HP 2012 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

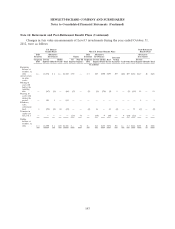

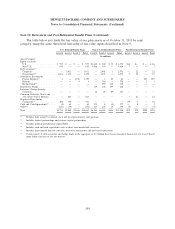

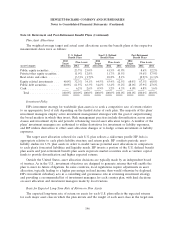

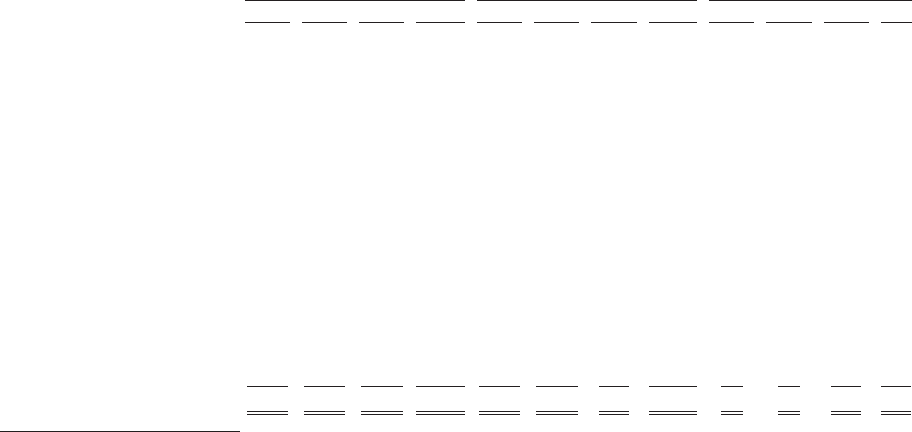

Note 16: Retirement and Post-Retirement Benefit Plans (Continued)

The table below sets forth the fair value of our plan assets as of October 31, 2011 by asset

category, using the same three-level hierarchy of fair-value inputs described in Note 9.

U.S. Defined Benefit Plans Non-U.S. Defined Benefit Plans Post-Retirement Benefit Plans

Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

In millions

Asset Category:

Equity securities

U.S. ................. $ 974 $ — $ — $ 974 $1,140 $ 200 $ 30 $ 1,370 $16 $— $ — $ 16

Non-U.S. .............. 850 — — 850 4,066 354 — 4,420 7 — — 7

Debt securities(6)

Corporate .............. — 3,031 — 3,031 — 2,948 3 2,951 — 22 — 22

Government(1) ........... 1,801 1,331 — 3,132 — 1,275 — 1,275 5 22 — 27

Alternative Investments

Private Equities(2) ......... 3 — 1,356 1,359 — 1 20 21 — — 227 227

Hybrids ............... — — 4 4 — 790 — 790 — — 1 1

Hedge Funds(6) ........... — — — — — 259 300 559 — — — —

Real Estate Funds .......... — — — — 349 138 199 686 — — — —

Insurance Group Annuity

Contracts .............. — — — — 16 46 89 151 — — — —

Common Collective Trusts and

103-12 Investment Entities .... — 843 — 843 — — — — — 21 — 21

Registered Investment

Companies(3) ............ 206 375 — 581 — — — — 69 7 — 76

Cash and Cash Equivalents(4) .... (4) 68 — 64 573 8 (4) 577 — 2 — 2

Other(5) ................. (117) (59) — (176) 217 144 19 380 (5) — — (5)

Total ................... $3,713 $5,589 $1,360 $10,662 $6,361 $6,163 $656 $13,180 $92 $74 $228 $394

(1) Includes debt issued by national, state and local governments and agencies.

(2) Includes limited partnerships and venture capital partnerships.

(3) Includes publicly and privately traded RICs.

(4) Includes cash and cash equivalents such as short-term marketable securities.

(5) Includes international insured contracts, derivative instruments and unsettled transactions.

(6) Certain non-U.S. debt securities and hedge funds in the aggregate of $3.2 billion have been reclassified from level 1 to level 2 based

upon further analysis of the investments.

144