HP 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

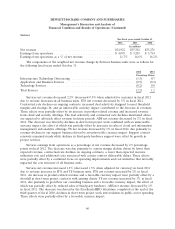

Impairment of Goodwill and Purchased Intangible Assets

In fiscal 2012, we recorded goodwill impairment charges of $8.0 billion and $5.7 billion associated

with the Services segment and the acquisition of Autonomy, respectively. In addition, we recorded

intangible asset impairment charges of $3.1 billion and $1.2 billion associated with the acquisition of

Autonomy and the ‘‘Compaq’’ trade name, respectively.

In fiscal 2011, we recorded $885 million impairment charges to goodwill and purchased intangible

assets associated with the acquisition of Palm, Inc. on July 1, 2010 as a result of the decision

announced on August 18, 2011 to wind down the webOS device business.

For more information on our impairment charges, see Note 7 to the Consolidated Financial

Statements in Item 8, which is incorporated herein by reference.

Restructuring Charges

The increase in restructuring costs for fiscal 2012 was due primarily to charges of $2.1 billion for

the restructuring plan announced in May 2012 (the ‘‘2012 Plan’’), the effect of which was partially

offset by lower charges in the fiscal 2008 and fiscal 2010 ES restructuring plans. Restructuring charges

for fiscal 2012 were $2.3 billion. These charges included $2.1 billion costs related to the 2012 Plan,

$106 million costs related to our fiscal 2008 restructuring plan and $75 million costs related to our

fiscal 2010 ES restructuring plan.

The decrease in restructuring costs for fiscal 2011 was due primarily to lower charges in the fiscal

2008 and fiscal 2010 ES restructuring plans. Restructuring charges for fiscal 2011 were $645 million.

These charges included $326 million of severance and facility costs related to our fiscal 2008

restructuring plan, $266 million of severance and facility costs related to our fiscal 2010 ES

restructuring plan and $33 million related to the decision to wind down the webOS device business.

Restructuring charges for fiscal 2010 were $1.1 billion. These charges included $650 million of

severance and facility costs related to our fiscal 2010 ES restructuring plan, $429 million of severance

and facility costs related to our fiscal 2008 restructuring plan, $46 million and $18 million associated

with the Palm and 3Com restructuring plans, respectively, and an increase of $1 million related to

adjustments to other restructuring plans.

For more information on our restructuring charges, see Note 8 to the Consolidated Financial

Statements in Item 8, which is incorporated herein by reference.

As part of our ongoing business operations, we incurred workforce rebalancing charges for

severance and related costs within certain business segments. Workforce rebalancing activities are

considered part of normal operations as we continue to optimize our cost structure. Workforce

rebalancing costs are included in our business segment results, and we expect to incur additional

workforce rebalancing costs in the future.

Amortization of Purchased Intangible Assets

The increase in amortization expense in fiscal 2012 was due primarily to amortization expenses

related to the intangible assets purchased as part of the Autonomy acquisition. This increase was

partially offset by decreased amortization expenses related to certain intangible assets associated with

prior acquisitions reaching the end of their amortization periods.

55