HP 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

Services

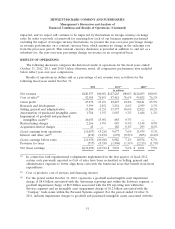

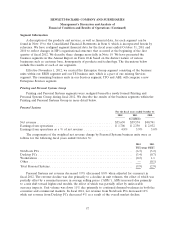

For fiscal years ended October 31

2012 2011 2010

In millions

Net revenue ........................................... $34,922 $35,702 $35,276

Earnings from operations ................................. $ 4,095 $ 5,203 $ 5,714

Earnings from operations as a % of net revenue ................ 11.7% 14.6% 16.2%

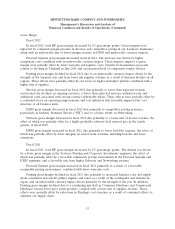

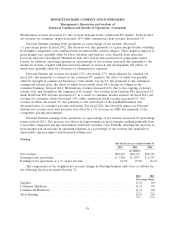

The components of the weighted net revenue change by Services business units were as follows for

the following fiscal years ended October 31:

2012 2011

Percentage Points

Infrastructure Technology Outsourcing ................................... (1.5) 0.7

Application and Business Services ....................................... (0.5) (0.3)

Technology Services ................................................. (0.2) 0.8

Total Services ..................................................... (2.2) 1.2

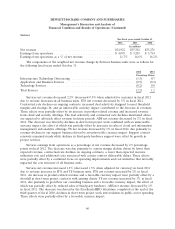

Services net revenue decreased 2.2% (decreased 0.5% when adjusted for currency) in fiscal 2012

due to revenue decreases in all business units. ITO net revenue decreased by 3% in fiscal 2012.

Contractual rate declines on ongoing contracts, increased deal selectivity designed to meet threshold

margins and strategic fit, and an unfavorable currency impact contributed to the decrease in revenues.

These effects were partially offset by an increase in product-related revenue and increased revenue

from cloud and security offerings. The deal selectivity and contractual rate declines mentioned above

are expected to adversely affect revenue in future periods. ABS net revenue decreased by 2% in fiscal

2012. The decrease was driven by declines in short-term project work combined with an unfavorable

currency impact, the effect of which was partially offset by increases in sales of cloud and information

management and analytics offerings. TS net revenue decreased by 1% in fiscal 2012, due primarily to

revenue declines in our support business driven by an unfavorable currency impact. Support contract

renewals remained steady while declines in third-party hardware support were offset by growth in

project services.

Services earnings from operations as a percentage of net revenue decreased by 2.9 percentage

points in fiscal 2012. The decrease was due primarily to a gross margin decline driven by lower than

expected revenue, contractual rate declines on ongoing contracts, a lower than expected resource

utilization rate and additional costs associated with certain contract deliverable delays. These effects

were partially offset by a continued focus on operating improvements and cost initiatives that favorably

impacted the cost structure of all business units.

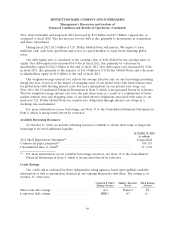

Services net revenue increased 1.2% (decreased 1.3% when adjusted for currency) in fiscal 2011

due to revenue increases in ITO and TS business units. ITO net revenue increased by 2% in fiscal

2011. An increase in product-related revenue and a favorable currency impact were partially offset by a

shortfall in short-term project contracts with existing clients. TS net revenue increased by 3% in fiscal

2011, due primarily to growth in our consulting business and a favorable currency impact, the effect of

which was partially offset by reduced sales of third-party hardware. ABS net revenue decreased by 1%

in fiscal 2011. The decrease was driven by the ExcellerateHRO divestiture completed at the end of the

third quarter of fiscal 2010, declines in short-term project work and weakness in public sector spending.

These effects were partially offset by a favorable currency impact.

60