HP 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 7: Goodwill and Purchased Intangible Assets

Goodwill

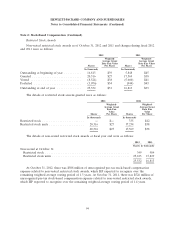

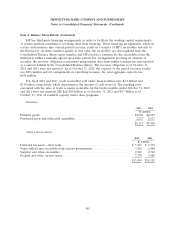

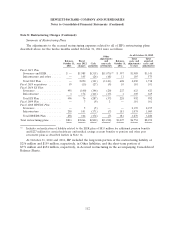

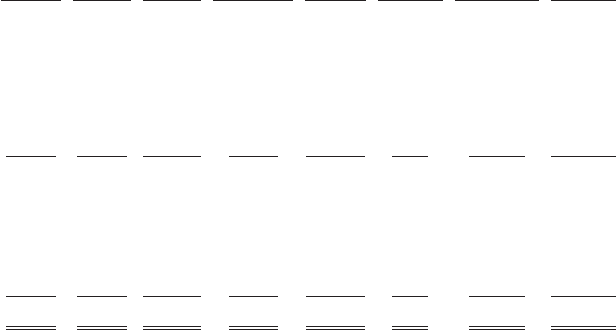

Goodwill allocated to HP’s reportable segments as of October 31, 2012 and 2011 and changes in

the carrying amount of goodwill during the fiscal years ended October 31, 2012 and 2011 are as

follows:

Enterprise

Servers,

Storage HP

Personal and Financial Corporate

Systems Printing Services Networking Software Services Investments Total

In millions

Net balance at October 31, 2010 . . $2,500 $2,456 $16,967 $6,610 $ 7,545 $144 $ 2,261 $ 38,483

Goodwill acquired during the

period ................... — 16 66 — 6,786 — — 6,868

Goodwill adjustments/

reclassifications ............ (2) (1) 247 1,460 (268) — (1,423) 13

Impairment loss .............. — — — — — — (813) (813)

Net balance at October 31, 2011 . . $2,498 $2,471 $17,280 $8,070 $14,063 $144 $ 25 $ 44,551

Goodwill acquired during the

period ................... — 16 — — — — — 16

Goodwill adjustments/

reclassifications ............ — — (40) (308) 580 — (25) 207

Impairment loss .............. — — (7,961) — (5,744) — — (13,705)

Net balance at October 31, 2012 . . $2,498 $2,487 $ 9,279 $7,762 $ 8,899 $144 $ — $ 31,069

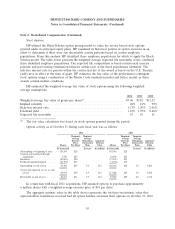

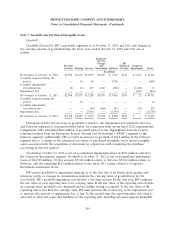

During fiscal 2012, the decrease in goodwill is related to the impairment loss within the Services

and Software segments as discussed further below. In connection with certain fiscal 2012 organizational

realignments, HP reclassified $280 million of goodwill related to the TippingPoint network security

solutions business from the Enterprise Servers, Storage and Networking (‘‘ESSN’’) segment to the

Software segment. Additionally, HP recorded an increase to goodwill of $244 million in the Software

segment due to a change in the estimated fair values of purchased intangible assets and net tangible

assets associated with the acquisition of Autonomy in conjunction with completing the purchase

accounting in the first quarter.

Goodwill at October 31, 2011 is net of accumulated impairment losses of $813 million related to

the Corporate Investments segment. Goodwill at October 31, 2012 is net of accumulated impairment

losses of $14,518 million. Of that amount, $7,961 million relates to Services, $5,744 million relates to

Software, and the remaining $813 million relates to the fiscal 2011 charge related to Corporate

Investments mentioned above.

HP reviews goodwill for impairment annually as of the first day of its fourth fiscal quarter and

whenever events or changes in circumstances indicate the carrying value of goodwill may not be

recoverable. HP’s goodwill impairment test involves a two-step process. In the first step, HP compares

the fair value of each reporting unit to its carrying value. If the fair value of the reporting unit exceeds

its carrying value, goodwill is not impaired and no further testing is required. If the fair value of the

reporting unit is less than the carrying value, HP must perform the second step of the impairment test

to measure the amount of impairment loss, if any. In the second step, the reporting unit’s fair value is

allocated to all of the assets and liabilities of the reporting unit, including any unrecognized intangible

104