HP 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

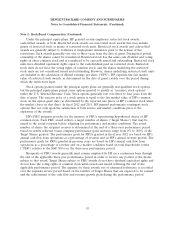

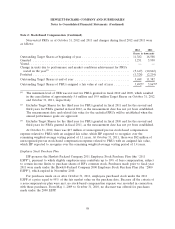

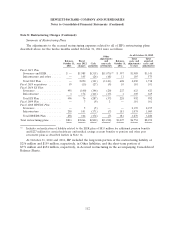

Note 4: Balance Sheet Details (Continued)

Other Liabilities

2012 2011

In millions

Pension, post-retirement, and post-employment liabilities .................... $ 7,780 $ 5,414

Deferred tax liability—long-term ..................................... 2,948 5,163

Long-term deferred revenue ........................................ 3,371 3,453

Other long-term liabilities .......................................... 3,381 3,490

$17,480 $17,520

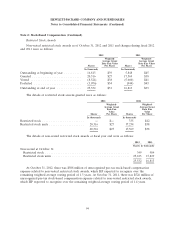

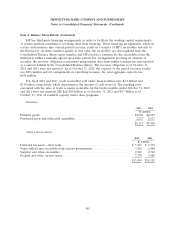

Note 5: Supplemental Cash Flow Information

Supplemental cash flow information to the Consolidated Statements of Cash Flows was as follows

for the following fiscal years ended October 31:

2012 2011 2010

In millions

Cash paid for income taxes, net ................................. $1,750 $1,134 $1,293

Cash paid for interest ........................................ $ 856 $ 451 $ 384

Non-cash investing and financing activities:

Issuance of common stock and stock awards assumed in business

acquisitions ............................................ $ — $ 23 $ 93

Purchase of assets under capital leases .......................... $ 12 $ 10 $ 122

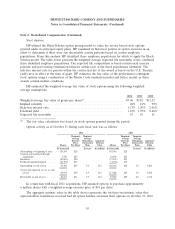

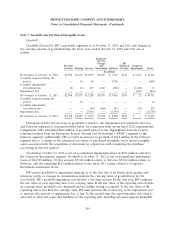

Note 6: Acquisitions

Acquisitions in prior years

In fiscal 2011, HP completed four acquisitions. Total fair value of purchase consideration for the

acquisitions was $11.4 billion, which includes cash paid for outstanding common stock, convertible

bonds, vested-in-the-money stock awards and the estimated fair value of earned unvested stock awards

assumed. In connection with these acquisitions, HP recorded approximately $6.9 billion of goodwill,

$4.7 billion of purchased intangibles and assumed $206 million of net liabilities. HP’s largest acquisition

in fiscal 2011 was its acquisition of Autonomy, with a total fair value of purchase consideration of

$11.0 billion.

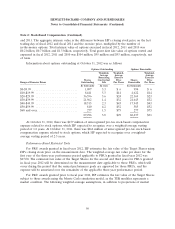

In fiscal 2010, HP completed eleven acquisitions. Total fair value of purchase consideration for the

acquisitions was $9.4 billion, which includes cash paid for common stock, vested-in-the-money stock

awards, the estimated fair value of earned unvested stock awards assumed, as well as certain debt that

was repaid at the acquisition date. In connection with these acquisitions, HP recorded approximately

$5.2 billion of goodwill, $2.4 billion of purchased intangibles and $331 million of IPR&D. The largest

four of the eleven acquisitions were the acquisitions of 3Com Corporation (‘‘3Com’’), Palm, Inc.

(‘‘Palm’’), 3PAR Inc. (‘‘3PAR’’) and ArcSight, Inc. (‘‘ArcSight’’).

103