HP 2012 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

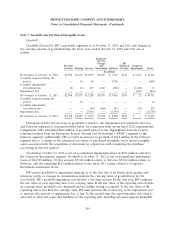

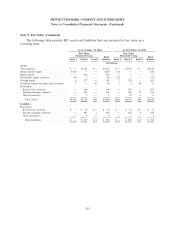

Note 7: Goodwill and Purchased Intangible Assets (Continued)

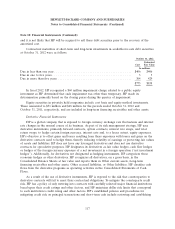

the goodwill impairment charge and the purchased intangible assets impairment charge, totaling

$8.8 billion, were included in the Impairment of Goodwill and Purchased Intangible Assets line item in

the Consolidated Statements of Earnings.

Subsequent to the Autonomy purchase price allocation period, which concluded in the first quarter

of fiscal 2012, and in conjunction with HP’s annual goodwill impairment testing, HP identified certain

indicators of impairment. The indicators of impairment included lower than expected revenue and

profitability levels over a sustained period of time, the trading values of HP stock and downward

revisions to management’s short-term and long-term forecast for the Autonomy business. HP revised its

multi-year forecast for the Autonomy business, and the timing of this forecast revision coincided with

the timing of HP’s overall forecasting process for all reporting units, which is completed each year in

the fourth fiscal quarter in conjunction with the annual goodwill impairment analysis. The change in

assumptions used in the revised forecast and the fair value estimates utilized in the impairment testing

of the Autonomy goodwill and long-lived assets incorporated insights gained from having owned the

Autonomy business for the preceding year. The revised forecast reflected changes related to organic

revenue growth rates, current market trends, business mix, cost structure, expected deal synergies and

other expectations about the anticipated short-term and long-term operating results of the Autonomy

business, driven by HP’s analysis regarding certain accounting improprieties, incomplete disclosures and

misrepresentations at Autonomy that occurred prior to the Autonomy acquisition with respect to

Autonomy’s pre-acquisition business and related operating results. Accordingly, the change in fair

values represented a change in accounting estimate that occurred outside the purchase price allocation

period, resulting in the recorded impairment charge.

Based on the results of the annual impairment test for all other reporting units, HP concluded that

no other goodwill impairment existed as of August 1, 2012, apart from the impairment charges

discussed above. The excess of fair value over carrying value for each of HP’s reporting units as of

August 1, 2012, the annual testing date, ranged from approximately 9% to approximately 330% of

carrying value. The Autonomy and legacy HP software reporting units have the lowest excess of fair

value over carrying value at 10% and 9%, respectively. HP will continue to evaluate goodwill, on an

annual basis as of the beginning of its fourth fiscal quarter, and whenever events or changes in

circumstances, such as significant adverse changes in business climate or operating results, changes in

management’s business strategy or further significant declines in HP’s stock price, indicate that there

may be a potential indicator of impairment.

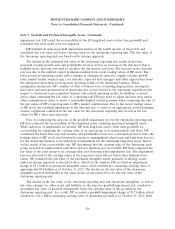

During fiscal 2011, HP recorded approximately $6.9 billion of goodwill related to acquisitions

based on its preliminary estimated fair values of the assets acquired and liabilities assumed. In

connection with organizational realignments implemented in the first quarter of fiscal 2011, HP also

reclassified goodwill related to the Networking business from Corporate Investments to ESSN and

goodwill related to the communications and media solutions business from Software to Services. In the

fourth quarter of fiscal 2011, HP determined that it would wind down the manufacture and sale of

webOS devices resulting from the Palm acquisition, including webOS smartphones and the HP

TouchPad. HP also announced that it would continue to explore alternatives to optimize the value of

the webOS technology, including, among others, licensing the webOS software or the related

intellectual property or selling all or a portion of the webOS assets. The decision triggered an

impairment review of the related goodwill and purchased intangible assets recorded in connection with

the Palm acquisition. HP first performed an impairment review of the purchased intangible assets,

which represents the value for the webOS technology, carrier relationships and the trade name. Based

107