

per year after the 15th year; however, total units

should not exceed 45. The rate of the Company’s

contributions to a pension fund was 2% after the Act

took effect. The pension fund is deposited in the

Bank of Taiwan (the Central Trust of China merged

with the Bank of Taiwan in 2007, with the Bank of

Taiwan as the survivor entity) in the committee’s

name. The pension fund balances were

NT$311,532 thousand, NT$348,439 and

NT$388,641 thousand (US$11,849 thousand) as of

December 31, 2006, 2007 and 2008, respectively.

Based on the Statement of Financial Accounting

Standards No. 18 - “Accounting for Pensions,”

issued by the Accounting Research and

Development Foundation of the ROC, pension cost

under a defined benefit pension plan should be

calculated by the actuarial method. Related

disclosure is as follows:

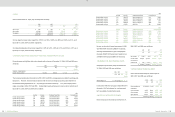

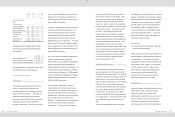

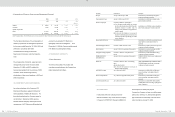

The Company’s net pension costs under the defined

benefit plan in 2006, 2007 and 2008 were as follows:

2006

2007

2008

NT$

NT$

NT$

US$

(Note 3)

Service cost

$

5,259

$

4,930

$

5,194

$

158

Interest cost

9,400

8,591

8,699

265

Projected return on plan assets

(

10,320

)

(

8,979

)

(

9,967

)

(

303

)

Amortization of unrecognized net

transition obligation, net

-

-

-

-

Amortization of net pension benefit

1,708

2,182

1,487

45

Net pension cost

$

6,047

$

6,724

$

5,413

$

165

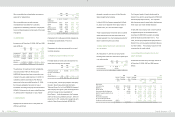

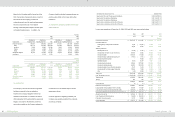

The reconciliations between pension fund status and

prepaid pension cost as of December 31, 2006,

2007 and 2008 were as follows: