HP 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

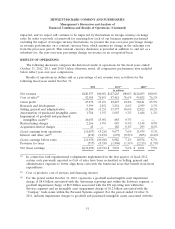

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

portfolio of hardware, software and services to solve customer problems. However, the rate at which we

are able to invest in our business and the returns that we are able to achieve from these investments

will be affected by many factors, including the efforts to address the execution, industry and

macroeconomic challenges facing our business as discussed above. As a result, we may experience

delays in the anticipated timing of activities related to these efforts, and the anticipated benefits of

these efforts may not materialize.

The following provides an overview of our key fiscal 2012 financial metrics:

HP(1) Personal

Consolidated Systems Printing Services ESSN Software HPFS

In millions, except per share amounts

Net revenue .............. $120,357 $35,650 $24,487 $34,922 $20,491 $4,060 $3,819

Year-over-year net revenue %

(decrease) increase ........ (5.4)% (9.9)% (6.5)% (2.2)% (7.1)% 20.6% 6.2%

(Loss) earnings from operations . $(11,057) $ 1,706 $ 3,585 $ 4,095 $ 2,132 $ 827 $ 388

(Loss) earnings from operations

as a % of net revenue ...... (9.2)% 4.8% 14.6% 11.7% 10.4% 20.4% 10.2%

Net loss ................. $(12,650)

Net loss per share

Basic ................. $ (6.41)

Diluted ................ $ (6.41)

(1) HP consolidated net revenue includes a reduction of approximately $3.2 billion primarily related to the

elimination of intersegment net revenue and revenue from our Corporate Investments segment. HP

consolidated (loss) earnings from operations includes amounts related to the impairment of goodwill and

purchased intangible assets, restructuring charges, amortization of purchased intangible assets, corporate and

unallocated costs and eliminations, unallocated costs related to certain stock-based compensation expenses,

acquisition-related charges, and a loss from the Corporate Investments segment.

Cash and cash equivalents at October 31, 2012 totaled $11.3 billion, an increase of $3.3 billion

from the October 31, 2011 balance of $8.0 billion. The increase for fiscal 2012 was due primarily to

$10.6 billion of cash provided from operations, the effect of which was partially offset by $3.1 billion

net investment in property, plant and equipment, $2.6 billion of cash used to repurchase common stock

and pay dividends and $2.0 billion from the net repayment of debt.

We intend the discussion of our financial condition and results of operations that follows to

provide information that will assist in understanding our Consolidated Financial Statements, the

changes in certain key items in those financial statements from year to year, and the primary factors

that accounted for those changes, as well as how certain accounting principles, policies and estimates

affect our Consolidated Financial Statements.

The discussion of results of operations at the consolidated level is followed by a more detailed

discussion of results of operations by segment.

For a further discussion of trends, uncertainties and other factors that could impact our operating

results, see the section entitled ‘‘Risk Factors’’ in Item 1A, which is incorporated herein by reference.

41