HP 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

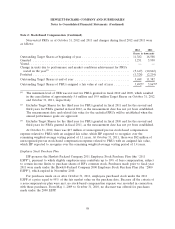

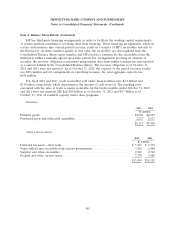

Note 2: Stock-Based Compensation (Continued)

Stock Options

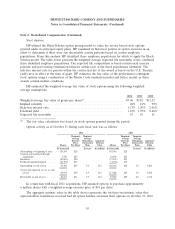

HP utilized the Black-Scholes option pricing model to value the service-based stock options

granted under its principal equity plans. HP examined its historical pattern of option exercises in an

effort to determine if there were any discernable activity patterns based on certain employee

populations. From this analysis, HP identified three employee populations for which to apply the Black-

Scholes model. The table below presents the weighted-average expected life in months of the combined

three identified employee populations. The expected life computation is based on historical exercise

patterns and post-vesting termination behavior within each of the three populations identified. The

risk-free interest rate for periods within the contractual life of the award is based on the U.S. Treasury

yield curve in effect at the time of grant. HP estimates the fair value of the performance-contingent

stock options using a combination of the Monte Carlo simulation model and lattice model, as these

awards contain market conditions.

HP estimated the weighted-average fair value of stock options using the following weighted-

average assumptions:

2012 2011 2010

Weighted-average fair value of grants per share(1) ...................... $9.06 $7.85 $13.33

Implied volatility ............................................. 42% 41% 30%

Risk-free interest rate .......................................... 1.17% 1.20% 2.06%

Dividend yield ............................................... 1.83% 1.97% 0.68%

Expected life in months ........................................ 67 63 61

(1) The fair value calculation was based on stock options granted during the period.

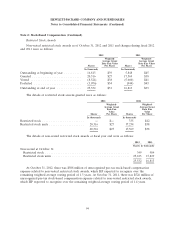

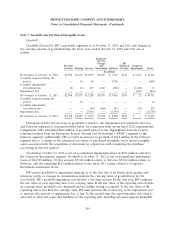

Option activity as of October 31 during each fiscal year was as follows:

2012 2011

Weighted- Weighted- Weighted- Weighted-

Average Average Average Average

Exercise Remaining Aggregate Exercise Remaining Aggregate

Price Contractual Intrinsic Price Contractual Intrinsic

Shares Per Share Term Value Shares Per Share Term Value

In thousands In years In millions In thousands In years In millions

Outstanding at beginning of year . . 120,243 $28 142,916 $28

Granted and assumed through

acquisitions ............. 7,529 $27 18,804 $21

Exercised ................ (29,683) $20 (37,121) $23

Forfeited/cancelled/expired ...... (10,793) $35 (4,356) $39

Outstanding at end of year ..... 87,296 $29 3.0 $15 120,243 $28 3.0 $460

Vested and expected to vest at end

of year ................ 85,935 $29 2.9 $15 117,066 $28 2.9 $442

Exercisable at end of year ...... 68,437 $31 1.9 $12 97,967 $29 2.0 $332

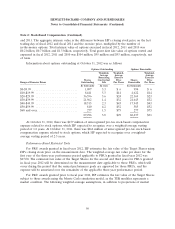

In connection with fiscal 2011 acquisitions, HP assumed options to purchase approximately

6 million shares with a weighted-average exercise price of $14 per share.

The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value that

option holders would have received had all option holders exercised their options on October 31, 2012

95