HP 2012 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

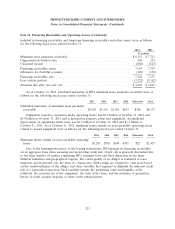

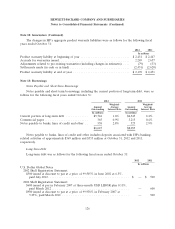

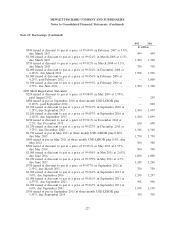

Note 13: Borrowings (Continued)

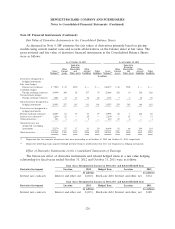

2012 2011

In millions

$650 issued at discount to par at a price of 99.946% in December 2011 at

2.625%, due December 2014 ................................... 650 —

$850 issued at discount to par at a price of 99.790% in December 2011 at

3.3%, due December 2016 ..................................... 849 —

$1,500 issued at discount to par at a price of 99.707% in December 2011 at

4.65%, due December 2021 .................................... 1,496 —

$1,500 issued at discount to par at a price of 99.985% in March 2012 at 2.6%,

due September 2017 ......................................... 1,500 —

$500 issued at discount to par at a price of 99.771% in March 2012 at 4.05%,

due September 2022 ......................................... 499 —

25,031 24,082

EDS Senior Notes

$1,100 issued June 2003 at 6.0%, due August 2013 ...................... 1,109 1,120

$300 issued October 1999 at 7.45%, due October 2029 .................... 314 315

1,423 1,435

Other, including capital lease obligations, at 0.60%-8.63%, due in calendar years

2012-2024 .................................................... 680 836

Fair value adjustment related to hedged debt ............................ 399 543

Less: current portion .............................................. (5,744) (4,345)

Total long-term debt .............................................. $21,789 $22,551

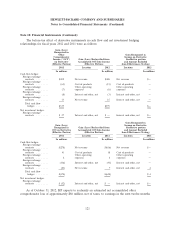

As disclosed in Note 10, HP uses interest rate swaps to mitigate the market risk exposures in

connection with certain fixed interest global notes to achieve primarily U.S. dollar LIBOR-based

floating interest expense. The interest rates in the table above have not been adjusted to reflect the

impact of any interest rate swaps.

HP may redeem some or all of the Global Notes set forth in the above table at any time at the

redemption prices described in the prospectus supplements relating thereto. The Global Notes are

senior unsecured debt.

In May 2012, HP filed a shelf registration statement (the ‘‘2012 Shelf Registration Statement’’)

with the SEC to enable the company to offer for sale, from time to time, in one or more offerings, an

unspecified amount of debt securities, common stock, preferred stock, depositary shares and warrants.

The 2012 Shelf Registration Statement replaced the registration statement filed in May 2009.

HP’s Board of Directors has authorized the issuance of up to $16.0 billion in aggregate principal

amount of commercial paper by HP. HP’s subsidiaries are authorized to issue up to an additional

$1.0 billion in aggregate principal amount of commercial paper. HP maintains two commercial paper

programs, and a wholly-owned subsidiary maintains a third program. HP’s U.S. program provides for

the issuance of U.S. dollar denominated commercial paper up to a maximum aggregate principal

amount of $16.0 billion. HP’s euro commercial paper program, which was established in September

2012, provides for the issuance of commercial paper outside of the United States denominated in U.S.

dollars, euros or British pounds up to a maximum aggregate principal amount of $3.0 billion or the

equivalent in those alternative currencies. The combined aggregate principal amount of commercial

128