HP 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

impacted, and we expect will continue to be impacted, by fluctuations in foreign currency exchange

rates. In order to provide a framework for assessing how each of our business segments performed

excluding the impact of foreign currency fluctuations, we present the year-over-year percentage change

in revenue performance on a constant currency basis, which assumes no change in the exchange rate

from the prior-year period. This constant currency disclosure is provided in addition to, and not as a

substitute for, the year-over-year percentage change in revenue on an as-reported basis.

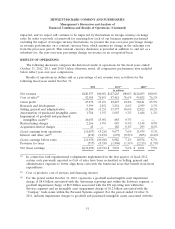

RESULTS OF OPERATIONS

The following discussion compares the historical results of operations for the fiscal years ended

October 31, 2012, 2011, and 2010. Unless otherwise noted, all comparative performance data included

below reflect year-over-year comparisons.

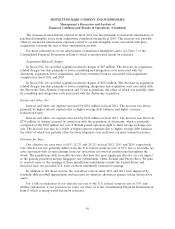

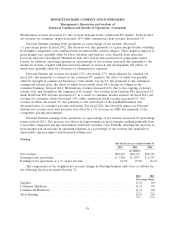

Results of operations in dollars and as a percentage of net revenue were as follows for the

following fiscal years ended October 31:

2012 2011(1) 2010(1)

In millions

Net revenue ......................... $120,357 100.0% $127,245 100.0% $126,033 100.0%

Cost of sales(2) ....................... 92,385 76.8% 97,418 76.6% 95,852 76.1%

Gross profit ......................... 27,972 23.2% 29,827 23.4% 30,181 23.9%

Research and development .............. 3,399 2.8% 3,254 2.6% 2,959 2.3%

Selling, general and administrative ......... 13,500 11.2% 13,577 10.6% 12,822 10.2%

Amortization of purchased intangible assets . . 1,784 1.5% 1,607 1.3% 1,484 1.2%

Impairment of goodwill and purchased

intangibles assets(3) .................. 18,035 15.0% 885 0.7% — —

Restructuring charges .................. 2,266 1.9% 645 0.5% 1,144 0.9%

Acquisition-related charges .............. 45 — 182 0.1% 293 0.2%

(Loss) earnings from operations .......... (11,057) (9.2)% 9,677 7.6% 11,479 9.1%

Interest and other, net(4) ................ (876) (0.8)% (695) (0.5)% (505) (0.4)%

(Loss) earnings before taxes ............. (11,933) (10.0)% 8,982 7.1% 10,974 8.7%

Provision for taxes .................... (717) (0.5)% (1,908) (1.5)% (2,213) (1.7)%

Net (loss) earnings .................... $(12,650) (10.5)% $ 7,074 5.6% $ 8,761 7.0%

(1) In connection with organizational realignments implemented in the first quarter of fiscal 2012,

certain costs previously reported as Cost of sales have been reclassified as Selling, general and

administrative expenses to better align those costs with the functional areas that benefit from those

expenditures.

(2) Cost of products, cost of services and financing interest.

(3) For the period ended October 31, 2012, represents a goodwill and intangible asset impairment

charge of $8.8 billion associated with the Autonomy reporting unit within the Software segment, a

goodwill impairment charge of $8.0 billion associated with the ES reporting unit within the

Services segment and an intangible asset impairment charge of $1.2 billion associated with the

‘‘Compaq’’ trade name within the Personal Systems segment. For the period ended October 31,

2011, includes impairment charges to goodwill and purchased intangible assets associated with the

51