HP 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

Services earnings from operations as a percentage of net revenue decreased by 1.6 percentage

points in fiscal 2011. Operating margin decreased due primarily to lower than expected revenue, rate

concessions arising from recent contract renewals, a lower than expected resource utilization rate and a

higher mix of lower-margin Infrastructure Technology Outsourcing revenue. The decrease in operating

margin was partially offset by a reduction in bad debt expense and a continued focus on operating

improvements and cost initiatives that favorably impacted the cost structure of both our enterprise

services and technology services businesses.

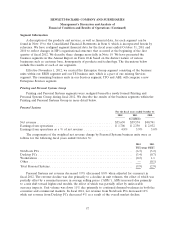

Enterprise Servers, Storage and Networking

For the fiscal years ended October 31

2012 2011 2010

In millions

Net revenue ........................................... $20,491 $22,064 $20,246

Earnings from operations ................................. $ 2,132 $ 2,997 $ 2,814

Earnings from operations as a % of net revenue ................ 10.4% 13.6% 13.9%

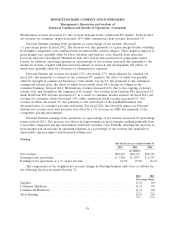

The components of the weighted net revenue change by ESSN business units were as follows for

the following fiscal years ended October 31:

2012 2011

Percentage Points

Industry Standard Servers ............................................. (4.2) 4.7

Business Critical Systems (‘‘BCS’’) ...................................... (2.2) (1.0)

Storage .......................................................... (1.1) 1.3

Networking ....................................................... 0.4 4.0

Total ESSN ....................................................... (7.1) 9.0

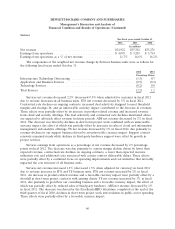

ESSN net revenue decreased 7.1% (6.4% when adjusted for currency) in fiscal 2012 due primarily

to revenue decreases in ISS, BCS and Storage. In fiscal 2012, ISS net revenue decreased by 7% driven

by declines in unit volume and average unit prices. The declines were due primarily to competitive

pricing pressures and macroeconomic challenges in EMEA. These effects were partially offset by

increased demand for public and private cloud offerings. BCS net revenue decreased by 23% in fiscal

2012 mainly as a result of lower demand for our Itanium-based servers, the impact of which was slightly

offset by growth in NonStop servers. Storage net revenue decreased 6% in fiscal 2012, due primarily to

revenue declines in storage tape and networking products, the effect of which was partially offset by

strong growth in 3PAR products and StoreOnce data deduplication solutions. Networking net revenue

increased 4% in fiscal 2012 due to higher market demand for our core data center products, the effect

of which was partially offset by competitive pricing pressures and the divestiture of our video

surveillance business.

ESSN earnings from operations as a percentage of net revenue decreased by 3.2 percentage points

in fiscal 2012 driven by a decrease in gross margin coupled with an increase in operating expenses as a

percentage of net revenue. The decrease in gross margin was due primarily to competitive pricing

pressures, particularly in ISS and, to a lesser extent, in Networking. The increase in operating expenses

as a percentage of net revenue was driven by an increase in research and development costs and field

selling costs, the effect of which was partially offset by lower administrative and marketing expenses.

61