HP 2012 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

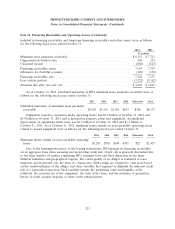

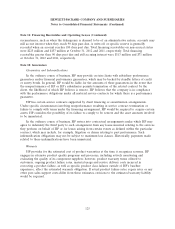

Note 11: Financing Receivables and Operating Leases (Continued)

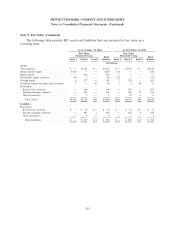

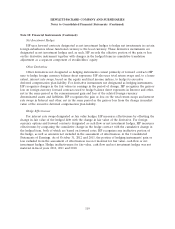

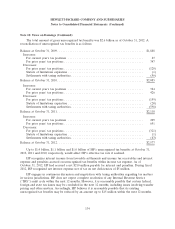

The credit risk profile of the gross financing receivables, based on internally assigned ratings, was

as follows for the following fiscal years ended October 31:

Risk Rating 2012 2011

In millions

Low ........................................................... $4,461 $4,261

Moderate ........................................................ 3,151 2,989

High ........................................................... 81 57

Total ........................................................... $7,693 $7,307

Accounts rated low risk typically have the equivalent of a Standard & Poor’s rating of BBBǁ or

higher, while accounts rated moderate risk would generally be the equivalent of BB+ or lower. HP

closely monitors accounts rated high risk and, based upon an impairment analysis, may establish

specific reserves against a portion of these leases.

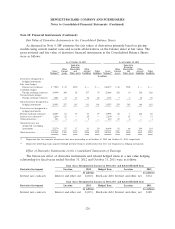

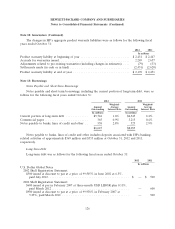

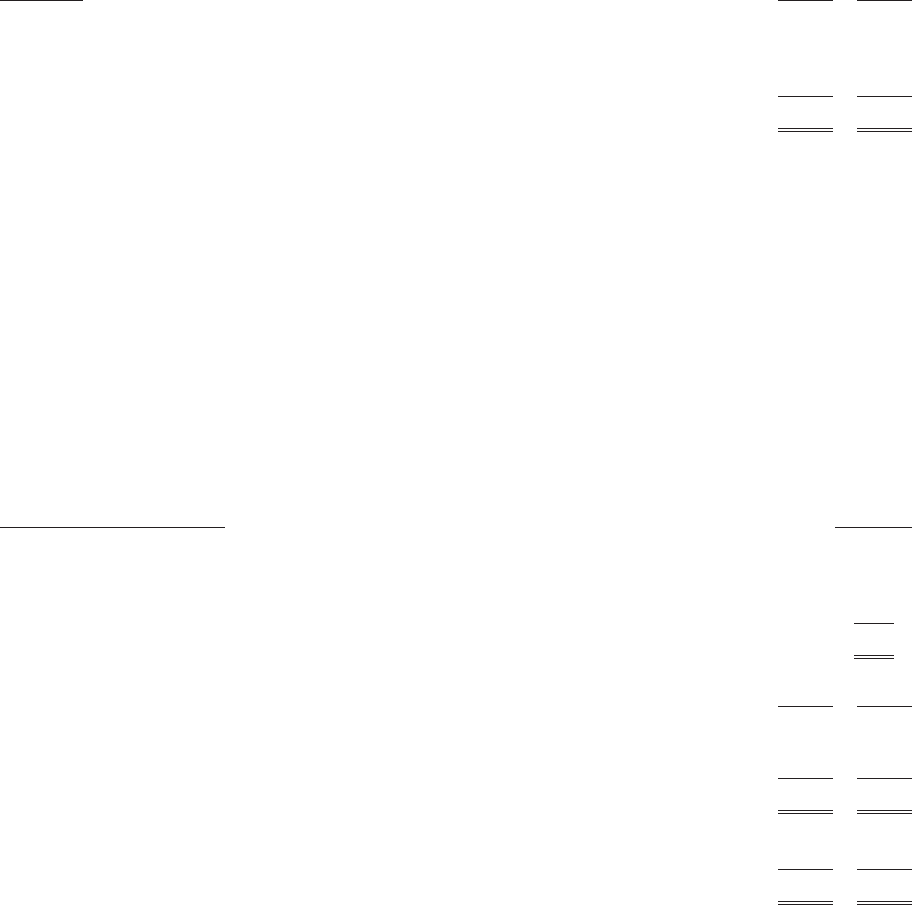

The allowance for doubtful accounts balance is comprised of a general reserve, which is

determined based on a percentage of the financing receivables balance, and a specific reserve, which is

established for certain leases with identified exposures, such as customer default, bankruptcy or other

events, that make it unlikely that HP will recover its investment in the lease. The general reserve

percentages are maintained on a regional basis and are based on several factors, which include

consideration of historical credit losses and portfolio delinquencies, trends in the overall weighted-

average risk rating of the portfolio, and information derived from competitive benchmarking.

The allowance for doubtful accounts and the related financing receivables were as follows for the

following fiscal years ended October 31:

Allowance for doubtful accounts 2012

In millions

Balance, beginning of period .............................................. $130

Additions to allowance ................................................... 42

Deductions, net of recoveries .............................................. (23)

Balance, end of period ................................................... $149

2012 2011

In millions

Allowance for financing receivables individually evaluated for loss ............... $ 45 $ 35

Allowance for financing receivables collectively evaluated for loss ............... 104 95

Total ......................................................... $ 149 $ 130

Gross financing receivables individually evaluated for loss ..................... $ 338 $ 228

Gross financing receivables collectively evaluated for loss ..................... 7,355 7,079

Total ......................................................... $7,693 $7,307

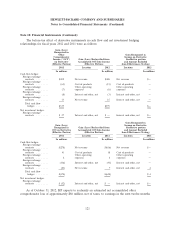

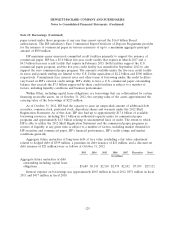

Accounts are generally put on non-accrual status (cessation of interest accrual) when they reach

90 days past due. The non-accrual status may not impact a customer’s risk rating. In certain

124