HP 2012 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

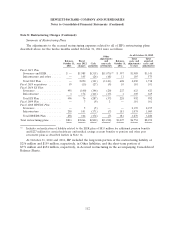

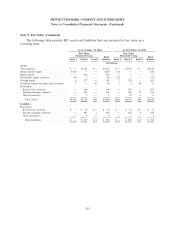

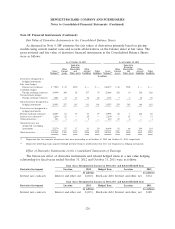

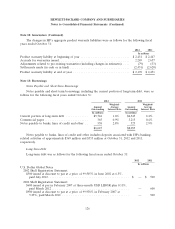

Note 10: Financial Instruments (Continued)

The before-tax effect of derivative instruments in cash flow and net investment hedging

relationships for fiscal years 2012 and 2011 were as follows:

Gain (Loss)

Recognized in

Other Gain Recognized in

Comprehensive Income on Derivative

Income (‘‘OCI’’) Gain (Loss) Reclassified from (Ineffective portion

on Derivative Accumulated OCI Into Income and Amount Excluded

(Effective Portion) (Effective Portion) from Effectiveness Testing)

2012 Location 2012 Location 2012

In millions In millions In millions

Cash flow hedges:

Foreign exchange

contracts ........ $402 Net revenue $408 Net revenue $—

Foreign exchange

contracts ........ (65) Cost of products (15) Cost of products —

Foreign exchange Other operating Other operating

contracts ........ (7) expenses (6) expenses —

Foreign exchange

contracts ........ (8) Interest and other, net (3) Interest and other, net —

Foreign exchange

contracts ........ 13 Net revenue 15 Interest and other, net —

Total cash flow

hedges ........ $335 $399 $—

Net investment hedges:

Foreign exchange

contracts ........ $37 Interest and other, net $ — Interest and other, net $—

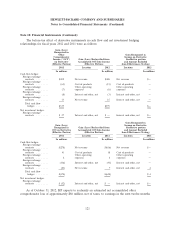

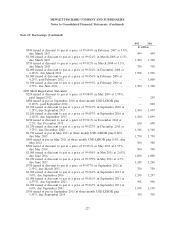

Gain Recognized in

Gain (Loss) Income on Derivative

Recognized in Gain (Loss) Reclassified from (Ineffective portion

OCI on Derivative Accumulated OCI Into Income and Amount Excluded

(Effective Portion) (Effective Portion) from Effectiveness Testing)

2011 Location 2011 Location 2011

In millions In millions In millions

Cash flow hedges:

Foreign exchange

contracts ........ $(278) Net revenue $(616) Net revenue $—

Foreign exchange

contracts ........ 41 Cost of products 38 Cost of products —

Foreign exchange Other operating Other operating

contracts ........ 2 expenses 4 expenses —

Foreign exchange

contracts ........ (116) Interest and other, net (91) Interest and other, net —

Foreign exchange

contracts ........ (23) Net revenue 7 Interest and other, net 4

Total cash flow

hedges ........ $(374) $(658) $ 4

Net investment hedges:

Foreign exchange

contracts ........ $(52) Interest and other, net $ — Interest and other, net $—

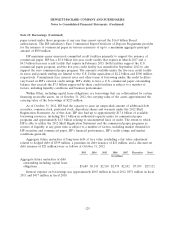

As of October 31, 2012, HP expects to reclassify an estimated net accumulated other

comprehensive loss of approximately $86 million, net of taxes, to earnings in the next twelve months

121