HP 2012 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

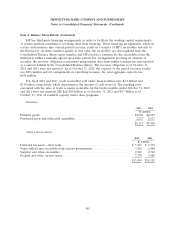

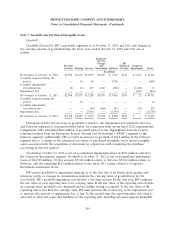

Note 7: Goodwill and Purchased Intangible Assets (Continued)

an impairment review of the ‘‘Compaq’’ trade name intangible asset. In conducting an impairment

review of a purchased intangible asset, HP compares the fair value of the asset to its carrying value. If

the fair value of the asset is less than the carrying value, the difference is recorded as an impairment

loss. HP estimated the fair value of the ‘‘Compaq’’ trade name by calculating the present value of the

royalties saved that would have been paid to a third party had HP not owned the trade name.

Following the completion of that analysis, HP determined that the fair value of the trade name asset

was less than the carrying value due primarily to the change in the useful life assumption and a

decrease in expected future revenues related to Compaq-branded products resulting from the more

focused branding strategy. As a result, HP recorded an impairment charge of $1.2 billion in the third

quarter of fiscal 2012, which was included in the Impairment of Goodwill and Purchased Intangible

Assets line item in the Consolidated Statements of Earnings.

The finite-lived purchased intangible assets consist of customer contracts, customer lists and

distribution agreements, which have weighted-average useful lives of eight years, and developed and

core technology, patents, product tradenames and product trademarks, which have weighted-average

useful lives of seven years.

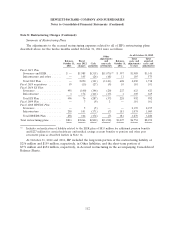

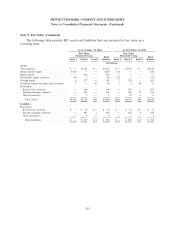

Estimated future amortization expense related to finite-lived purchased intangible assets at

October 31, 2012 is as follows:

Fiscal year: In millions

2013 ................................................................ $1,363

2014 ................................................................ 1,026

2015 ................................................................ 837

2016 ................................................................ 680

2017 ................................................................ 254

Thereafter ............................................................ 348

Total ................................................................ $4,508

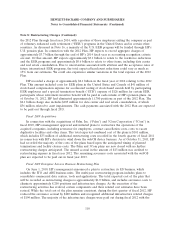

Note 8: Restructuring Charges

HP records restructuring charges associated with management-approved restructuring plans to

either reorganize one or more of HP’s business segments, or to remove duplicative headcount and

infrastructure associated with one or more business acquisitions. Restructuring charges can include

severance costs to eliminate a specified number of employees, infrastructure charges to vacate facilities

and consolidate operations, and contract cancellation costs. Restructuring charges are recorded based

upon planned employee termination dates and site closure and consolidation plans. The timing of

associated cash payments is dependent upon the type of restructuring charge and can extend over a

multi-year period. HP records the short-term portion of the restructuring liability in Accrued

restructuring and the long-term portion in Other liabilities in the Consolidated Balance Sheets.

Fiscal 2012 Restructuring Plan

On May 23, 2012, HP adopted a multi-year restructuring plan (the ‘‘2012 Plan’’) designed to

simplify business processes, accelerate innovation and deliver better results for customers, employees

and stockholders. HP estimates that it will eliminate approximately 29,000 positions in connection with

109