HP 2012 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

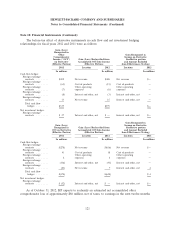

Note 14: Taxes on Earnings (Continued)

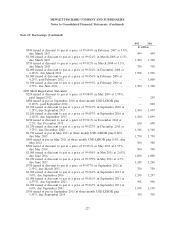

The significant components of deferred tax assets and deferred tax liabilities were as follows for

the following fiscal years ended October 31:

2012 2011

Deferred Deferred Deferred Deferred

Tax Tax Tax Ta x

Assets Liabilities Assets Liabilities

In millions

Loss carryforwards ............................... $ 9,142 $ — $ 9,793 $ —

Credit carryforwards .............................. 3,884 — 2,739 —

Unremitted earnings of foreign subsidiaries ............. — 7,559 — 8,209

Inventory valuation ............................... 185 12 236 12

Intercompany transactions—profit in inventory ........... 463 — 418 —

Intercompany transactions—excluding inventory .......... 881 — 1,529 —

Fixed assets .................................... 349 65 486 63

Warranty ...................................... 663 — 747 —

Employee and retiree benefits ....................... 3,264 16 2,559 18

Accounts receivable allowance ....................... 161 2 262 2

Capitalized research and development ................. 16 — 294 —

Purchased intangible assets ......................... 264 1,111 125 2,738

Restructuring ................................... 225 — 233 —

Equity investments ............................... 25 7 58 6

Deferred revenue ................................ 969 16 1,025 38

Other ........................................ 1,066 360 1,325 233

Gross deferred tax assets and liabilities ................ 21,557 9,148 21,829 11,319

Valuation allowance .............................. (10,223) — (9,057) —

Total deferred tax assets and liabilities ................. $11,334 $9,148 $12,772 $11,319

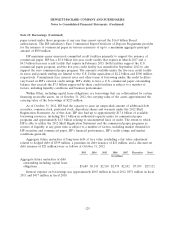

The decline in deferred tax liabilities associated with purchased intangible assets was primarily

attributable to the impairment of purchased intangible assets during the fiscal year.

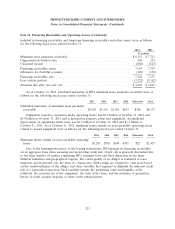

The breakdown between current and long-term deferred tax assets and deferred tax liabilities was

as follows for the following fiscal years ended October 31:

2012 2011

In millions

Current deferred tax assets .......................................... $3,783 $ 5,374

Current deferred tax liabilities ....................................... (230) (41)

Long-term deferred tax assets ........................................ 1,581 1,283

Long-term deferred tax liabilities ..................................... (2,948) (5,163)

Total deferred tax assets net of deferred tax liabilities ...................... $2,186 $ 1,453

The decline in long-term deferred tax liabilities was primarily attributable to reversals of deferred

income tax liabilities attributable to impaired purchased intangible assets (as noted above) and

temporary basis differences related to certain foreign subsidiaries that were reduced by the impairment

charges for goodwill.

131