HP 2012 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

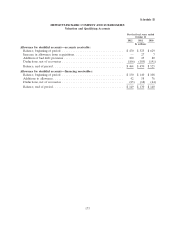

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

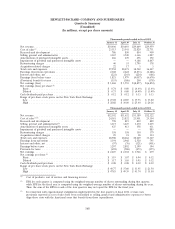

Note 19: Segment Information (Continued)

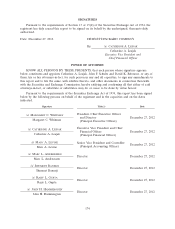

HP allocates its assets to its business segments based on the primary segments benefiting from the

assets. Total assets by segment and the reconciliation of segment assets to HP consolidated total assets

were as follows at October 31:

2012 2011 2010

In millions

Personal Systems ....................................... $ 12,752 $ 15,781 $ 16,548

Printing ............................................. 11,169 11,939 12,514

Printing and Personal Systems Group ........................ 23,921 27,720 29,062

Services ............................................. 31,234 40,614 41,989

Enterprise Servers, Storage and Networking ................... 16,000 17,539 18,262

Software ............................................. 12,264 21,028 9,979

HP Financial Services ................................... 12,924 13,543 12,123

Corporate Investments .................................. 248 517 1,619

Corporate and unallocated assets ........................... 12,177 8,556 11,469

Total HP consolidated assets .............................. $108,768 $129,517 $124,503

Assets allocated to the Personal Systems segment decreased 19% in fiscal 2012 driven largely by

the recording of an impairment charge to purchased intangible assets related to a change in the

branding strategy impacting the ‘‘Compaq’’ trade name as described further in Note 7. Assets allocated

to the Services segment decreased 23% due primarily to the recording of an impairment charge to

goodwill related to the ES reporting unit as described further in Note 7. In addition, assets allocated to

the Software segment decreased 42% due primarily to the recording of an impairment charge to

goodwill and purchased intangible assets related to the Autonomy reporting unit as described further in

Note 7.

The total assets allocated to the Corporate Investments segment decreased 68% in fiscal 2011

mostly due to an impairment charge to goodwill and certain purchased intangible assets associated with

the Palm acquisition following the decision to wind down the webOS device business. Assets allocated

to the Software segment increased by 111% in fiscal 2011 due to the acquisition of Autonomy. In

addition, in connection with certain fiscal 2011 organizational realignments, HP reclassified total assets

of its networking business from Corporate Investments to ESSN and total assets of the communications

and media solutions business from Software to Services. There have been no other material changes to

the total assets of HP’s segments since October 31, 2010.

Major Customers

No single customer represented 10% or more of HP’s total net revenue in any fiscal year

presented.

165