HP 2012 Annual Report Download - page 171

Download and view the complete annual report

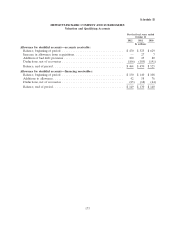

Please find page 171 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

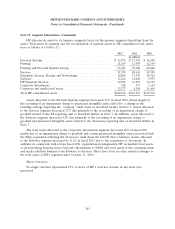

Note 19: Segment Information (Continued)

the corporate level. These unallocated costs include primarily restructuring charges and any associated

adjustments related to restructuring actions, impairment and amortization of purchased intangible

assets, impairment of goodwill, stock-based compensation expense related to HP-granted employee

stock options, PRUs, restricted stock awards and the employee stock purchase plan, certain acquisition-

related charges and charges for purchased IPR&D, as well as certain corporate governance costs.

Segment revenue includes revenues from sales to external customers and intersegment revenues

that reflect transactions between the segments that are carried out at an arm’s-length transfer price.

Intersegment revenues primarily consist of sales of hardware and software that are sourced internally

and, in the majority of the cases, are structured through HPFS as operating leases. HP’s Consolidated

Net Revenue is derived and reported after elimination of intersegment revenues for such arrangements

in accordance with U.S. GAAP.

To provide improved visibility and comparability, HP has reclassified segment operating results for

fiscal 2011 and 2010 to conform to certain fiscal 2012 organizational realignments. The realignment

resulted in transfer of revenue and operating profit among Services, Printing, ESSN, Software and

Corporate Investments. In addition, revenue was transferred among the business units within Services.

These realignments include:

• The transfer of Indigo and Scitex support and the LaserJet and enterprise solutions trade

support business from the TS business unit within Services to the Commercial Hardware

business unit within Printing;

• The transfer of the TippingPoint business from the Networking business unit within ESSN to

Software;

• The transfer of the business intelligence services business from Corporate Investments to a newly

formed ABS business unit within Services;

• The consolidation of the Application Services, Business Process Outsourcing and Other Services

business units within Services into the new ABS business unit; and

• The transfer of the information management services business from Software to the new ABS

business unit within Services.

These changes had no impact on the previously reported financial results for Personal Systems or

HPFS. In addition, none of these changes impacted HP’s previously reported consolidated net revenue,

earnings from operations, net earnings or net earnings per share.

163