HP 2012 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

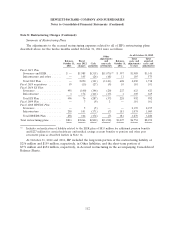

Notes to Consolidated Financial Statements (Continued)

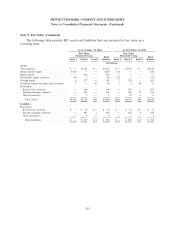

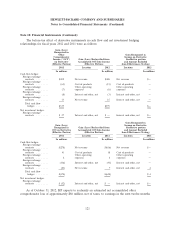

Note 9: Fair Value (Continued)

long-term debt was approximately $31.1 billion at October 31, 2011, compared to a carrying value of

$30.6 billion at that date. If measured at fair value in the Consolidated Balance Sheets, short- and

long-term debt would be classified as Level 2 in the fair value hierarchy.

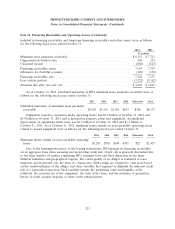

HP’s non-marketable equity investments and non-financial assets, such as intangible assets,

goodwill and property, plant and equipment, are recorded at fair value only if an impairment charge is

recognized. For the fiscal year ended October 31, 2012, HP recognized a goodwill and intangible asset

impairment charge of $8.8 billion associated with the Autonomy reporting unit within the Software

segment, a goodwill impairment charge of $8.0 billion associated with the ES reporting unit within the

Services segment and an intangible asset impairment charge of $1.2 billion associated with the

‘‘Compaq’’ trade name within the Personal Systems segment.

The remeasurement of goodwill is classified as a Level 3 fair value assessment due to the

significance of unobservable inputs developed using company-specific information. HP used the income

approach to measure the fair value of the ES and Autonomy reporting units. Under the income

approach, HP calculates the fair value of a reporting unit based on the present value of the estimated

future cash flows. Cash flow projections are based on management’s estimates of revenue growth rates

and operating margins, taking into consideration industry and market conditions. The discount rate

used is based on the weighted-average cost of capital adjusted for the relevant risk associated with

business-specific characteristics and the uncertainty related to the business’s ability to execute on the

projected cash flows. The discount rate also reflects adjustments required when comparing the sum of

the fair values of HP’s reporting units to HP’s market capitalization as discussed in Note 7. The

unobservable inputs used to fair value these reporting units include projected revenue growth rates,

profitability and the risk factor added to the discount rate.

The inputs used to measure the fair value of the intangible assets of Autonomy and the ‘‘Compaq’’

trade name were largely unobservable, and, accordingly, these measurements were classified as Level 3.

The fair value of the intangible assets for Autonomy was estimated using the income approach, which is

based on management’s cash flow projections of revenue growth rates and operating margins, taking

into consideration industry and market conditions. HP estimated the fair value of the ‘‘Compaq’’ trade

name by calculating the present value of the royalties saved that would have been paid to a third party

had HP not owned the trade name. The discount rates used in the fair value calculations for the

Autonomy intangibles and the ‘‘Compaq’’ trade name were based on a weighted average cost of capital

adjusted for the relevant risk associated with those assets. The unobservable inputs used in these

valuations include projected revenue growth rates, operating margins, royalty rates and the risk factor

added to the discount rate. The discount rates ranged from 11% to 16%. Projected revenue growth

rates ranged from (61)% to 13%. The (61)% rate reflects the significant decline in expected future

revenues for Compaq-branded products from fiscal year 2013 to fiscal year 2014 due to the change in

branding strategy discussed in Note 7.

For more information on these impairments measured as nonrecurring fair value adjustments, see

Note 7.

114