HP 2012 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

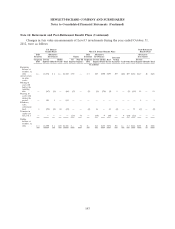

Note 16: Retirement and Post-Retirement Benefit Plans (Continued)

programs. Plan participants in the Pre-2003 Program make contributions based on their choice of

medical option and length of service. U.S. employees hired or rehired on or after January 1, 2003 may

become eligible to participate in a post-retirement medical plan, the HP Retiree Medical Program, but

must bear the full cost of their participation. Effective January 1, 2006, employees whose combination

of age and years of service was less than 62 were no longer eligible for the subsidized Pre-2003

Program, but instead were eligible for the HP Retiree Medical Program. Employees no longer eligible

for the Pre-2003 Program, as well as employees hired on or after January 1, 2003, are eligible for

certain credits under the HP Retirement Medical Savings Account Plan (‘‘RMSA Plan’’) upon attaining

age 45. Upon retirement, former employees may use credits under the RMSA Plan for the

reimbursement of certain eligible medical expenses, including premiums required for coverage under

the HP Retiree Medical Program. In February 2007, HP further limited future eligibility for the

Pre-2003 HP Retiree Medical Program to those employees who were within five years of satisfying the

program’s retirement criteria on June 30, 2007. Employees not meeting the modified program criteria

may become eligible for participation in the HP Retiree Medical Program. In November 2008, HP

announced that it was changing the limits on future cost-sharing for the Pre-2003 Program whereby all

future cost increases will be paid by participating retirees starting in 2011. In June 2008, HP modified

the RMSA Plan to provide that generally only those employees who were employed with HP as of

July 31, 2008 would be eligible to receive employer credits. In September 2008, HP further modified

the RMSA Plan to provide that such employees would receive employer credits only in the form of

matching contributions.

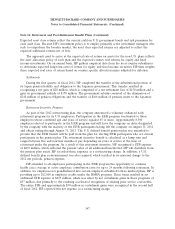

HP currently collects a retiree drug subsidy from the U.S. federal government relating to the

retiree prescription drug benefits that it provides. Collecting the retiree drug subsidy is one of several

alternatives under Medicare Part D that employers have in financing these benefits. In March 2010, HP

decided to contract with a prescription drug plan, leveraging the employer group waiver plan process,

to provide group benefits under Medicare Part D as an alternative to collecting the retiree drug

subsidy. This change in retiree prescription drug financing strategy will take effect in 2013, and, due to

the health care reform legislation enacted in March 2010, is expected to give HP access to greater U.S.

federal subsidies over time to help pay for retiree benefits. Aside from this impact, the health care

reform legislation is not expected to affect the cost of HP’s retiree welfare programs because the

subsidy offered by HP to retiree participants is fixed.

During fiscal year 2010, HP also announced the elimination of company-paid retiree life insurance

effective January 1, 2011.

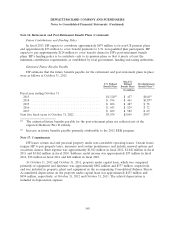

Defined Contribution Plans

HP offers various defined contribution plans for U.S. and non-U.S. employees. Total defined

contribution expense was $628 million in fiscal 2012, $626 million in fiscal 2011 and $535 million in

fiscal 2010. U.S. employees are automatically enrolled in the Hewlett-Packard Company 401(k) Plan

(the ‘‘HP 401(k) Plan’’) when they meet eligibility requirements, unless they decline participation.

Effective April 1, 2009, HP matching contributions for the HP 401(k) Plan was changed to a

quarterly, discretionary, performance-based match of up to a maximum of 4% of eligible compensation

for all U.S. employees to be determined each fiscal quarter based on business results. HP’s matching

contributions for all of the quarters in fiscal 2010 were 100% of the maximum 4% match. Effective at

the beginning of fiscal 2011, the quarterly employer matching contributions in the HP 401(k) Plan were

138