HP 2012 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

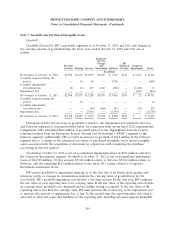

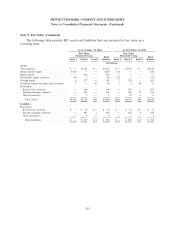

Note 7: Goodwill and Purchased Intangible Assets (Continued)

impairment test, HP tested the recoverability of the ES long-lived assets (other than goodwill) and

concluded that such assets were not impaired.

HP initiated its annual goodwill impairment analysis in the fourth quarter of fiscal 2012 and

concluded that fair value was below carrying value for the Autonomy reporting unit. The fair value of

the Autonomy reporting unit was based on the income approach.

The decline in the estimated fair value of the Autonomy reporting unit results from lower

projected revenue growth rates and profitability levels as well as an increase in the risk factor that is

included in the discount rate used to calculate the discounted cash flows. The increase in the discount

rate was due to the implied control premium resulting from recent trading values of HP stock. The

lower projected operating results reflect changes in assumptions related to organic revenue growth

rates, market trends, business mix, cost structure, expected deal synergies and other expectations about

the anticipated short-term and long-term operating results of the Autonomy business. These

assumptions incorporate HP’s analysis of what it believes were accounting improprieties, incomplete

disclosures and misrepresentations at Autonomy that occurred prior to the Autonomy acquisition with

respect to Autonomy’s pre-acquisition business and related operating results. In addition, as noted

above, when estimating the fair value of a reporting unit HP may need to adjust discount rates and/or

other assumptions in order to derive a reasonable implied control premium when comparing the sum of

the fair values of HP’s reporting units to HP’s market capitalization. Due to the recent trading values

of HP stock, the resulting adjustments to the discount rate to arrive at an appropriate control premium

caused a significant reduction in the fair value for the Autonomy reporting unit as well as the fair

values for HP’s other reporting units.

Prior to conducting the step one of the goodwill impairment test for the Autonomy reporting unit,

HP first evaluated the recoverability of the long-lived assets, including purchased intangible assets.

When indicators of impairment are present, HP tests long-lived assets (other than goodwill) for

recoverability by comparing the carrying value of an asset group to its undiscounted cash flows. HP

considered the lower than expected revenue and profitability levels over a sustained period of time, the

trading values of HP stock and downward revisions to management’s short-term and long-term forecast

for the Autonomy business to be indicators of impairment for the Autonomy long-lived assets. Based

on the results of the recoverability test, HP determined that the carrying value of the Autonomy asset

group exceeded its undiscounted cash flows and was therefore not recoverable. HP then compared the

fair value of the asset group to its carrying value and determined the impairment loss. The impairment

loss was allocated to the carrying values of the long-lived assets but not below their individual fair

values. HP estimated the fair value of the purchased intangible assets, primarily technology assets,

under an income approach as described above. Based on the analysis, HP recorded an impairment

charge of $3.1 billion on purchased intangible assets, which resulted in a remaining carrying value of

approximately $0.8 billion as of October 31, 2012. The decline in the fair value of the Autonomy

intangible assets is attributable to the same factors as discussed above for the fair value of the

Autonomy reporting unit.

The decline in the fair value of the Autonomy reporting unit and Autonomy intangibles, as well as

fair value changes for other assets and liabilities in the step two goodwill impairment test, resulted in

an implied fair value of goodwill substantially below the carrying value of the goodwill for the

Autonomy reporting unit. As a result, HP recorded a goodwill impairment charge of $5.7 billion, which

resulted in a $1.2 billion remaining carrying value of Autonomy goodwill as of October 31, 2012. Both

106