HP 2012 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

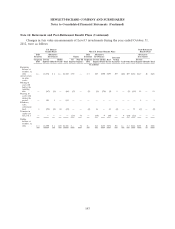

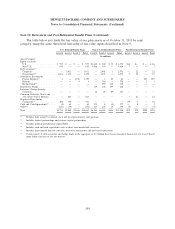

Note 16: Retirement and Post-Retirement Benefit Plans (Continued)

Expected asset class returns reflect the current yield on U.S. government bonds and risk premiums for

each asset class. Because HP’s investment policy is to employ primarily active investment managers who

seek to outperform the broader market, the asset class expected returns are adjusted to reflect the

expected additional returns net of fees.

The approach used to arrive at the expected rate of return on assets for the non-U.S. plans reflects

the asset allocation policy of each plan and the expected country real returns for equity and fixed

income investments. On an annual basis, HP gathers empirical data from the local country subsidiaries

to determine expected long-term rates of return for equity and fixed income securities. HP then weights

these expected real rates of return based on country specific allocation mixes adjusted for inflation.

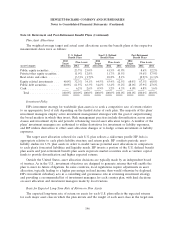

Settlements

During the first quarter of fiscal 2012, HP completed the transfer of the substitutional portion of

its Japan pension liability and obligation to the Japanese government. This transfer resulted in

recognizing a net gain of $28 million, which is comprised of a net settlement loss of $150 million and a

gain on government subsidy of $178 million. The government subsidy consisted of the elimination of

$344 million of pension obligations and the transfer of $166 million of pension assets to the Japanese

government.

Retirement Incentive Program

As part of the 2012 restructuring plan, the company announced a voluntary enhanced early

retirement program for its U.S employees. Participation in the EER program was limited to those

employees whose combined age and years of service equaled 65 or more. Approximately 8,500

employees elected to participate in the EER program and will leave the company on dates designated

by the company with the majority of the EER participants having left the company on August 31, 2012

and others exiting through August 31, 2013. The U.S. defined benefit pension plan was amended to

provide that the EER benefit will be paid from the plan for electing EER participants who are current

participants in the pension plan. The retirement incentive benefit is calculated as a lump sum and

ranges between five and fourteen months of pay depending on years of service at the time of

retirement under the program. As a result of this retirement incentive, HP recognized a STB expense

of $833 million, which reflected the present value of all additional benefits that HP will distribute from

the pension plan assets. HP recorded these expenses as a restructuring charge. In addition, a U.S.

defined benefit plan re-measurement was also required, which resulted in no material change to the

2012 net periodic pension expense.

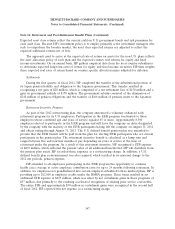

HP extended to all employees participating in the EER program the opportunity to continue

health care coverage at active employee contribution rates for up to 24 months following retirement. In

addition, for employees not grandfathered into certain employer-subsidized retiree medical plans, HP is

providing up to $12,000 in employer credits under the RMSA program. These items resulted in an

additional STB expense of $227 million, which was offset by net curtailment gains in those programs of

$37 million, due primarily to the resulting accelerated recognition of existing prior service cost/credits.

The entire STB and approximately $30 million in curtailment gains were recognized in the second half

of fiscal 2012. HP reported this net expense as a restructuring charge.

147