HP 2012 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 13: Borrowings (Continued)

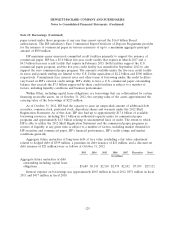

paper issued under those programs at any one time cannot exceed the $16.0 billion Board

authorization. The HP subsidiary’s Euro Commercial Paper/Certificate of Deposit Programme provides

for the issuance of commercial paper in various currencies of up to a maximum aggregate principal

amount of $500 million.

HP maintains senior unsecured committed credit facilities primarily to support the issuance of

commercial paper. HP has a $3.0 billion five-year credit facility that expires in March 2017 and a

$4.5 billion four-year credit facility that expires in February 2015. Both facilities support the U.S.

commercial paper program, and the five-year credit facility was amended in September 2012 to also

support the euro commercial paper program. The amounts available under the five-year credit facility

in euros and pounds sterling are limited to the U.S. Dollar equivalent of $2.2 billion and $300 million,

respectively. Commitment fees, interest rates and other terms of borrowing under the credit facilities

vary based on HP’s external credit ratings. HP’s ability to have a U.S. commercial paper outstanding

balance that exceeds the $7.5 billion supported by these credit facilities is subject to a number of

factors, including liquidity conditions and business performance.

Within Other, including capital lease obligations, are borrowings that are collateralized by certain

financing receivable assets. As of October 31, 2012, the carrying value of the assets approximated the

carrying value of the borrowings of $225 million.

As of October 31, 2012, HP had the capacity to issue an unspecified amount of additional debt

securities, common stock, preferred stock, depositary shares and warrants under the 2012 Shelf

Registration Statement. As of that date, HP also had up to approximately $17.4 billion of available

borrowing resources, including $16.1 billion in authorized capacity under its commercial paper

programs and approximately $1.3 billion relating to uncommitted lines of credit. The extent to which

HP is able to utilize the 2012 Shelf Registration Statement and the commercial paper programs as

sources of liquidity at any given time is subject to a number of factors, including market demand for

HP securities and commercial paper, HP’s financial performance, HP’s credit ratings and market

conditions generally.

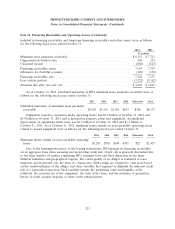

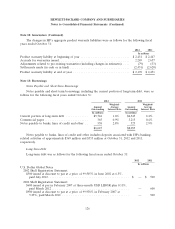

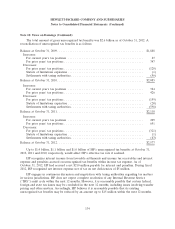

Aggregate future maturities of long-term debt at face value (excluding a fair value adjustment

related to hedged debt of $399 million, a premium on debt issuance of $23 million, and a discount on

debt issuance of $21 million) were as follows at October 31, 2012:

2013 2014 2015 2016 2017 Thereafter Total

In millions

Aggregate future maturities of debt

outstanding including capital lease

obligations ....................... $5,689 $5,143 $2,510 $2,979 $2,852 $7,959 $27,132

Interest expense on borrowings was approximately $865 million in fiscal 2012, $551 million in fiscal

2011 and $417 million in fiscal 2010.

129